As major cryptocurrencies such as Bitcoin (BTCUSD) and Ethereum (ETHUSD) continue to scale new heights, related companies from the industry are looking to cash in on the euphoria and are making a beeline to get themselves listed. The latest to join this bandwagon is Gemini Space Station (GEMI).

About Gemini Space Station

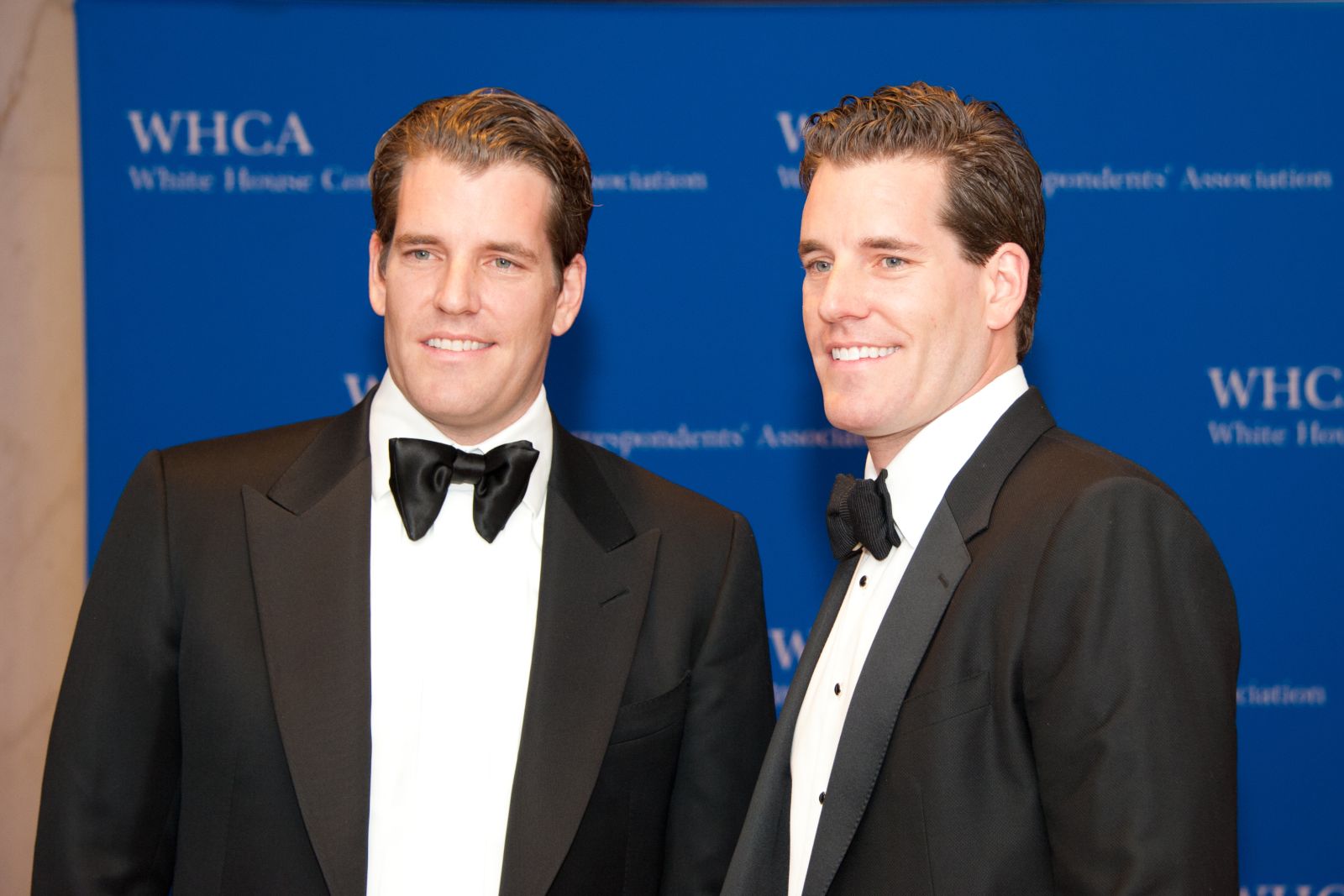

At first glance, someone would find it odd that a crypto platform is named as such, but Gemini in Latin means “twins,” a clear nod to the founders—Cameron and Tyler Winklevoss. And “Space Station” may hint at the company's ambitions to become a central hub for the evolving universe of digital assets.

Founded in 2014, Gemini Space Station is a cryptocurrency exchange and custodial platform, offering services to both retail and institutional clients worldwide. It is a comprehensive platform featuring crypto-exchange services for buying, selling, and storing digital assets. It also provides institutional-grade custody, derivatives trading, staking, stablecoin issuance (Gemini Dollar, GUSD), (GUSDUST) a U.S. credit card, OTC trading, and an NFT-focused Web3 studio.

Gemini is looking to raise just over $300 million by offloading 16.7 million shares at a price range of $17 to $19. Moreover, just before its IPO, the company received a boost in the form of a $50 million investment through a private placement by Nasdaq ($NASX), one of the largest and most popular exchanges in the world. It will trade under the ticker "GEMI."

Meanwhile, the company plans to allocate the net proceeds toward general corporate purposes, which could include product development, administrative expenses, capital investments, and the repayment of some or all outstanding third-party debt.

So, amid a flurry of IPOs in the crypto space, does Gemini stand out? Let's find out.

Financials Losing Momentum but Operating Metrics Improving

Gemini's total revenues for 2024 came in at $142.2 million, up 44.8% from the previous year, while the first six months of 2025 have already seen the company reporting revenues of $68.6 million. However, this was 7.7% less than the revenues in the corresponding period a year ago. The same scenario repeated in the case of net losses, as the same narrowed in 2024 to $158.5 million from $319.7 million in 2023, but for the first six months of 2025, Gemini reported substantial losses of $282.5 million, up considerably from the prior year's figure of losses of $41.4 million.

Yet, some of the key operating metrics are showing improvement. Monthly transacting users rose to 523,000 in H1 2025 from 497,000 in H1 2024. Yearly, Gemini ended 2024 with 512,000 monthly transacting users compared to 448,000 in 2023. Lifetime transacting users jumped to 1.5 million at the end of June 30, 2025, from 1.4 million in the previous year.

Platform assets almost doubled to $18.2 billion at the end of 2024 from $9.7 billion at the end of 2023. However, it remained unchanged in H1 2025, compared to $13.9 billion in H1 2024. Finally, trading volume witnessed a more than 3x jump in 2024 to $38.6 billion from just $12.5 billion in 2023, with H1 2025 seeing trading volume of $24.8 billion, which was $16.6 billion in H1 2024.

Notably, net cash outflow from operating activities narrowed considerably to $18.5 million in H1 2024 from $95.4 million in H1 2023. Overall, the company closed the Jan-Jun 2025 period with a cash balance of $42.8 million in 2024. This was much lower than the company’s short-term debt levels of about $680 million.

Thus, Gemini's financials are truly a mixed bag. On one hand, sales are growing, but on the other, they have slowed in the first half of this year. The net losses mirrored this trend as well. However, betterment in the operating metrics hints at the fact that the company's offerings are finding takers, but ballooning short-term debt towering over the cash balance remains a concern.

In such a predicament, Gemini should focus on gaining more acceptance among the users and aim to be operationally profitable as a first step. After that, the transition towards net profitability will be relatively easier. This is because even if they pile up more debt, their operating profits would provide support to service a substantial part of it.

Gemini Should Double Down on Its Institutional Focus

Projected to grow to $264 billion by 2030, Gemini operates in a market that is growing fast, unlike Black Rock Coffee Bar, whose market can be said to have stable growth, if one is being generous.

Moreover, Gemini has a presence in this market that cannot be dismissed. With its 549,000 monthly transacting users (as of July 31, 2025), present in over 60 countries, Gemini has had over $285 billion in lifetime trading volume and over $830 billion in transfers processed on its platform since its founding in 2014, with over $21 billion in assets under its custody. Although these metrics may look much smaller than much more established peers such as Coinbase (COIN), Binance, and Kraken, in a growing market, this gives Gemini a much bigger opportunity to expand its operations.

While Gemini’s growth strategy emphasizes increasing monthly transacting users, boosting trading volume, expanding internationally, growing its asset base, and pursuing potential M&A opportunities for inorganic growth, what truly sets the company apart is its institutional focus. Unlike other exchanges that offer institutional products as a secondary service, Gemini positions this as a core competency, making it particularly attractive to large, risk-conscious clients who value trust, regulatory compliance, and security over sheer scale.

Moreover, Gemini offers its own stablecoin, the GUSD. Like other stablecoins, it is pegged in a 1:1 manner to the US dollar. However, what separates it from more popular stablecoins such as USDC and USDT is its regulatory situation. GUSD is issued by the Gemini Trust Company, a New York State-chartered trust regulated by the New York State Department of Financial Services (NYDFS), unlike the USDC and USDT. The NYDFS is one of the most stringent financial regulators in the world, which means that Gemini must comply with strict capital requirements, cybersecurity standards, and tough anti-money laundering and Know Your Customer (KYC) regulations. This gives institutions and high-net-worth clients confidence that their funds are held with a legally accountable, highly regulated entity.

Also, unlike USDC and USDT, being an NYDFS trust allows Gemini to offer insured crypto custody services, and it is legally obligated to maintain full reserves for fiat-backed assets, reducing counterparty and liquidity risks. Again, this is critical for institutional clients who need regulatory-compliant, insured storage for large crypto holdings.

Final Take

Thus, Gemini should look to play to its strengths and look to become the exchange of choice for institutions globally for their crypto activities, while at the same time addressing the problem of non-profitability. Notably, its institutional focus will lead to Gemini forming its own niche that will allow it to compete with retail-focused players such as Coinbase and Binance. The strategy should be replicated in the realm of stablecoins as well, as GUSD can provide a unique regulatory arbitrage for its holders.

As for the IPO, I reckon it can be a “Subscribe” candidate, but the enthusiasm around the same should be curbed, as Gemini is not for short-term investors. Rather, investors who are in it for the long haul and who want a differentiated exposure to the crypto space can consider Gemini a serious investment option.