Redwire Corp. (NYSE:RDW) stock witnessed a drop of over 24 in value during pre-market trading following the company’s second-quarter earnings report.

Check out how RDW stock is trading here.

What Happened: The stock price of Redwire Corp., a global leader in space and defense technology solutions, plummeted to $10.33 in the pre-market session on Thursday. This represents a 25.53% decrease from the previous close of $13.70, according to Benzinga Pro data.

Redwire’s second-quarter earnings report showed a 20.9% decrease in revenue, which fell to $61.8 million compared to $78.1 million in the same period last year.

The net loss for the quarter was $97 million, a significant increase from the $18.1 million loss in the second quarter of 2024. The adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) also dropped to a loss of $27.4 million from a gain of $1.6 million in the second quarter last year.

Peter Cannito, Chairman and Chief Executive Officer of Redwire, attributed the revenue decline to delays in the U.S. government’s budget approval processes.

He further stated, "We have begun to see positive indicators as well. Whether Golden Dome, U.S. drone dominance, or increased defense spending internationally by NATO allies, we are well-positioned to capitalize on high-growth trends going forward."

The Florida-based aerospace manufacturer has traded between $4.87 and $26.66 over the past year. It saw a volume of about 3.7 million shares today, with a market cap of around $2.1 billion.

Why It Matters: The disappointing second-quarter results and the subsequent stock plunge come after Redwire Corporation reported worse-than-expected second-quarter financial results and cut its 2025 sales guidance on Wednesday. The company’s stock has been on a downward trend.

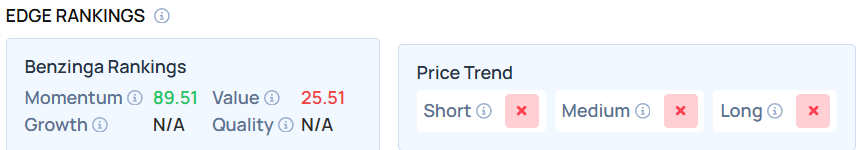

With a strong Momentum in the 89th percentile, Benzinga’s Edge Stock Rankings indicate that RDW has a negative price trend across all time frames. Here is how the stock fares on other parameters.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: T. Schneider / Shutterstock