Shares of Rivian Automotive Inc (NASDAQ:RIVN) are trading higher Wednesday morning after the electric vehicle maker reported third-quarter financial results that beat analyst expectations. Here’s what investors need to know.

- RIVN is charging ahead with explosive momentum. Find out why here.

What To Know: The EV company announced total revenue of $1.56 billion, a 78% increase year-over-year, surpassing the Street consensus estimate of $1.50 billion. Rivian also reported a consolidated gross profit of $24 million for the quarter. The company posted a loss of 65 cents per share, which was better than the analyst consensus estimate for a loss 72 cents per share.

In the third quarter, Rivian delivered 13,201 vehicles. For its full-year 2025 guidance, Rivian maintained its vehicle delivery forecast of 41,500 to 43,500 vehicles. The company also guided for a full-year adjusted EBITDA loss between $2.0 billion and $2.25 billion.

Key operational updates included confirmation that its next-generation R2 vehicle remains on track for deliveries in the first half of 2026. Rivian also announced it will host an “Autonomy & AI day” on Dec. 11.

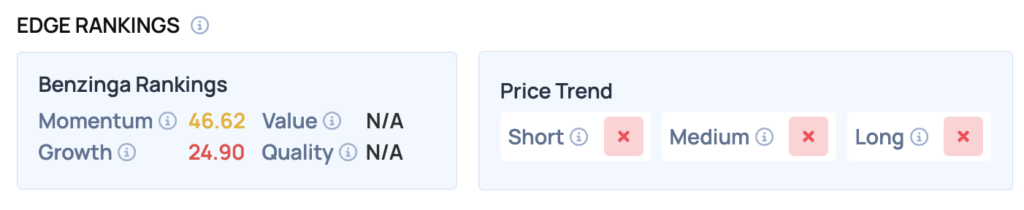

Benzinga Edge Rankings: According to Benzinga Edge Rankings, RIVN stock has a Momentum score of 46.62 and a Growth score of 24.90.

RIVN Price Action: Rivian Automotive shares were up 13.84% at $14.23 at the time of publication on Wednesday, according to Benzinga Pro data.

Read Also: Quantum Stocks Fight Back: Slight Rebound On Advances And Funding

How To Buy RIVN Stock

By now you're likely curious about how to participate in the market for Rivian Automotive – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock