Rocket Companies Inc (NYSE:RKT) shares are trading lower on Wednesday afternoon, caught in a broader market sell-off fueled by comments from Federal Reserve Chair Jerome Powell. Here’s what investors need to know.

- RKT shares are retreating from recent levels. Get the inside scoop here.

What To Know: While the Fed cut its benchmark interest rate by 25 basis points, Powell introduced uncertainty by stating that another rate cut in December is not a "foregone conclusion," noting "strongly differing views" among policymakers.

As a major mortgage lender, Rocket’s business is highly sensitive to interest rate fluctuations. Powell's cautious tone dampened investor hopes for a sustained rate-cutting cycle, which would lower mortgage rates and stimulate demand for new loans and refinancing.

The prospect of borrowing costs remaining elevated for longer than anticipated clouds the outlook for the housing market and, consequently, RKT's potential profitability. This uncertainty is causing investors to sell off the stock ahead of its financial update.

Investors will now turn their attention to the company's third-quarter earnings report, scheduled for release after the market closes on Thursday. Analysts are forecasting earnings of 3 cents per share on $1.69 billion in revenue.

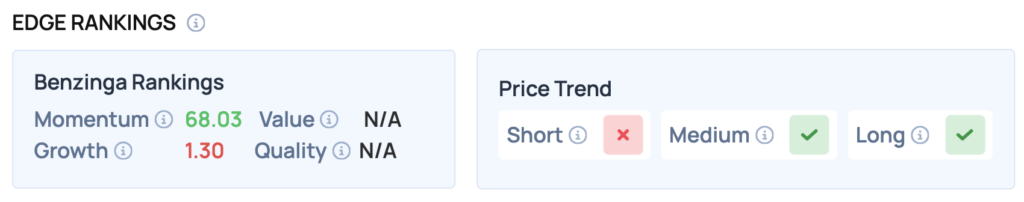

Benzinga Edge Rankings: Highlighting the stock’s current downward pressure, Benzinga Edge data indicates a negative short-term price trend for RKT.

RKT Price Action: Rocket Companies shares were down 7.22% at $16.25 at the time of publication on Wednesday, according to Benzinga Pro data.

Read Also: Western Digital Stock Is Surging Wednesday: What’s Going On?

How To Buy RKT Stock

By now, you're likely curious about how to participate in the market for Rocket Companies — be it to purchase shares or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading — either way it allows you to profit from the share price decline.

Image: Shutterstock