/Seagate%20Technology%20Holdings%20Plc%20logo%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

Shares of Seagate Technology (STX) have risen by over 172% year to date, benefiting from AI-driven tailwinds. While shares of this data storage solutions provider have appreciated significantly, its upcoming first-quarter fiscal 2026 earnings could set the stock’s future trajectory.

Seagate will report first-quarter fiscal 2026 financial results on Tuesday, Oct. 28. Seagate’s fundamentals look strong heading into the earnings report. Moreover, the stock appears to have room for further upside. STX’s 14-day Relative Strength Index (RSI) stands at 60.4, well below the 70 threshold that typically signals overbought conditions. This suggests that despite its remarkable run, the stock may still have potential to climb higher if Seagate delivers solid earnings and provides a better-than-expected outlook.

Strong AI Demand and Margin Expansion Set Seagate Up for Growth

Seagate’s first-quarter financials will reflect the solid AI-driven tailwinds, with demand for its storage solutions accelerating as cloud providers and enterprise customers expand infrastructure for AI-driven applications. Notably, data centers are scaling rapidly, driving strong adoption of Seagate’s mass-capacity storage products.

Notably, Seagate posted a 39% year-over-year increase in revenue for fiscal 2025, while operating income more than tripled. This momentum will sustain in fiscal 2026. Further, its bottom line will continue to benefit from higher sales, ongoing cost discipline, supply-demand management, and a shift to a build-to-order (BTO) manufacturing model complemented by dynamic pricing. These measures will bolster margins and enhance operational efficiency.

Seagate is also ramping production of its next-generation products, including its heat-assisted magnetic recording (HAMR) hard drives. Launched in fiscal 2025, HAMR drives are designed to be both cost- and energy-efficient, positioning the company to capture future demand. The market response has been encouraging. Notably, three major cloud providers have already qualified HAMR-based drives, with more customers in the pipeline. At the same time, nearline sales in the enterprise OEM segment continue to grow steadily.

Seagate’s outlook for fiscal 2026 is optimistic. The BTO approach is expected to improve alignment between supply and customer needs, while disciplined pricing and supply strategies should continue to enhance margins. With a robust product pipeline, the company is well-positioned to generate stronger cash flows and deliver higher earnings.

Management has resumed share repurchases, signaling confidence in the company’s cash generation capabilities and commitment to returning capital to shareholders. Concurrently, debt reduction efforts are strengthening the balance sheet, providing Seagate with increased financial flexibility for future growth and deleveraging initiatives.

For the September quarter, management expects revenue around $2.5 billion, up about 15% year-over-year, supported by sustained demand for high-capacity nearline drives. Adjusted operating margins are projected to expand into the mid-to-high 20% range, with adjusted EPS expected at $2.30.

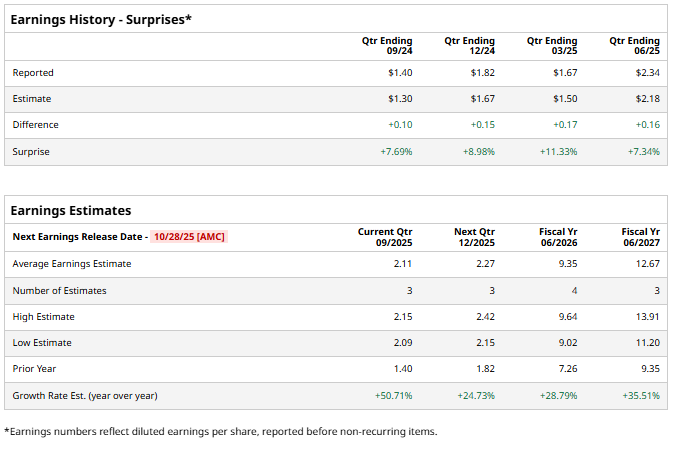

Analysts forecast EPS of $2.11 for Q1, reflecting a 50.7% year-over-year gain. The company’s recent track record adds confidence tp its future trajectory. Seagate has exceeded analysts’ EPS expectations in each of the past four quarters, including a 7.3% beat in its last report.

Will Seagate Stock Sustain Its Uptrend?

Seagate has strong growth potential, driven by rising demand for AI-driven storage solutions, new product launches, and expanding profitability. These factors position the company well to deliver solid financial results, which could, in turn, lift its share price.

From a valuation perspective, Seagate stock remains appealing. Despite an impressive rally this year, the stock still offers room for growth. Seagate stock trades at a forward price-earnings multiple of roughly 23x and appears reasonably priced given its growth prospects. Analysts expect the company’s earnings per share to rise by 28.8% in fiscal 2026 and surge another 35.5% in 2027, highlighting the stock’s undervaluation.

Wall Street sentiment adds to the positive outlook. Analysts collectively rate Seagate as a “Strong Buy,” with the highest price target reaching $350, suggesting potential gains of more than 49% from current levels.

With solid fundamentals and favorable market dynamics, Seagate stock could maintain its upward trajectory.