Shares of Quantum Computing Inc (NASDAQ:QUBT) are trading higher Thursday morning following reports that the Trump administration is exploring taking equity stakes in several U.S. quantum computing companies. The potential deal would involve providing federal funding, reportedly starting at $10 million per company, in exchange for ownership shares.

- QUBT shares are powering higher on strong volume. Get the market research here.

What To Know: This news is a significant catalyst for QUBT’s stock for several key reasons. Firstly, a direct cash infusion from the government would provide crucial, non-dilutive capital to accelerate the company's high-cost research and development efforts in a capital-intensive industry.

Secondly, and perhaps more importantly, a federal investment serves as a vote of confidence. This government validation de-risks the company in the eyes of private investors, signaling that its technology is vital to national strategic interests.

This support can potentially attract further investment, top-tier talent and increase the likelihood of securing future government contracts, bolstering the company's long-term growth trajectory and competitive position in the global quantum race.

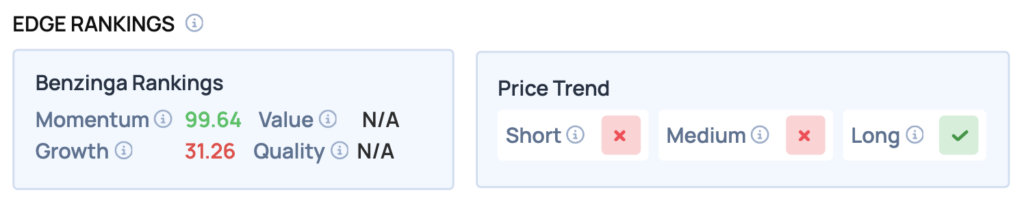

Benzinga Edge Rankings: According to Benzinga Edge Rankings, QUBT boasts an exceptionally high Momentum score of 99.64, indicating very strong recent price performance.

QUBT Price Action: Quantum Computing shares were up 8.68% at $16.16 at the time of publication on Thursday, according to Benzinga Pro data.

Read Also: Tesla Stock Is Trading Lower Thursday: What’s Driving The Action?

How To Buy QUBT Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Quantum Computing’s case, it is in the Information Technology sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock