Leading analysts are divided over Qualcomm Inc.‘s (NASDAQ:QCOM) entry into the AI chip market, aimed at challenging NVIDIA Corp.‘s (NASDAQ:NVDA) dominance in this multi-billion-dollar segment.

QCOM is reaching significant price levels. Get the market research here.

‘Still Early’ In The AI Race

Fund manager Gene Munster of Deepwater Asset Management said that Qualcomm’s announcement is a sign that it is “still early” in the AI race, while speaking on CNBC’s Fast Money on Monday.

“We need to read between the lines,” Munster said, adding that the company’s chips, which are set to be launched in 2026 or 2027, signal a “big opportunity” in this space. He said this speaks to the “supply constraints” that currently persist across the AI value chain.

See Also: Qualcomm (QCOM) Stock Surges On New AI Data Center Chip Announcement: What Investors Need To Know

Munster, however, acknowledged that there is no substance behind Qualcomm’s claims just yet, “this is a press release that’s unlocked $20 billion in market cap,” he said.

‘Empty-Suited’ Competitor

On Monday, in a post on X, TV host Jim Cramer dismissed Qualcomm’s threats to NVIDIA, referring to the former as an “empty-suited competitor.”

He said that the company's AI buzz may have briefly spooked investors in Nvidia, saying that it “shakes out Nvidia shareholders, of course.” Nvidia shares were, however, up 2.81% on Monday, and are up another 0.04% in after-hours trading.

Qualcomm Can ‘Win Big By Winning Small’

Daniel Newman, the CEO of The Futurum Group, was bullish on the company and its new AI chips, noting that it can “win big by winning small,” by virtue of the sheer size and scale of this market.

In a post on X, Newman said that even a 1% market share in this segment “is worth Billions,” adding that the company can “win a few percent of this massive market.”

“The critics will chirp, but by mid next year, the deals will come and the same critics will be silenced or at very least they will be wrong,” he said, while acknowledging that Qualcomm has its “work cut out,” to prove that it can compete in the competitive AI data center space.

BoFA Remains Skeptical

Analysts at Bank of America remain skeptical of Qualcomm’s prospects in the AI data center segment, terming its rally following the announcement as a potential “fade.”

The analysts note that “these are lower-end chips,” without high bandwidth memory, which are set to ship only after a year, with only one “Middle East customer disclosed” so far, as reported by CNBC journalist Kristina Partsinevelos in a post on X.

“They estimate $1-2B in revenue potential,” while highlighting that the company’s market capitalization just surged by $20 billion following the announcement.

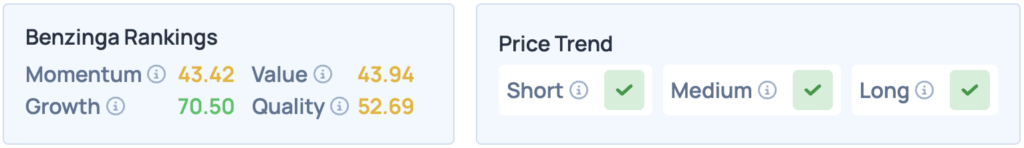

Qualcomm’s shares were up 11.09% on Monday, closing at $187.68, and are up 0.54% in overnight trade. The stock scores high on Growth in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights on the stock, its peers and competitors.

Read More:

Photo Courtesy: Bandersnatch on Shutterstock.com