The downfall of companies like Kodak (KODK), Blackberry (BB), Nokia (NOK), and Blockbuster are ones for the corporate folklore. Once household names that have now been lost in oblivion, the reason for their irrelevance was that they did not keep up with the times and held the false notion that their way of doing business was the only one, making their obsolescence imminent.

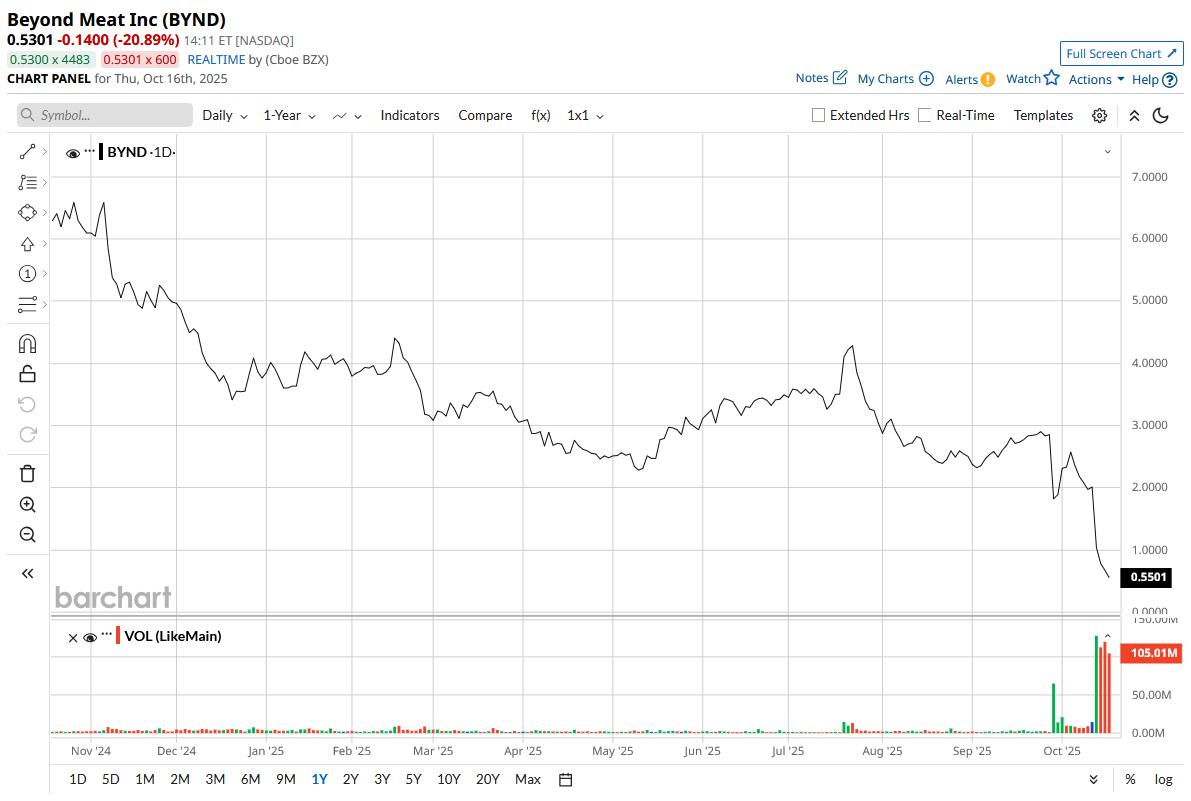

However, what about a company that made a blockbuster debut on the exchanges with a 163% pop in its share price, having celebrity backers like Leonardo DiCaprio, Bill Gates, and comedian Kevin Hart, among others, which operates in a market that is increasingly associated with healthy living, and which commanded a peak market cap of about $13 billion just six years ago, seeing its stock nosedive by more than 55% on a single day and witnessing its market cap languish at levels of $60 million now? Beyond that, it has a short interest of 40% for its total float, too.

This is all that Beyond Meat (BYND) has had to go through… so far.

About Beyond Meat

Founded in 2009, Beyond Meat makes plant-based meat substitutes intended to mimic the taste, texture, and sensory attributes of traditional animal meats, but with ingredients derived from plants and with claims of better environmental, health, or ethical profiles. They have expanded globally, partnering with fast-food chains and foodservice operators (McDonald’s (MCD), KFC, and Pizza Hut) for plant-based versions of menu items.

Far removed from its heyday, when it boasted of a market cap beyond $10 billion, Beyond Meat's current market cap is at just $59.9 million. Moreover, BYND stock has been in free fall this year, declining by over 85% on a year-to-date (YTD) basis.

This is nothing new for the stock, as since its listing, the BYND stock's trajectory has been downward. However, the most recent decline followed the company’s announcement that nearly all of its convertible noteholders had accepted a debt exchange agreement, under which more than $1.1 billion of its 2027 notes would be swapped for new notes and up to 326,190,370 shares of common stock.

The share price reacted as such because this move may postpone the debt maturities, but it doesn't do away with them, as the new maturities are due in 2030 at a 7% coupon (compared to a 0% coupon on the existing notes), while at the same time, with the issuance of new shares, the value for the existing shareholders gets diluted as well.

So, considering all this, is this an opportunity to add the BYND stock, or should investors be cognizant of its track record and stay away from the counter? Let's find out.

Cannot Look Beyond the Financials

Despite all the razzmatazz of a sensational IPO and a gamut of celebrity backers, Beyond Meat has not reported a profitable quarter since its listing. In fact, in the last two years, Beyond Meat's bottom line has missed Street estimates on seven occasions. Further, revenues have witnessed a negative CAGR of 5.55% in the last five years.

Notably, the most recent quarter saw the company reporting misses on both the revenue and earnings fronts. Net revenues for the quarter were $75 million, which represented a decline of 19.6% from the previous year. Both the U.S. and International segments saw a fall in revenues, with the U.S. segment seeing a sharper 20.4% decrease to $44 million. The revenues for the International segment were at $30.9 million, which denoted an annual drop of 18.4%.

Net cash used in operating activities for the first six months of 2025 widened to $59.4 million from $47.8 million in the year-ago period as the company closed the June 2025 quarter with a cash balance of $103.5 million. The company’s cash balance was the only saving grace on its balance sheet, as it was much higher than the short-term debt levels of $21.4 million.

For Q3 2025, the management expects the company to report revenues in the range of $68 million to $73 million, the midpoint of which denotes an annual decline of 13%.

Hard to Make a Case for Investing

The thing is that the alternative meat market is a growing one, with the same projected to reach $16.13 billion by 2032, doubling from the levels of $7.24 billion in 2024. But it is becoming increasingly unlikely that Beyond Meat will be one of the key beneficiaries of it, despite being one of the pioneers in the space.

The immediate reason, however, is really beyond Beyond Meat. It is that inflation is continuing to sting the pockets of the common public, with the effects of the tariffs yet to come in full force. In such a scenario, the preference for households for high-priced plant-based meats is continually decreasing, not helping the cause of Beyond Meat at all. Thus, Beyond Meat's strategy to broaden its offerings appears to overstate the enduring strength and allure of its diminishing brand equity.

Notably, the company has also observed that numerous retail partners have shifted their items from chilled sections to freezer cases, thereby diminishing their prominence and impeding sales momentum. Compounding this, the negative perception surrounding plant-based meats, particularly their elevated sodium levels aimed at mimicking animal flavors, continues to alienate potential buyers. Finally, a surge in conservatism across the country and the changing political landscape have also played their part in demand destruction for Beyond Meat's products.

In short, Beyond Meat faces tough obstacles to any real comeback, from lacking solid patent protections on its core inventions to tougher competition from upstarts and not enough customer buy-in to fuel steady revenue growth, making the revival of Beyond Meat a herculean task, maybe not possible with plant-based protein.

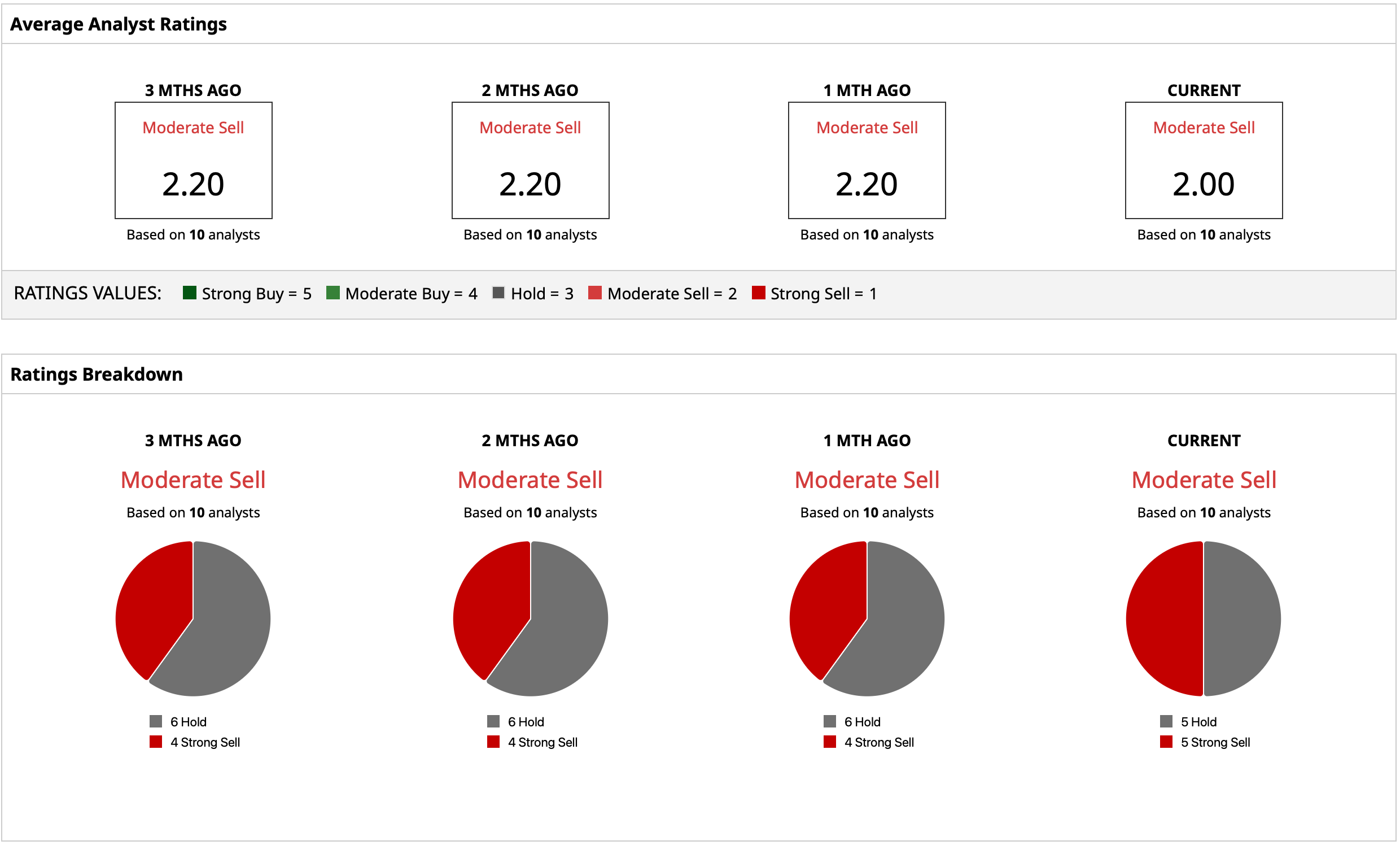

Analyst Opinion

Taking all of this into account, analysts have deemed the BYND stock a “Moderate Sell,” with a mean target price of $2.36, which looks, well, beyond reach. Out of 10 analysts covering the stock, five have a “Hold” rating, and five have a “Strong Sell” rating.