/Row%20of%20charging%20vehicles%20by%20Helloabc%20via%20Shutterstock.jpg)

Solid-state battery maker QuantumScape (QS) saw its shares soar after the company reported a lower-than-expected loss in its most recent quarterly results, while also guiding for lower EBITDA losses in the range of $245 million–$260 million from $250 million–$270 million earlier.

And the good news did not end there for the pre-revenue company, as it reported customer billings of $12.8 million in Q3. The customer billings can be thought of as the dollar value of invoices QuantumScape issues to customers or partners for collaborative development work, prototype cells, and related services, an important indicator of revenue visibility.

About QuantumScape

Founded in 2010, QuantumScape develops next-generation solid-state lithium-metal batteries aimed primarily at the electric vehicle (EV) market. Their goal is to make higher energy density, faster charging, improved safety, and simpler architecture compared with conventional lithium-ion batteries. With notable backers like Bill Gates, automobile major Volkswagen AG (VWAGY), and the Qatar Investment Authority,

QuantumScape IPO-ed on Nov. 27, 2020, following its business combination (SPAC merger) with Kensington Capital Acquisition Corp.

Currently valued at a market cap of $7.7 billion, the QS stock has been on a tear this year, as it is up 208% on a year-to-date (YTD) basis.

So, are solid guidance and a roaring share price performance enough reasons to make a bet on the QS stock? Let's find out.

Prudent Financial Management

For a company like QuantumScape, which has no sales, it is essential that it curb its losses and provide confidence to investors that it will generate revenue soon. QuantumScape is delivering on both.

Since Q2 2024, the company's losses have been narrowing, and since Q4 2024, its losses have been consistently coming in below consensus forecasts. Then, it deepened its existing relationship with motorcycle major Ducati by unveiling the Ducati V21L race motorcycle, which was developed with QuantumScape's next-generation battery technology.

Also, the company began shipping Cobra-based QSE-5 B1 samples in Q3. The company claims that the QSE-5 is designed to deliver “no-compromise” performance through high-energy density (844 Wh/L was cited for early B-samples), along with fast charging (~12.2 minutes to go from 10% to 80%) and high discharge capability and low-temperature performance. When combined with the scalable Cobra process, QuantumScape argues these cells will make solid-state batteries commercially viable for automotive use.

Coming back to the metrics, QuantumScape's operating expenses for the third quarter stood at about $115 million, down from $130.16 million in the previous year. Net cash used in operating activities also reduced to $63.7 million from $92.8 million in the year-ago period, with the company closing the September 2025 quarter with a cash balance of $225.8 million. This was much higher than the company’s short-term debt levels of about $8 million. In fact, the cash balance was also higher than the company's long-term debt levels of $65 million, thus driving home the fact that it has done a good job managing debt.

On the Cusp of Something Great?

QuantumScape believes that its batteries, developed with anode-free architecture, will provide some material benefits to consumers when compared to lithium-ion batteries, which are the standard now in EVs worldwide.

Key advancements in QuantumScape's solid-state battery design encompass greater energy storage capacity, extended lifespan through more cycles, enhanced protection via a flame-resistant and non-ignitable separator, and quicker recharge times. Such features directly tackle the primary worries weighing on buyers today, with the added prospect of lower production expenses from forgoing traditional anode substrates and associated outlays. As a result, the company's technology positions itself as a standout option for electric vehicles across critical performance indicators, casting an encouraging light on its extended horizon.

Beyond that, ties to Volkswagen and its PowerCo division are already yielding royalty streams for QuantumScape. A fresh agreement inked in July secures $31 million across the coming two years, including $10 million billed in the third quarter. Viewed strategically, this arrangement stretches the firm's funding horizon out to 2029.

The company has also forged pacts with a pair of industry titans in materials: Murata Manufacturing (MRAAY) and Corning (GLW). For an early-stage outfit, validation from such players carries real weight. Both are committing resources to ramp up the output of the ceramic electrolytes needed to support QuantumScape.

Thus, the trajectory for QuantumScape appears electric. As the shift to EVs accelerates, demand for solid-state power sources will surge to fuel broader uptake, and the firm's strategy charts a promising course. Anchored by its flagship collaboration with Volkswagen, capped by a proven rollout on a Ducati bike, the path to market entry now feels within reach.

Analyst Opinion of QS Stock

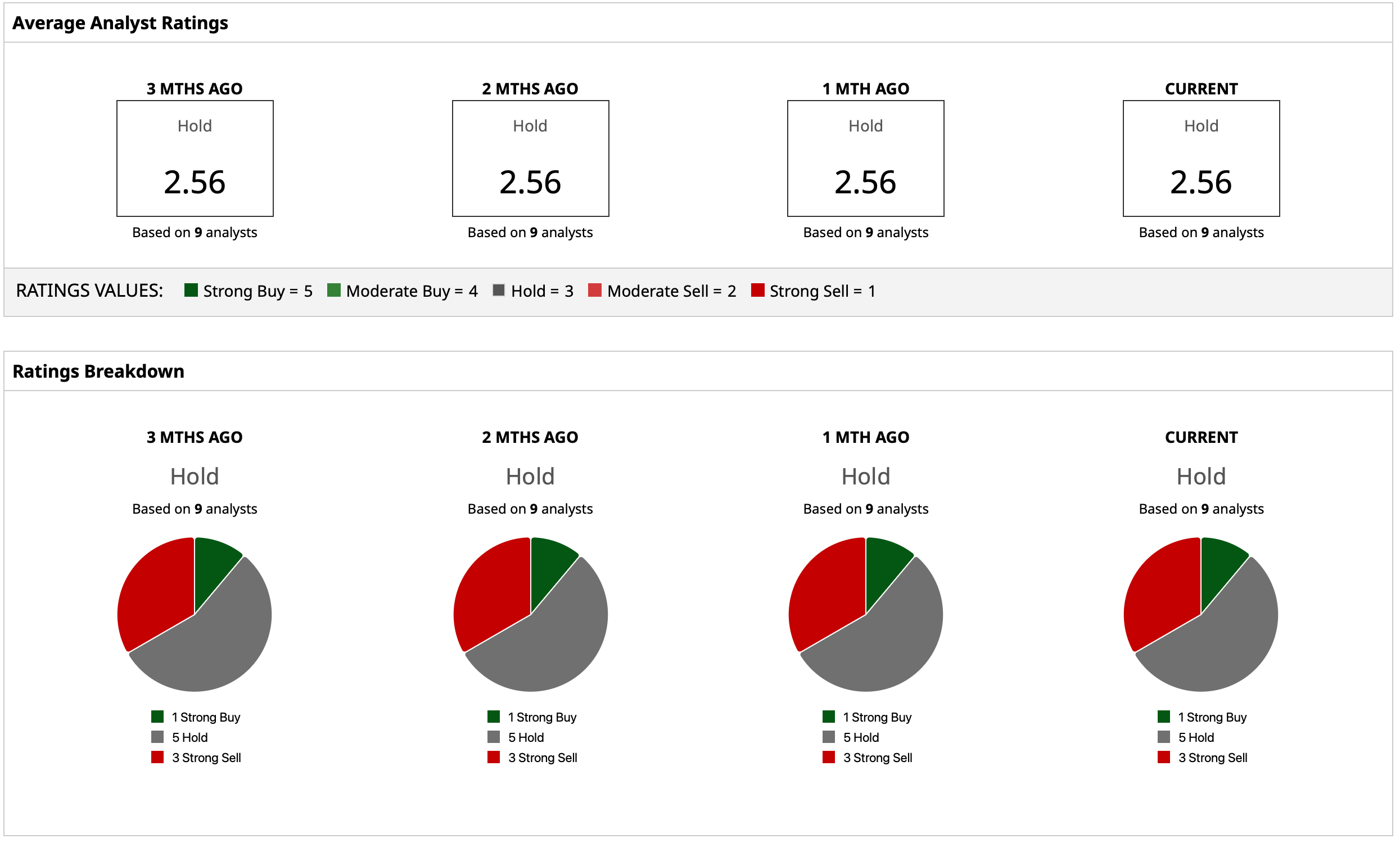

Overall, analysts have deemed the QS stock a “Hold,” with a mean target price of $7.07, which has already been surpassed. The high target price of $16 has also been surpassed as of this writing. Out of nine analysts covering the stock, one has a “Strong Buy” rating, five have a “Hold” rating, and three have a “Strong Sell” rating.