Shares of Royal Caribbean Cruises Ltd (NYSE:RCL) are trading lower Tuesday afternoon, falling in sympathy with competitor Norwegian Cruise Line Holdings, which dropped after reporting third-quarter earnings. Here’s what investors need to know.

- RCL shares are retreating from recent levels. See the full breakdown here.

What To Know: Norwegian posted third-quarter revenue of $2.5 billion. While up 5% year-over-year, this figure fell significantly short of the $3.02 billion analysts had forecasted.

The revenue miss from Norwegian appears to be sparking investor concern about broader consumer demand and spending trends for the entire sector, pulling down competitors like Royal Caribbean.

The sympathy sell-off adds to Royal Caribbean’s recent volatility. Last week, Royal Caribbean reported strong third-quarter results, beating profit expectations and raising its full-year EPS guidance.

Despite the strong bottom-liner results, the stock declined as its revenue of $5.1 billion came in just shy of Wall Street forecasts, and the company noted a 4.8% increase in net cruise costs. It’s worth noting that Royal Caribbean shares are holding up better than the other major cruise line stocks on Tuesday.

Read Also: Norwegian Cruise Line Q3 2025 Earnings Call Transcript

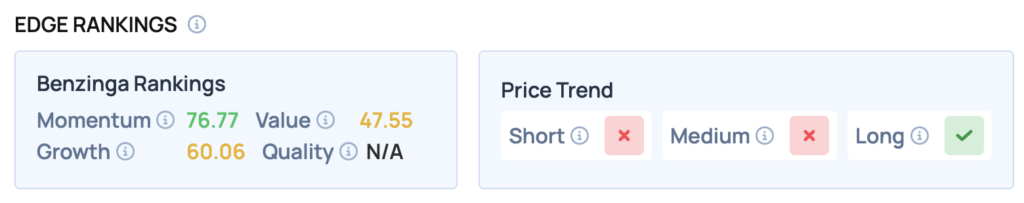

Benzinga Edge Rankings: Despite Tuesday’s downturn, Benzinga Edge Rankings show a positive long-term price trend for the stock, contrasting with negative short and medium-term indicators.

RCL Price Action: Royal Caribbean shares were down 6.12% at $260.81 at the time of publication on Tuesday, according to Benzinga Pro data.

Read Also: Pfizer’s Core Drugs Offset COVID Revenue Drop, Lifts 2025 Profit Outlook Despite Tariffs

How To Buy RCL Stock

By now you're likely curious about how to participate in the market for Royal Caribbean – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock