/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

Advanced Micro Devices (AMD) will release its second-quarter earnings on Tuesday, Aug. 5. AMD stock has been on an impressive run ahead of the earnings, recently hitting a 52-week high of $182.50 on July 31. Notably, shares of this semiconductor giant have gained 77.65% in three months, far outperforming the broader S&P 500 Index ($SPX), which has gained 11.31% in the same period.

This impressive rally reflects the growing investor enthusiasm surrounding AMD, particularly as the company continues to benefit from its positioning in the artificial intelligence (AI) space. Anticipation is building around potential updates in the earnings report, especially concerning the restart of MI308 chip shipments to China, a significant development that could help drive further growth.

However, this explosive rally has driven AMD's 14-day Relative Strength Index (RSI) to 69.29, nearing overbought levels. While this might be a caution flag for some investors, the strong demand driven by AI and favorable market conditions, such as the expected restart of MI308 chip shipments to China, could sustain AMD's upward momentum.

That said, AMD stock isn’t cheap. It currently trades at a forward price-to-earnings (P/E) ratio of 57.02x, a level that suggests high expectations are already baked into the price. For comparison, rival Nvidia (NVDA) trades at a slightly lower forward P/E of around 44.23x.

Analysts project AMD’s earnings per share (EPS) will rise by 17.94% in fiscal year 2025 and accelerate to 56.96% growth in 2026 — figures that support its stretched multiple. Still, while the growth story is compelling, AMD stock is not a bargain at current levels.

What the Options Market is Pricing in for AMD Stock

Heading into earnings, there’s also an element of risk. AMD’s recent performance has set a high bar, and even a slight disappointment in financial results or guidance could trigger a sell-off.

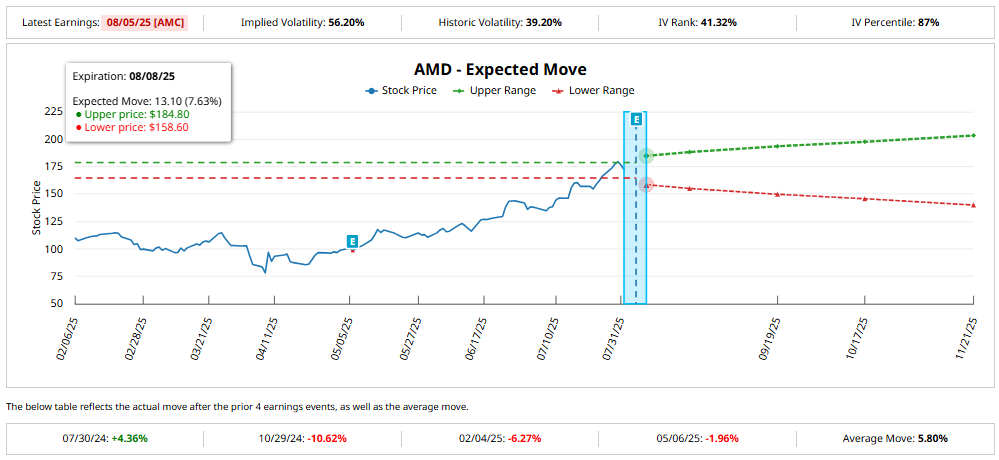

The options market is already bracing for potential turbulence, pricing in a post-earnings move of about 7.63% in either direction. That’s higher than AMD’s average earnings-day move of 5.8% over the past year. Adding to the cautionary tone, the stock has dropped after earnings in three of the last four quarters.

Is AMD Stock a Buy Now?

AMD’s second-quarter financials will continue to benefit from the strong demand for its Instinct AI accelerators. In the first quarter of the year, AMD’s data center AI business posted robust double-digit revenue growth, thanks in large part to rising shipments of its MI325X GPUs. Hyperscalers are increasingly adopting AMD’s Instinct chips, and this growing momentum is expected to continue in the foreseeable future - particularly as AMD continues to secure more CPU market share. However, the potential impact of new export license requirements could act as a headwind on revenue growth.

AMD projected second-quarter revenue to reach around $7.4 billion, marking a healthy 27% year-over-year increase. The company’s top line could again benefit from the ongoing strength in its data center business and the strong customer demand for its new-generation Zen 5 Ryzen processors.

On the profitability front, AMD has been steadily expanding its gross margins for five consecutive quarters. This improvement is mainly due to a favorable shift in its product mix, led by more sales from the data center segment and premium Ryzen chips. Despite macroeconomic uncertainty, AMD’s strong product lineup and pricing power may help sustain margins in Q2.

However, while revenue and margin trends are encouraging, analysts caution that earnings may face some pressure this quarter. Notably, AMD has beaten Wall Street’s earnings expectations in three of the last four quarters, but has still tended toward negative post-earnings price action.

Despite these near-term uncertainties, market sentiment remains strongly positive. With 44 analysts in coverage, 63% maintain a “Strong Buy” rating on AMD stock, signaling confidence in the company’s growth story, particularly as AI adoption accelerates.

In short, AMD’s fundamentals and prospects are solid, making it a compelling long-term investment. However, with the stock richly valued and recent gains setting a high bar for Q2 earnings, short-term risks remain elevated, implying investors should wait for a potential pullback before adding exposure.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.