/EV%20charging%20spot%20by%20Patpitchaya%20via%20iStock.jpg)

QuantumScape (QS) stock is coming off of a remarkable rally, reaching a new 52-week high of $15.03 on July 18 to cap off a nine-day win streak leading up to its Q2 earnings release on July 23. The company's recent success is largely attributed to the groundbreaking integration of its Cobra separator process into baseline cell production, which has dramatically improved manufacturing efficiency by a factor of 25 compared to previous methods.

The technological advancement has not only streamlined production but also reduced equipment requirements and operational footprint, contributing to the battery stock's staggering 268% rise from its April lows.

QS Stock is Set to Slide Again Today

However, the recently high-flying momentum stock is currently on pace to continue Monday’s sharp reversal into a second session. In premarket trading, QS has collapsed by 9.5% on heavy volume, on pace to add to yesterday’s 14.5% decline.

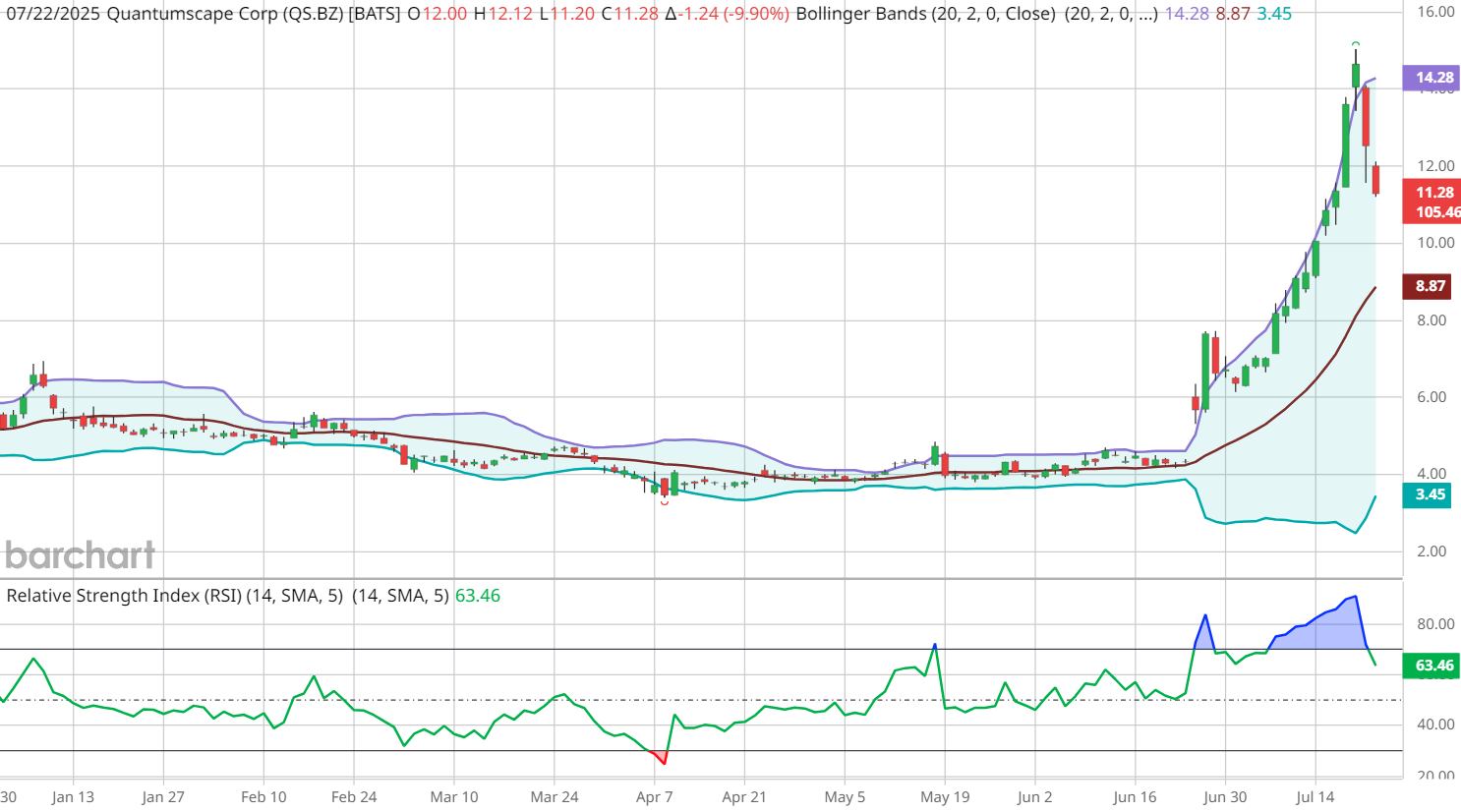

QuantumScape stock is now below its upper Bollinger Band again, after briefly breaking out above this technical level. Additionally, the 14-day Relative Strength Index (RSI) stands at 63.46, retreating from a surge into deeply overbought territory earlier this month.

What’s Driving Growth at QuantumScape?

While QuantumScape maintains a strong financial position, with $860 million in liquidity extending into late 2028, the company remains pre-revenue. For its second quarter, due out after Wednesday night’s close, analysts expect QS to show improvement with a projected loss of $0.20 per share, compared to a loss of $0.25 per share last year.

A strategic partnership with Volkswagen's (VWAGY) PowerCo battery arm continues to be a crucial element in QuantumScape's commercialization strategy, positioning QS to potentially license its technology for mass production of electric vehicle (EV) battery cells. QuantumScape is progressing toward customer sample shipments and field testing of QSE-5 modules in 2026, marking important milestones in its development timeline.

More broadly, global EV sales are projected to exceed 20 million units in 2025, with the battery market expected to nearly triple production to 377,000 units in the same year. However, supply chain vulnerabilities persist - particularly as it relates to critical minerals and battery materials, where China maintains dominant control over 70% of global lithium supply and processing capacity.

Should You Buy the Dip in QS Stock Ahead of Earnings?

Despite this week’s pullback, QS stock's current price-to-book ratio near 7.8x appears stretched for a development-stage company, raising valuation concerns. While the company's progress in addressing key EV market challenges of range anxiety and charging speed continues to attract investor attention, the significant gap between market enthusiasm and fundamental business metrics suggests careful consideration is warranted.

With 8 analysts in coverage, the consensus rating on Wall Street is a cautious “Hold,” with an average price target of $4.79 and a high price target of $8.00 - both of which are a discount to Monday’s close at $12.52.

Given the heightened volatility in QS ahead of earnings, investors may prefer to give this stock a wide berth until the Wednesday night report provides more clarity on QuantumScape’s financial metrics and future outlook.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.