Rivian Automotive Inc (NASDAQ:RIVN) shares are dropping on Thursday afternoon. The decline follows a Wall Street Journal report that the company is cutting less than 1.5% of its workforce. The layoffs are an effort to reduce costs and increase efficiency before the launch of its more affordable R2 SUV.

What To Know: A company spokesperson told the Wall Street Journal the layoffs are part of an effort to improve operations for the new vehicle. These job reductions follow several other rounds of layoffs as Rivian works to streamline its business and prepare for the R2’s release.

A Needham analyst last week provided optimistic color by reiterating a Buy rating, noting the R2’s potential to significantly broaden the automaker’s market with its more accessible $50,000 price.

To support this expansion, Rivian will break ground on its $5 billion Georgia factory on Sept. 16, with R2 production set to commence in 2028. This new plant is a cornerstone of the company's strategy and could help it surpass 2026 delivery targets.

However, Rivian faces significant challenges. The company is grappling with a nearly $100 million revenue shortfall after a policy change on federal fuel economy rules disrupted the lucrative market for regulatory credits.

Rising tariffs are escalating production costs and contributing to stock volatility. While the company has recently recorded positive gross profit, its high cash burn rate remains a persistent concern.

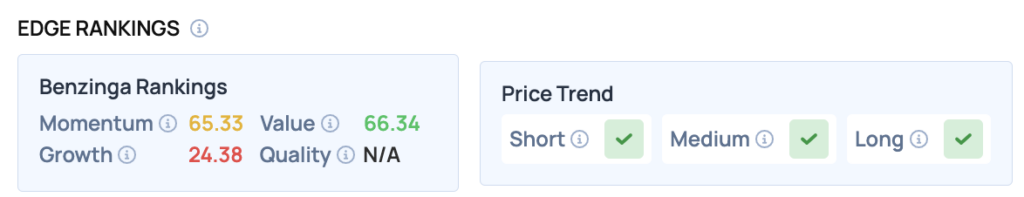

Benzinga Edge Rankings: Benzinga Edge stock rankings show a key weakness in the stock, as its Growth score is ranked at a low 24.38.

RIVN Price Action: According to data from Benzinga Pro, Rivian shares are trading 5.36% lower at $13.67 on Thursday afternoon. The stock has a 52-week high of $17.14 and a 52-week low of $9.50.

Read Also: What’s Going On With Rivian Stock?

How To Buy RIVN Stock

Besides going to a brokerage platform to purchase a share — or fractional share — of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For Rivian Automotive, it is in the Consumer Discretionary sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock