It’s been an interesting road for Luckin Coffee (LKNCY). The Chinese-based coffee chain was one of the darlings on Wall Street last decade as it opened hundreds of locations and set its sights on toppling Starbucks (SBUX) as the No. 1 coffee chain in China.

But as quickly as it started, Luckin’s story unraveled. A short-seller’s report accused Luckin of falsifying sales figures, and by 2020, the company acknowledged that an executive had inflated 2019 sales figures by $310 million. Luckin's stock was delisted from the Nasdaq, and the Securities and Exchange Commission (SEC) imposed a $180 million fine. The company filed for bankruptcy.

But Luckin wasn’t done yet. The company retrenched, emerged from bankruptcy, and has succeeded in replacing Starbucks as China's biggest coffee chain. And now it has come to the U.S., with two stores in New York that opened in July.

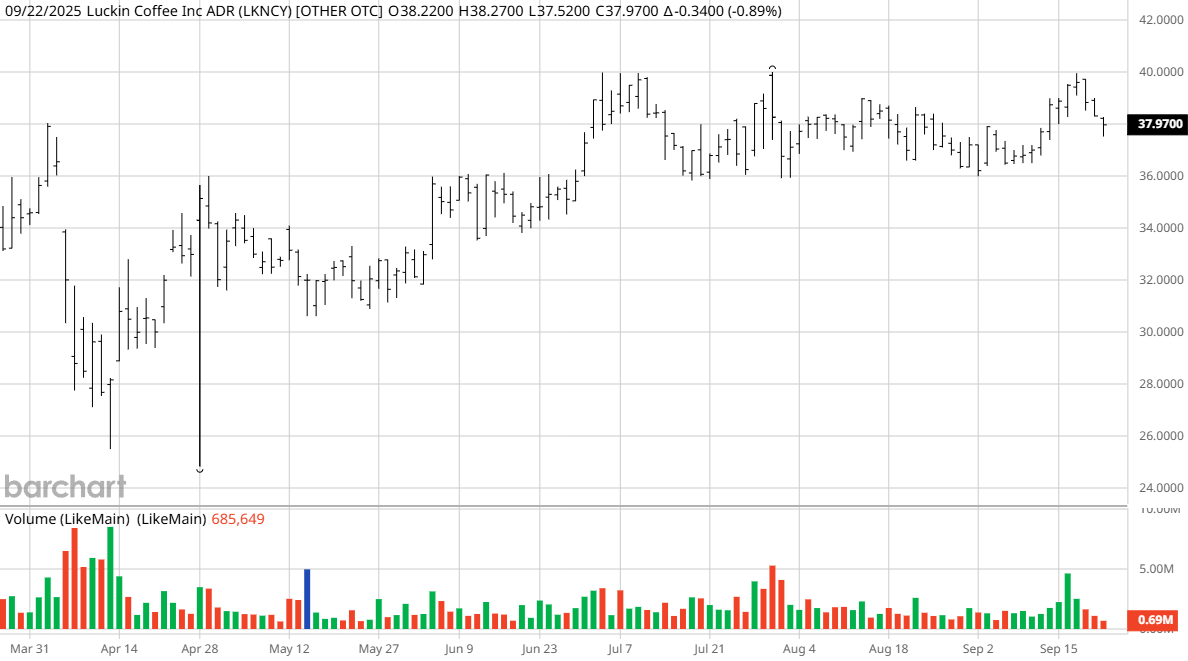

Luckin shares are still available to investors in the over-the-counter market. With its re-emergence and new focus on U.S. expansion, is it time to invest in Luckin stock?

About Luckin Coffee Stock

Luckin is headquartered in Xiamen, China, and currently operates 26,200 stores, with most of them in China and Hong Kong. The coffee store also has six stores in Singapore, 16 in Malaysia, and its two New York locations.

Luckin Coffee keeps costs down by operating stores entirely without cashiers—customers must use the company’s mobile app to order and pay for their food and drinks. The app keeps customers engaged by often offering steep discounts in an effort to build the company’s customer base.

In addition to various traditional coffee drinks, Luckin Coffee also sells coffee-and-juice combinations, espresso, matcha lattes, and snacks.

Despite trading on the over-the-counter (OTC) market, Luckin has an impressive market capitalization of $10 billion, with a trading volume of roughly 1.9 million shares per day. It’s a bigger coffee company by market cap than several that trade on major indices, including Dutch Bros (BROS) and Westrock Coffee (WEST).

It’s also by far the best-performing coffee stock in the last 12 months, rising 94% versus the 62% gain of Dutch Bros. Three other coffee stocks—Westrock, Starbucks, and Reborn Coffee (REBN)—are in the red during that period. Luckin Coffee stock is up 47% in 2025.

Luckin Coffee is also attractively valued compared to its peers—its forward price-to-earnings (P/E) ratio of 19.7 is lower than Starbucks (38.7) and Dutch Bros. (83.7). The forward price-to-sales ratio of 1.6 is lower than Starbucks (2.6) and Dutch Bros. (4.4).

Luckin Coffee Earnings Are Strong

Considering the accounting scandal that caused Luckin to be delisted five years ago, the company’s quarterly earnings reports get a lot of attention. But Luckin Coffee appears to be on the right track, with rapid expansion and growing revenue.

In the second quarter, Luckin reported revenue of $1.72 billion, up 47.1% from a year ago. GAAP operating income was $237 million, up 61% from a year ago, and the company’s margins increased from 12.5% to 13.8%.

Luckin Coffee opened 2,109 new stores in the quarter, continuing its rapid expansion. Most of Luckin’s stores are self-operated, but it has a growing number of what it calls partnership stores that are a form of franchising.

| Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | |

| Total stores | 19,961 | 21,343 | 22,340 | 24,097 | 26,206 |

| Self-operated stores | 13,056 | 13,936 | 14,591 | 15,598 | 16,968 |

| Partnership stores | 6,905 | 7,407 | 7,749 | 8,499 | 9,238 |

| Average monthly customer transactions | 69.68 million | 79.84 million | 77.76 million | 74.27 million | 91.69 million |

Source: Luckin Coffee Q2 Earnings Report

“Notably, the soft opening of two stores in New York marked a significant milestone in Luckin’s international expansion strategy,” CEO Guo Jinyi said. “The U.S. is a highly developed coffee market, and we remain in the early stages of exploration. Our approach will be disciplined and deliberate, with a focus on validating consumer response to our brand positioning, digital ordering experience, product portfolio, and pricing strategy. Through this early phase, we aim to establish Luckin’s unique value propositions and customer experience in the U.S. market, while building localized operational capabilities to support future scaled expansion.”

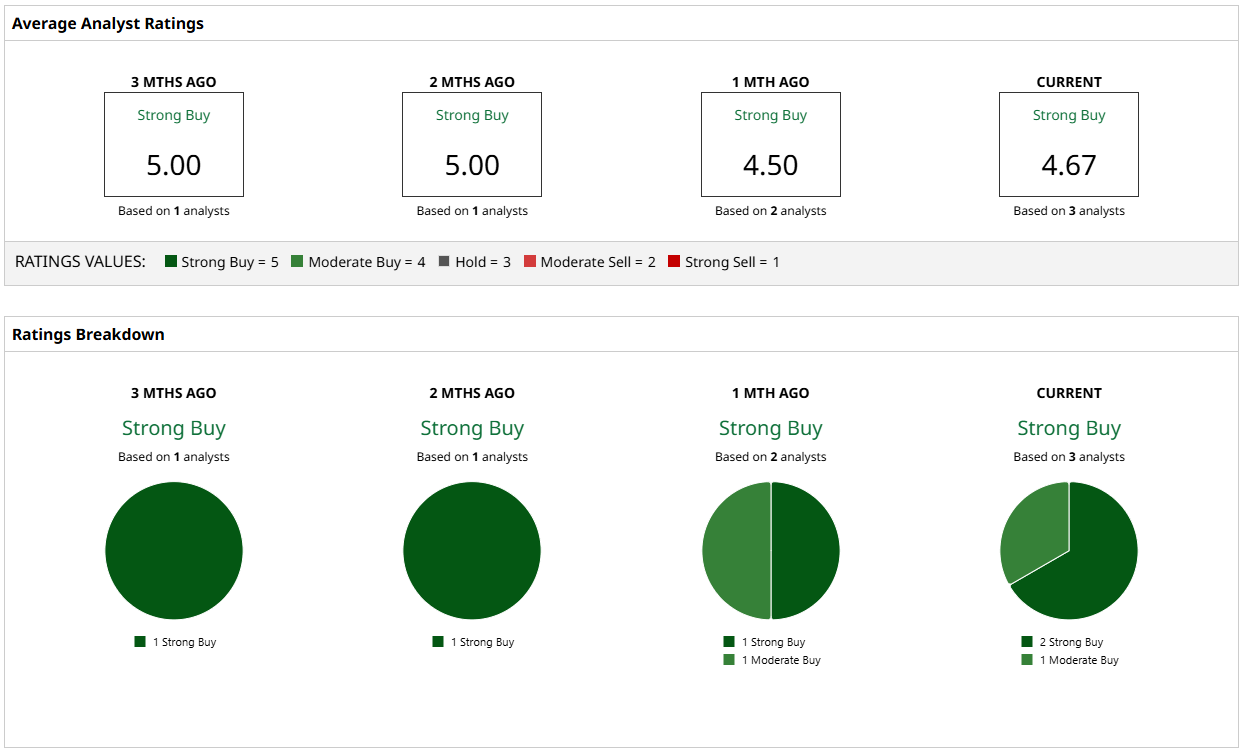

What Do Analysts Expect for LKNCY Stock?

Perhaps because Luckin Coffee is still traded on the over-the-counter market, there isn’t a great deal of analyst coverage or commentary. The three analysts who currently cover LKNCY stock have a consensus Strong Buy rating, with a mean price target of $47.98—indicating potentially a 26% gain in the next several months for Luckin Coffee stock.

Considering the company’s rapid growth, its stock performance over the last 12 months, and analyst sentiment, Luckin Coffee is worth serious consideration. Five years after its fraud scandal, the company is once again a significant player in the food and beverage space.