Illinois electric and gas companies are quietly sorting their customers into different “risk” categories that could mean faster disconnections for people struggling to pay their bills and more leeway for those who aren’t.

Customers never see this information. It doesn’t appear on bills. But consumer groups are raising questions about whether the practice of “risk ranking” is fair, and state regulators are now taking a look.

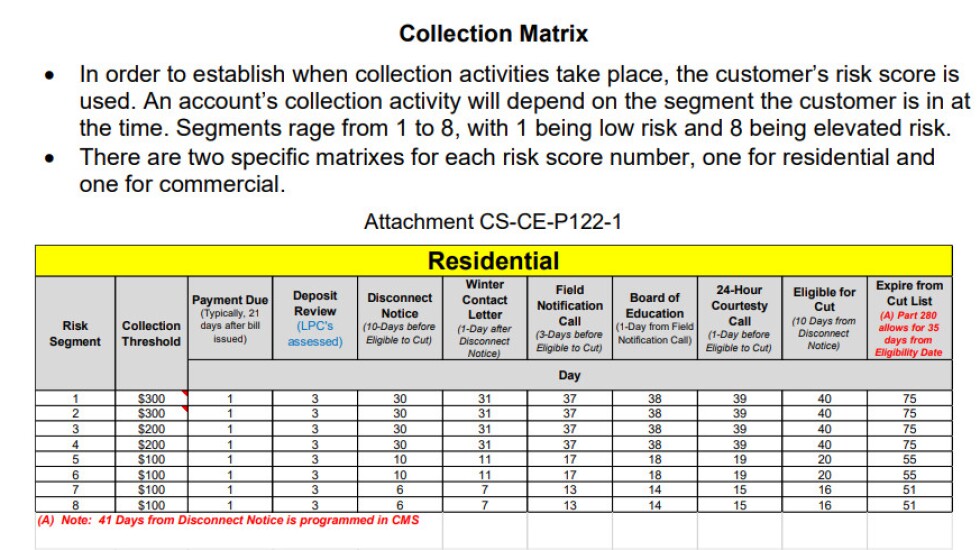

With electric service, this customer sorting means households placed in ComEd’s “riskiest” categories — based on data such as payment history and length of time as a customer — could see their power shut off 16 days after being flagged for disconnection, compared with a more generous 40 days for customers who are considered less risky, according to a ComEd document shared with state regulators and obtained by the Chicago Sun-Times.

Like ComEd, Peoples Gas and its sister company North Shore Gas, as well as the downstate electric and gas company Ameren, sort their customers into risk groups that are treated differently in the collections and disconnections process, documents show.

All four of those utilities use the same outside vendor to sort their accounts.

Nicor, which serves the Chicago suburbs and northern Illinois, says it uses its own in-house system “to evaluate eligibility and select customers” for potential disconnection.

Utilities say such algorithmic sorting processes — in use for years but only recently coming to light in documents filed with the Illinois Commerce Commission — are essential for managing collections and getting bad debt off their books.

They say nudging customers to pay their bills, by whatever method works best for each segment, helps everyone because bad debt write-offs are ultimately paid by other customers.

“We have an obligation as a public service company to all of our ratepayers,” says Jason Decker, ComEd’s vice president of customer financial operations, adding that “disconnection is always a tool of last resort.”

ComEd notes that its quickest disconnect time of 16 days happens only after an account has already gone unpaid for at least two billing cycles, giving customers at least 60 days to make arrangements.

But some consumer advocates say routing people with a history of bill-paying problems onto a track with faster disconnections is unfair — especially when energy and natural gas bills are so high.

“We think there’s a strong argument that this process is discriminatory,” says Karen Lusson, a former assistant public utilities bureau chief for the Illinois Attorney General’s Office who’s now with the nonprofit National Consumer Law Center.

“It’s sort of a cyclical process in that the customer that is considered riskier … is going to receive the disconnection notice quicker, is going to get disconnected, is going to get late fees,” Lusson says.

“People aren’t choosing not to pay. It’s because the bills are so unaffordable,” she says.

And bills are bound to get bigger, as all the utilities have asked the ICC for rate increases. ComEd wants a record $1.47 billion over four years, which would bump up the average residential bill by $17 a month by 2027. Peoples Gas wants $402 million or an increase of almost $12 a month, Nicor is seeking $321 million and North Shore Gas is asking for $18.5 million.

Lusson says she first heard about risk-ranking during the COVID pandemic, in talks with utilities about how to mitigate disconnections.

State regulators also began looking at it, and in late 2021, ICC staff sent all the utilities a series of questions about whether they use “any programs, algorithms, formulae or other predictive tools” in targeting people for disconnection.

Because it’s an opaque process, no individual utility customer knows what their risk rank is.

‘How am I going to pay’

Many of the people walking into the Northwest Center, a nonprofit agency in Chicago’s Belmont Cragin neighborhood that does financial and housing counseling, are facing potentially disruptive and costly utility shut-offs. The center helps people apply for grants through the Low Income Home Energy Assistance Program (LIHEAP).

Jose Silva of Belmont Cragin sought help there this month for his family’s ComEd and Peoples Gas bills, which ballooned to a combined $1,379 after he suffered a debilitating inner ear problem that forced him to stay home from his 28-year job at a sheet metal business.

Silva is getting medical treatment and physical therapy and hopes to return to work soon, but meanwhile, the bills have piled up.

“I’m not working, so I was like oh my gosh, how am I going to pay? I’ve got a lot of doctor’s bills,” he says.

Silva has no way of knowing what risk category he’s in, but he thinks all customers should be treated the same when it comes to disconnections.

“It should be the same, for those who have no money and those who do,” he says.

Jose Villalobos and Carmen DeLeon agree. The husband and wife from Hermosa, who have four children, came to the Northwest Center to apply for LIHEAP after Jose’s income dropped, inflation hit and they fell behind on their utility bills.

“I just want things to be equal for everyone,” DeLeon says.

Risk ranking has been used for years and in some cases decades by utilities.

ComEd, Peoples Gas and North Shore Gas and Ameren all use a Nevada-incorporated company called Total Solution Inc., or TSI, which puts customer payment data such as how often a person pays late, how long they’ve lived at their home and whether they’ve defaulted on a payment plan into a proprietary formula to figure out how likely an account is to default in the future.

ComEd uses eight “risk segments” for its customers, according to a chart it provided to the ICC.

All eight groups get 21 days to pay their monthly bills on time. A potential disconnection comes into play after a household has missed paying two average monthly bills.

After that, things diverge. The two riskiest groups are sent a disconnection notice in as little as six days, compared with 30 days for the least-risky groups. Those risky groups can be shut off in 16 days, compared with 40 days for the least-risky customers.

Consumer advocates worry that because LIHEAP applications can take 30 days, some households on the 16-day track could get cut off as they wait for help.

ComEd says it manually pauses disconnection if it’s informed of a pending LIHEAP application. The company says it is working with state officials to try to automate that.

ComEd used to target the highest-risk customer groups when they hit $100 in past-due bills, while letting the two least-risky groups accumulate $300 in bills. Those amounts were eliminated last year to make the process more fair, the company says.

In their written answers to ICC staff, Peoples and North Shore said they sort gas customers into four categories and that “as a general practice, higher risk customers are prioritized for collection action sooner than less risky customers” and “customers with the highest/oldest arrears” get more attention.

All the utilities stressed that they provide information about public and private grant programs and payment plans to struggling customers, so people can take action and avoid shut-offs.

Utilities defend practice as ‘fair and accurate’

TSI’s president, Stephen Bona, says segmenting accounts and targeting them differently saves time and money for utility companies.

Instead of blanketing every late customer with a disconnection notice the moment they fall behind, utilities can focus on those deemed most likely to default, Bona says. Some customers are habitually slow in paying, he says, and a wake-up call of potential disconnection can push them to seek grant money or agree to a payment plan.

“Frankly, it would be foolish and would cause rates to go up significantly” if risk-ranking were eliminated, Bona says.

The sorting process happens monthly, so customers who pay off their balances and keep paying on time move up to a better category, he says. A customer’s job or income doesn’t factor into the ranking.

“This tool does not know or care where you live or how you live. What matters is how you pay the bill. It’s been proven to be eminently fair and accurate,” Bona says.

ComEd says targeting the riskiest accounts faster can prevent an even worse debt spiral, because it’s easier to rebound after only two missed payments.

Peoples Gas spokesman David Schwartz says steering struggling customers to available bill payment help has resulted in the gas company’s low-income customers being “two times less likely to receive a disconnection notice than our overall customer base.”

But some consumer groups say risk ranking is unfair.

Blacks in Green, Sierra Club Illinois and other groups are backing state legislation that would give financially-struggling customers discounted rates and prohibit accelerated disconnections based on risk ranking.

The People’s Utility Rate Relief Act (HB 2172) also would offer protection from disconnections for medically or financially vulnerable people.

The ICC is looking at all the utilities’ collection practices, a spokeswoman says.

David Kolata, executive director of the Citizens Utility Board, says ranking customers could be good or bad depending on what’s done with the data. But the process needs more transparency.

“This is the downside of something happening behind the scenes,” Kolata says. “I do think it’s important to take a hard look at this.”