/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)

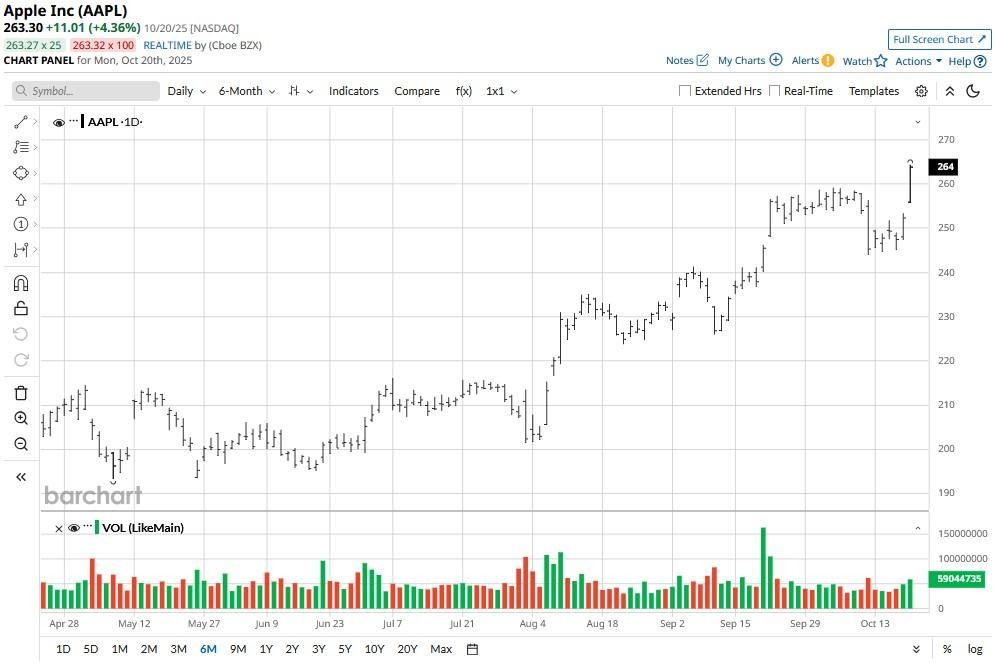

Apple (AAPL) rallied to a new all-time high on Monday following a Counterpoint Research report that the initial iPhone 17 sales are handily beating its predecessor in both the U.S. and China.

“Base model iPhone 17 is very compelling to consumers – offering great value for money,” wrote Mengmeng Zhang, a senior analyst at the market research firm.

Including today’s gains, Apple stock is up more than 50% versus its year-to-date low set on April 8.

Why Does the iPhone Sales Data Warrant Buying Apple Stock?

The said report is bullish for AAPL stock as the U.S. and China are two of its most critical markets, and early momentum there signals strong consumer demand heading into the holiday quarter.

Meanwhile, Zhang’s comment implying strong value perception supports Apple’s overall margin growth story as well.

Combined with the company’s operational efficiency and ecosystem lock-in, this surge in demand reinforces confidence in its future earnings.

Apple is scheduled to report its Q4 earnings on Oct. 30. Consensus is for the titan to earn $1.74 on a per-share basis, which translates to a 6.41% increase on a year-over-year basis.

Loop Capital Now Sees AAPL Shares Rallying to $315

Loop Capital analyst Ananda Baruah sees better-than-expected initial demand for iPhone 17 as a catalyst that could push Apple shares higher from here.

“We are now at front end of AAPL’s long-anticipated adoption cycle that suggests ongoing iPhone shipment expansion through CY2027,” he told clients in a research note on Monday.

Baruah upgraded AAPL shares this morning to “Buy” and raised his price target to $315, indicating potential upside of another 22% from current levels.

According to him, the company will soon release its first purpose-built “AI Phone,” easing concerns that it’s lagging behind in the artificial intelligence arms race as well.

Apple Remains a ‘Buy’ Among Wall Street Firms

Despite concerns of an innovation slowdown at Apple, other Wall Street firms are also keeping positive on the tech behemoth for the next 12 months.

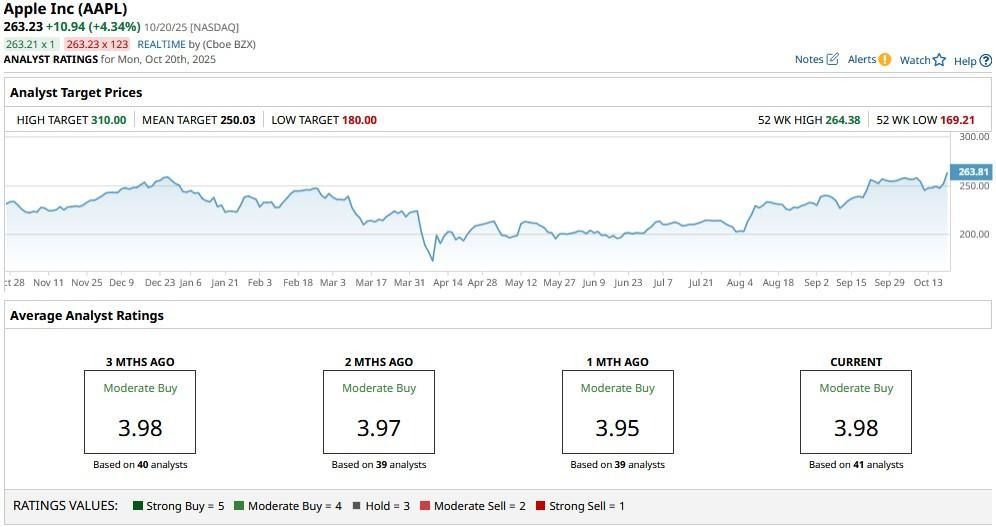

According to Barchart, the consensus rating on Apple stock currently sits at “Moderate Buy.”