Real estate investment trusts (REITs) traded in different directions at the open on Monday as investors decided which to buy and which to sell:

Among the major REITs, Realty Income Corp (NYSE:O) is down at the open, off by 0.85%. Realty Income is the net-lease operation that pays a monthly dividend.

Healthcare Realty Trust Inc (NYSE:HR) is selling off this morning, it’s lower at the open by 0.60%.

The real estate investment trust buys and operates healthcare facilities, as the name implies, and is paying a dividend of 4.62%.

Medical Properties Trust Inc (NYSE:MPW) has opened up by 0.39%. Continuing to move upward off of the mid-June lows, Medical Properties Trust still has a long way to go to reach its early 2022 highs.

Prologis Inc (NYSE:PLD) is also off just after the morning bell, taking a 1.11% hit to the downside.

With largely industrial properties in the Americas, Europe and Asia, Prologis at this price pays a 2.58% dividend.

So, some REITS up and some are down this morning as this sector attempts to stabilize after hitting 2022 lows just weeks ago.

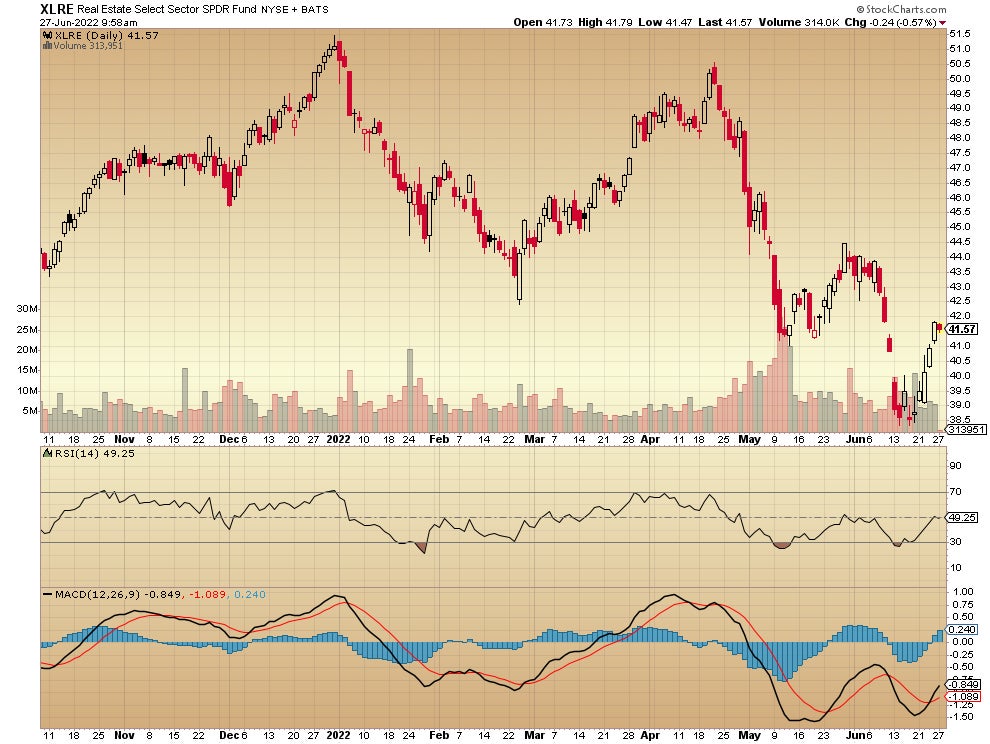

The benchmark ETF, the Real Estate Select Sector SPDR (XLRE), was off shortly after the open, by 0.57%.

The fund represents a cross-section of real estate investment trusts and generally reflects the overall bullish or bearish bias in the sector.

Charts courtesy of StockCharts

Not investment advice. For educational purposes only