Senate Republicans have blocked a bipartisan tax package that aimed to temporarily expand the child tax credit and restore certain business tax benefits. The bill failed to advance in a procedural vote, falling short of the 60 votes required for success.

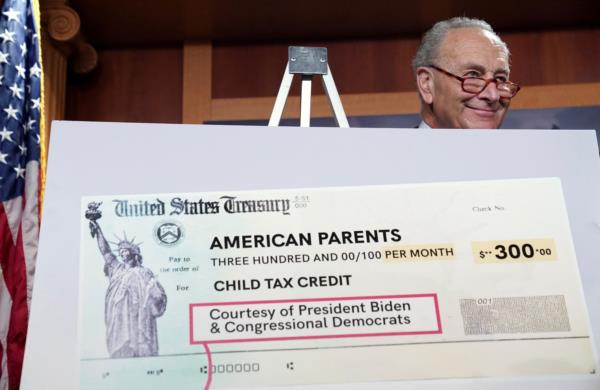

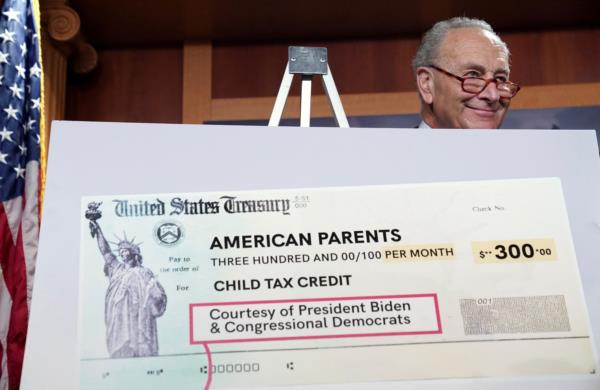

Democrats strategically brought up the vote to highlight the child tax credit ahead of the November elections, providing an opportunity for vulnerable party members to support the expansion while putting Republicans in a challenging position on the issue.

The bipartisan tax bill, previously passed by the Republican-led House, faced resistance from some Senate Republicans who raised concerns and sought amendments to the legislation.

Despite the bill's failure, the Senate recently passed legislation focused on protecting children online in a broad bipartisan vote.

The proposed tax package aimed to provide a larger child tax credit to low-income families, benefiting approximately 16 million children who currently do not receive the full credit due to their families' low earnings. The bill was projected to lift at least half a million children out of poverty and improve the financial situation of around 5 million more children.

Additionally, the package would have temporarily restored various business tax benefits, including deductions for research investments, machinery, equipment, and interest expenses. It also included provisions for disaster relief and enhancements to the low-income housing tax credit.

While some Republicans expressed concerns about potential disincentives to work and undocumented immigrants claiming the credit, the bill maintained minimum earnings thresholds and requirements for Social Security numbers.

Overall, the legislation aimed to address key economic issues and provide support to families and businesses, with provisions set to be in effect through 2025.