Robinhood Markets Inc (NASDAQ:HOOD) shares are trading higher Monday, building on recent momentum that has seen the stock rally about 10% over the past week. The latest surge comes after a bullish initiation, signaling fresh confidence from Wall Street.

- HOOD stock is showing exceptional strength. Get the market research here.

What To Know: CICC initiated coverage on Robinhood with an Outperform rating and set a price target of $155 on Monday.

The new rating adds to an overwhelmingly positive sentiment from analysts. Bank of America recently raised its price target to a Street-high of $157, while Goldman Sachs and Piper Sandler hold targets of $152 and $155, respectively. The stock, which is up over 270% year-to-date, is approaching its 52-week high of $153.86.

Analysts are highlighting the rapid expansion of Robinhood’s prediction markets as a significant catalyst. CEO Vlad Tenev recently announced the division has already exceeded four billion trades, and the company is reportedly pursuing strategic acquisitions to accelerate its growth.

Investors are now turning their attention to the company's third-quarter earnings report, scheduled for release after the market closes on Nov. 5.

Analysts expect Robinhood to report earnings of 51 cents per share and revenue of approximately $1.18 billion. Investors will be keenly watching for updates on user growth and the performance of new product areas.

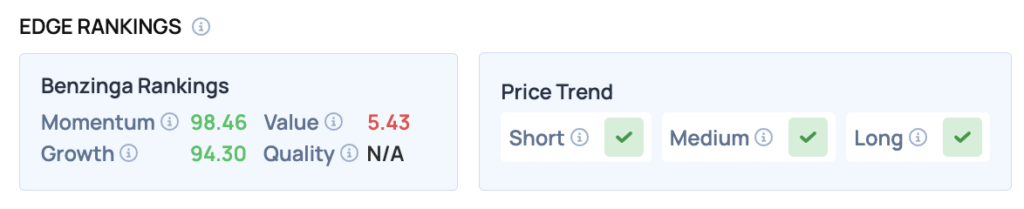

Benzinga Edge Rankings: According to Benzinga Edge proprietary stock rankings, Robinhood boasts exceptional scores for Momentum (98.46) and Growth (94.30).

HOOD Price Action: Robinhood Markets shares were up 4.6% at $146.22 at the time of publication on Monday. The stock is approaching its 52-week high of $153.86, according to Benzinga Pro data.

Read Also: Rate Cuts, Meltups, And Market Euphoria — Ed Yardeni Says It’s 1999 All Over Again

How To Buy HOOD Stock

By now you're likely curious about how to participate in the market for Robinhood Markets – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock