Commodities shipper Golden Ocean Group reported booming earnings early Thursday, following hot results earlier in the week from container-focused ZIM Integrated Shipping and Danaos, a lessor of container ships.

GOGL stock soared to a record high Thursday. ZIM stock and Danaos rebounded, after retreating earlier in the week amid broad concerns about economic growth.

The reports arrive as shipping stocks come off highs and anxieties deepen over the state of the economy. Concerns have grown about waning demand for ocean freight following a surge in profits last year, after the pandemic created bottlenecks up and down the supply chain that sent shipping costs higher.

Golden Ocean Earnings

Estimates: Wall Street expected Golden Ocean to earn 39 cents per share, a 179% gain. Revenue was seen climbing to $192.2 million.

Results: Golden Ocean earnings soared to 62 cents a share, with revenue up 68% to $265.2 million.

The dry bulk shipper announced a first-quarter dividend of 50 cents a share and promised more to come

"With the anticipated strengthening of the freight market in the second half of the year, we expect to generate significant cash flows," CEO said Ulrik Andersen. "Given our strong balance sheet and low debt, our capital allocation strategy will continue to focus on returning capital to our shareholders."

The dry bulk shipper say Q2 and Q3 shipping rates so far are above Q1 levels.

Shares rose 8.8% to 16.02 on the stock market today close to Tuesday's all-time high. GOGL stock lost 3.5% on Wednesday. Golden Ocean stock, similar to the other shipping stocks here, has a 98 Composite Rating. Its EPS Rating is 80.

Golden Ocean, based in Bermuda, owns and operates vessels that ship dry bulk, like iron ore and coal. When the company reported in February, before Russia's invasion and China's most recent round of aggressive Covid restrictions, it said slowing steel production in the nation had weighed on shipping rates. However, China is starting to ease lockdowns in Shanghai, with manufacturing slowly returning.

Also, dry-bulk freightliners haven't ordered new ships at the same rate as the container-shipping industry, some analysts say, amid costs to comply with engine-emissions requirements.

ZIM Earnings

Estimates: Wall Street expected ZIM to earn $12.57 per share, a 134% jump from a year ago. Revenue estimates were unavailable from FactSet.

Results: ZIM Integrated reported adjusted earnings of $14.19, well above expectations. Revenue of $3.72 billion was up 113% vs. a year earlier. Management reported first-quarter freight rates per TEU were $3,848 — a 100% increase over year-ago prices.

ZIM stock rose 4% to 63.76 on Thursday, reclaiming its 50-day line. Shares fell 5.75% on Wednesday despite the strong results. Shares are attempting to climb the right side of a 39% deep cup base, which shows a buy point at 79.05. ZIM stock could be building a handle.

The stock has a 97 Composite Rating and an EPS Rating of 84.

Based in Israel, ZIM leases the vast majority of its container fleet through suppliers including Danaos, rather than owning the vessels outright. The stock tore higher through 2021, after its debut in January of that year.

ZIM, which ships goods across the Atlantic, Pacific, Asia and through the Suez Canal, has expanded its expedited e-commerce shipments service. It has also boosted its spending on shipping containers themselves.

Shipping Stocks Backdrop

Other shipping stocks also have strong ratings, after the pandemic shutdowns created hiccups in flow of goods from factories to ports to warehouses and store shelves. Shipping costs soared as container ships backed up outside ports and available containers and ships to load with new products became hard to find.

This year, however, the run higher for many shipping stocks has cooled off. Freight rates have eased from recent highs. China's Covid lockdowns have raised concerns about the nation's export volumes. Price increases for many goods — driven higher in part by the world's supply-chain backups — have led to greater worries about softer consumer demand.

Shipping operators also ordered more ships in an effort to ride rising container-freight rates to greater profit. That expanded fleet could eventually push freight rates lower, offering some relief to businesses who have had to pay thousands for a single container shipment. Lower rates would also threaten profits for shipping stocks.

However, it can take years before new ship orders arrive. In the near term, supply disruptions from Russia's war and a reopening of China's economy could well keep rates elevated.

Danaos Earnings, Shipping Stocks

Danaos earned $11.36 per share, well above expectations for $6.14 per share. Revenue of $229.9 million topped forecasts for $205.9 million, helped in part by newly acquired ships and its ability to charge more on ship leases.

The company said it had declared a 75-cent per-share dividend for the first quarter. It also sold 1.5 million shares of ZIM, in which it has an investment, for $85.3 million. ZIM is among a handful of Danaos' big revenue drivers.

Based in Greece, Danaos leases its ships out to other container liners. The results for the quarter prompted Danaos to invest in expanding its shipping fleet. Danaos said that in recent weeks, it had entered into agreements to build two container ships in China for $156 million, and four in South Korea for $372.7 million. The ships were set to be delivered in 2024.

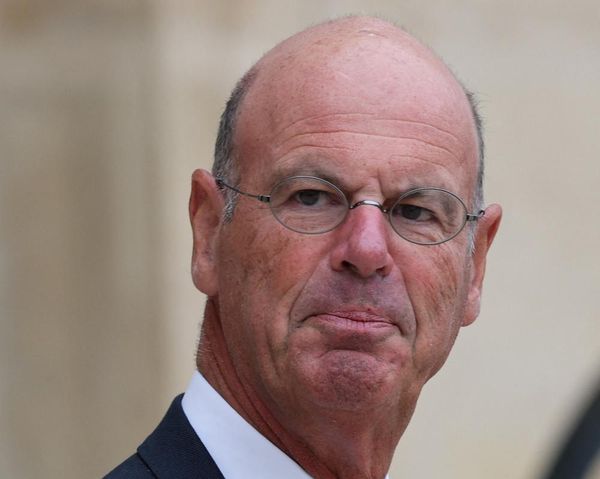

CEO John Coustas said in a statement that container freight rates and lease prices hadn't yet been significantly affected by rising prices — as supply-chain backups and Russia's war in Ukraine cause a surge in prices for oil and crops. But he warned that investors had grown more cautious.

"Although box freight rates and charter rates have not been significantly affected, sentiment has changed, and market participants have adopted a more conservative short-term attitude," he said.

Danaos stock rose 5.6% to 78.68 after falling near the open to the lowest since late January. Shares sank 5.6% on Wednesday and 3.4% on Tuesday, retreating from their 200-day line. DAC stock sliced below its 50-day line last month, giving back all of the gains from a January breakout.

Shares still have a strong 93 Composite Rating. Their EPS Rating is 83.