Based on the common principles of supply and demand, President Donald Trump's decision to end the federal electric vehicle tax credit on Sept. 30 should have represented a boon for the oil industry. After all, with fewer incentives available — combined with the many inconveniences of EV ownership, such as the hit-or-miss reliability of public charging stations — there's far less motivation right now to consider making the switch.

Interestingly, though, Deepwater Asset Management‘s investor Gene Munster believes that EV manufacturers like Tesla Inc. (NASDAQ:TSLA) would benefit from anti-EV measures like the end of the tax credit, particularly because it would discourage legacy automakers from aggressively pivoting toward the sector. As such, the current leaders in the space may continue to enjoy a scale advantage. Still, this argument hasn't really panned out as predicted.

On a year-to-date basis, TSLA stock is only up a hair above parity. Furthermore, in the trailing month, the security lost almost 10% of equity value. On the other end, crude oil hasn't really benefited either. Since the end of September, the light crude oil market has fallen approximately 4.47%. What's more, both the 50- and 200-day moving averages have imposed upside resistance on oil, frustrating the bulls.

Another issue is that the Trump administration's policies seem to feature somewhat counterproductive aims. Recently, the president claimed victory on a key economic promise: to get gasoline prices to $2 a gallon. In certain markets, this milestone has been achieved, though with a critical caveat. Rather than stemming from Trump's direct actions, the cheapened gas may be due to oil succumbing to OPEC+ engaging in a long and shallow price war.

Still, it wouldn't be completely fair to characterize the oil market as exclusively bearish. In late October, a fresh wave of U.S. sanctions on Russia's largest oil companies — ordered by Trump — boosted the energy markets at the time. With little indication that the conflict will come to an end anytime soon, the geopolitical turmoil could present a cynical case for upside.

The Direxion ETFs: With dynamic narratives on both sides of the aisle, traders have ample opportunity to attempt to extract short-term profits. For those seeking a straightforward way to speculate on oil, financial services provider Direxion offers two countervailing products.

First, optimistic traders may consider the Direxion Daily S&P Oil & Gas Exp. & Prod. Bull (NYSE:GUSH), which seeks the daily investment results of 200% of the performance of the S&P Oil & Gas Exploration & Production Select Industry Index. Second, for the pessimists, the Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2X Shares (NYSE:DRIP) seeks 200% of the inverse performance of the aforementioned index.

In both cases, the marketing angle is the magnified speculation. Typically, those interested in leveraged or inverse trades must engage the options market. However, the underlying derivative instruments feature unique complexities that may not align with every investor's needs. With Direxion ETFs, the units can be bought and sold much like any other public security, thus mitigating the learning curve.

Nevertheless, prospective buyers should be aware that leveraged and inverse ETFs carry significant risks. Primarily, traders must be cognizant of the often-extreme volatility that can erupt with these funds. Furthermore, these Direxion ETFs are designed for exposure lasting no longer than one day. Holding beyond the recommended period may lead to positional decay due to the daily compounding effect.

The GUSH ETF: Since the start of the year, the GUSH ETF has lost about 14% of value. However, in the trailing six months, the ultra-bull fund is up roughly 9%.

- While the 50 and 200 DMAs previously imposed resistance on GUSH, the bulls managed to break above the threshold on Nov. 10.

- Currently, the price action is trending within a sideways consolidation phase. The next logical target would be psychological resistance at $25.

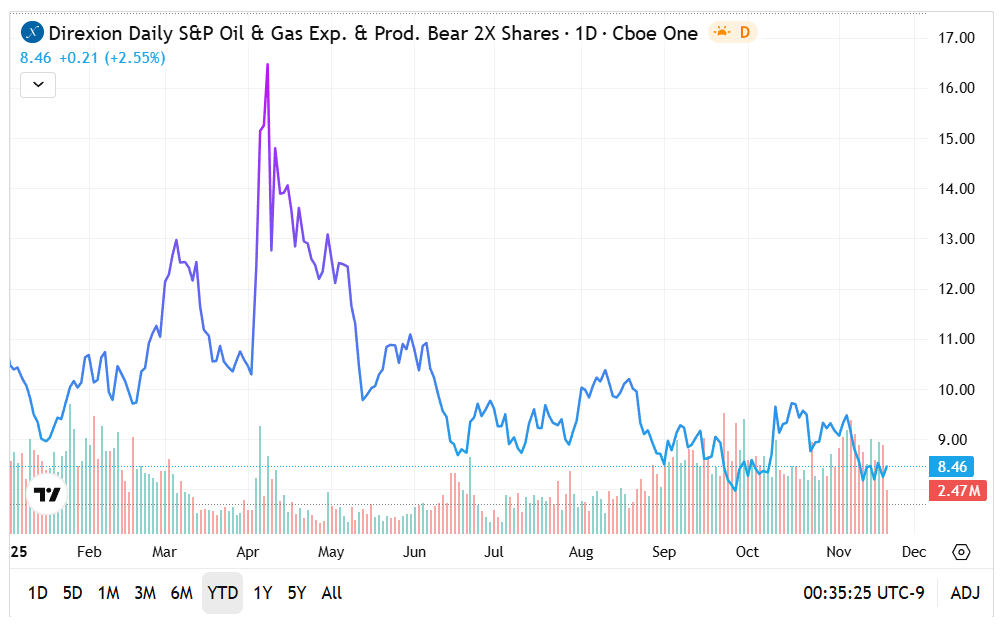

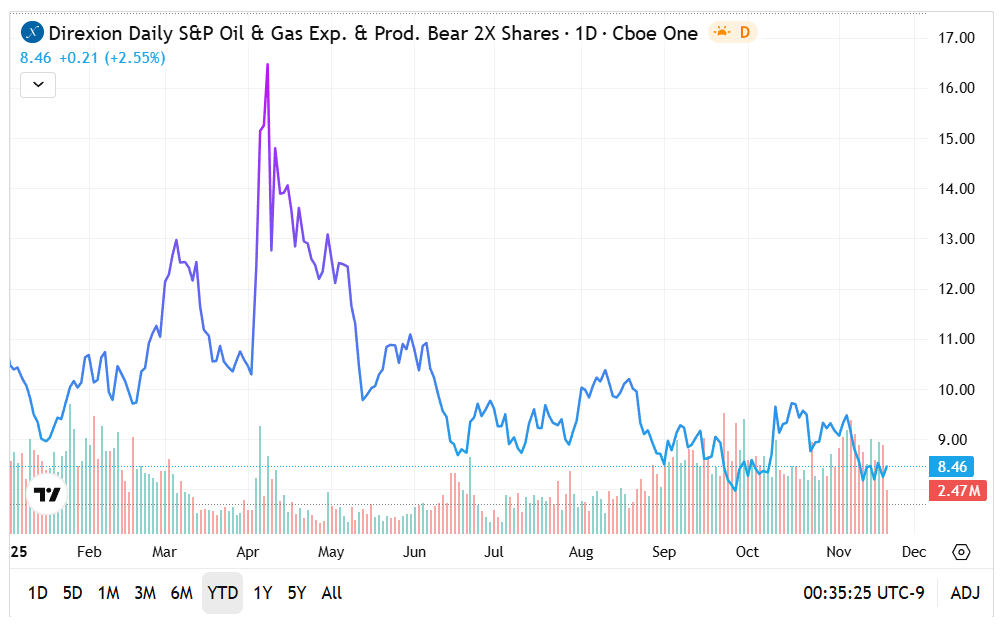

The DRIP ETF: From the beginning of January, the DRIP ETF dropped more than 22%. In the trailing half-year period, the loss has only been partially softened to about 19%.

- Unlike its bullish counterpart, DRIP previously broke above the 50 DMA last month before succumbing to pressure and falling below this key level.

- Volume levels have generally been rising relative to levels seen during much of spring and summer, suggesting a potential sentiment pivot.

Featured photo from Shutterstock