/Prudential%20Financial%20Inc_%20on%20laptop-by%20monticello%20via%20Shutterstock.jpg)

Prudential Financial, Inc. (PRU) is a leading global financial services company headquartered in Newark, New Jersey. With a market cap of $35.4 billion, the firm provides a wide range of insurance, investment management, and retirement-related products and services to individual and institutional clients across the United States, Asia, Europe, and Latin America.

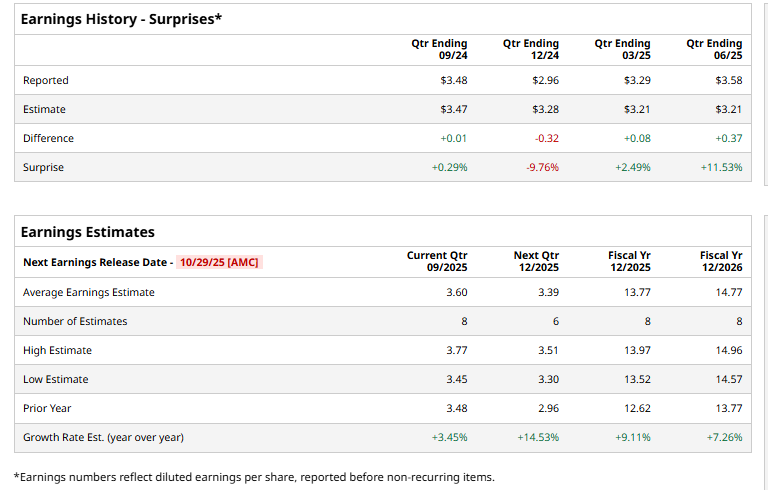

The insurance giant is expected to release its Q3 earnings after the market closes on Wednesday, Oct. 29. Ahead of the event, analysts expect Prudential to report a profit of $3.60 per share, up 3.5% from $3.48 per share reported in the year-ago quarter. The company has beaten Wall Street’s adjusted EPS estimates in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts expect PRU to deliver an EPS of $13.77, up 9.1% from $12.62 in fiscal 2024. In fiscal 2026, its earnings are expected to further grow 7.3% annually to $14.77 per share.

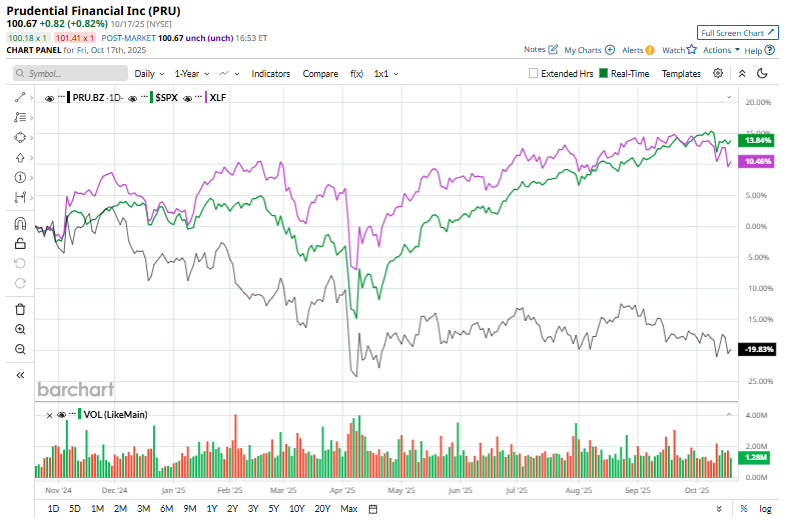

PRU has plunged 21.2% over the past 52 weeks, trailing the S&P 500 Index’s ($SPX) 14.1% returns and the Financial Select Sector SPDR Fund’s (XLF) 9.6% surge during the same time frame.

The stock’s weak momentum over the past year stems from high interest rates, lower investment spreads, and foreign exchange pressures in the company’s international operations.

On October 16, Prudential Financial shares fell 3.2% after two major Wall Street firms, KBW’s Ryan Krueger and Piper Sandler’s John Barnidge, reiterated “Hold” ratings, with price targets of $117 and $110, respectively. The cautious outlook signaled fading investor confidence amid ongoing earnings and margin pressures.

PRU holds a consensus “Hold” rating overall as analysts remain cautious about the stock’s prospects. Of the 19 analysts covering the stock, only two recommend “Strong Buy,” while 15 suggest “Hold” and two advocate a “Strong Sell” rating. Its mean price target of $116.73 represents an 16% premium to current price levels.