Shares of Robinhood Markets Inc. (NASDAQ:HOOD) have stumbled, falling over 7% in the last five trading sessions, as it didn’t make it into the S&P 500 index again; however, a bullish outlook from Cathie Wood‘s Ark Invest sees the company poised to disrupt the multi-billion-dollar sports betting industry.

Check out HOOD’s stock price here.

Interactive Brokers In! HOOD Still On The Sidelines

The S&P Dow Jones Indices announced late Monday that Interactive Brokers Group Inc. (NASDAQ:IBKR) would join the benchmark index, taking a spot that many on Wall Street had anticipated would go to Robinhood.

A place in the S&P 500 is highly sought after, as it guarantees a stock's purchase by countless passive index funds and increases its exposure to a wider range of investors.

This marks the latest in a series of snubs for Robinhood, which has met key eligibility criteria but has been repeatedly overlooked by the index committee.

Ark Bets On HOOD Positioning In Sports Betting Industry

While the market reacts to the index exclusion, a recent commentary from Ark Invest highlights a strategic pivot that it believes could be a game-changer for Robinhood.

The investment firm is focused on the company's new partnership with Kalshi to offer event contracts on sports, effectively creating a federally regulated prediction market.

According to the commentary, this new venture could “reshape the way investors and consumers think about and respond to the convergence between sports and financial markets.”

See Also: Interactive Brokers Stock Rises On S&P 500 Inclusion

DraftKings And FanDuel Face The Pressure

The key difference lies in the regulatory framework. While sportsbooks like DraftKings must navigate a complex “patchwork of state gambling laws,” Robinhood’s new offering is regulated by the Commodity Futures Trading Commission (CFTC).

This allows the event contracts to function more like “tradable financial contracts than sports bets,” opening the door to a nationwide market with significantly less friction.

Betting On Robinhood More Economical?

Ark's analysis also points to a more transparent and cost-effective economic model. Robinhood charges a flat $0.02 fee per contract, a stark contrast to traditional sportsbooks that embed a 4-6% margin, or “vig,” into their odds.

This structure means bettors often need to win 52-55% of the time just to break even. In its conclusion, Ark suggests that Robinhood's approach—combining federal oversight, lower fees, and broader access—is a pioneering model that could ultimately “turbocharge the convergence between sports and financial markets.”

Price Action

HOOD shares closed 1.26% lower on Monday and fell 0.50% after hours. It was down 7.04% in the last five sessions. but higher by staggering 173.68% year-to-date. The stock has surged by 414.98% over the year.

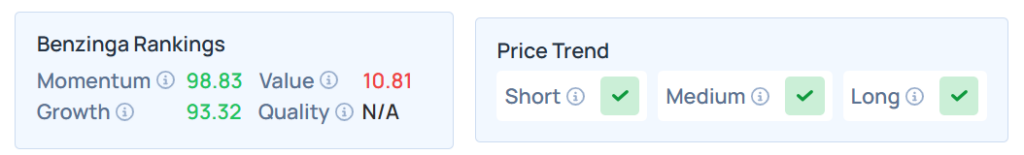

Benzinga’s Edge Stock Rankings indicate that HOOD maintains a stronger price trend in the short, medium, and long terms. However, the stock scores poorly on value rankings. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell on Monday. The SPY was down 0.44% at $642.47, while the QQQ also declined 0.29% to $570.32, according to Benzinga Pro data.

On Tuesday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading lower.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: Sergei Elagin On Shutterstock.com