Copper prices are poised to rally in fall 2025, driven by seasonal demand and structural supply constraints, offering traders profitable opportunities as home builders stockpile copper for spring construction, particularly for wiring and plumbing, and demand surges from September to March. This seasonal pattern and global economic trends create a prime trading window. Here’s how traders can capitalize and the fundamentals to monitor.

- The fall buying season aligns with U.S. housing starts, which are projected to rise 4% in 2026, per the National Association of Home Builders. This demand spike tightens an already constrained market.

- Global copper supply faces a 300,000-metric-ton deficit in 2025, driven by production issues in Chile and Peru, including labor strikes and mine disruptions.

- Low inventories on the London Metal Exchange, sometimes covering less than a day’s demand, amplify price volatility.

- The energy transition—electric vehicles, solar, and AI-driven data centers—further fuels demand, with copper consumption continuing to grow annually since 2020.

Traders can exploit this rally using CME Group Exchange copper standard or micro-sized futures for direct exposure. Options, such as buying calls, offer flexibility to profit from sharp upswings while limiting downside risk. Copper miner stocks, like Freeport-McMoRan (FCX), or the Global X Copper Miners ETF (COPX), provide leveraged exposure to price gains.

Key fundamentals to watch include U.S. dollar strength, as a weaker dollar boosts copper’s affordability for global buyers. Monitor China’s stimulus policies, given its 50% share of global copper demand. Geopolitical events, like tariffs or supply disruptions, can trigger volatility. Track LME inventory reports and housing data for real-time insights. By aligning trades with these drivers, traders can maximize profits in copper’s seasonal fall 2025 rally.

Can Copper Outperform?

As of this article, the copper market performance has lagged the other popular metals markets over the past 52 weeks.

- Platinum 54%

- Silver 44%

- Gold 39%

- Copper 4%

If you’re a value buyer, you might scream “OPPORTUNITY!”

Technical Picture

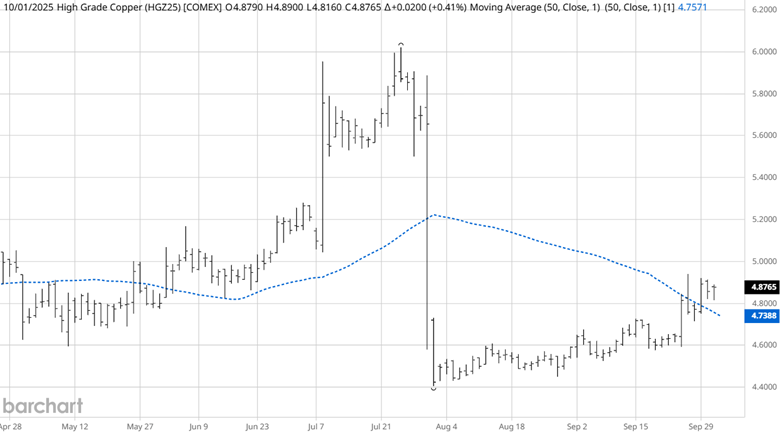

Source: Barchart

The50% tariffs imposed in August had a significant impact on copper prices. Copper has spent the last two months consolidating the waterfall price collapse. Recently, prices appeared to have broken out of the congestion. The 50-day simple moving average (SMA) is still sloping down, but prices are trading higher, which, if they continue, will result in the SMA turning higher, supporting higher copper prices. Recently, price action has had multiple higher highs and higher lows, albeit not with significant price gains. As we will address in the upcoming seasonal section, the fall season has traditionally been a springboard for higher copper prices. Will copper have a sympathy rally to participate with its fellow metals?

Disaggregated Commitment of Traders (COT) Report

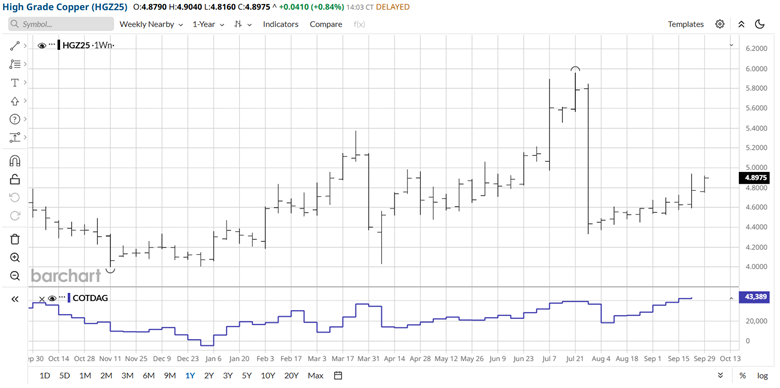

Source: Barchart

The COT report shows that the trend following managed money traders are now the most net long than any time in the past year. As copper rallied this year, the managed money traders greeted each new high price with additional long positions. The sharp correction during the tariff announcement only shook out a small number of traders. Currently, we are away from another new high, but managed money is extremely bullish.

Seasonality

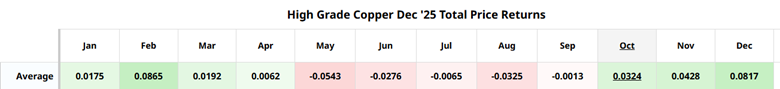

Barchart’s seasonal performance shows that the fall season indicates more positive returns until after the first of the year.

Source: Barchart

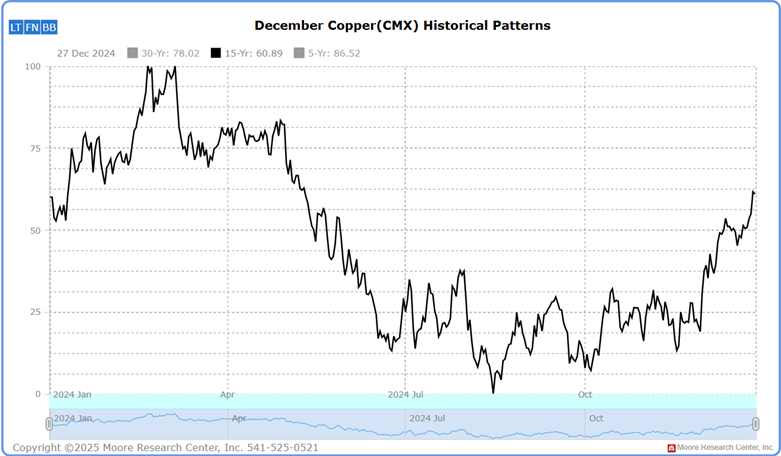

Moore Research Center, Inc. (MRCI) has researched the seasonal pattern extensively and found a seasonal buying window that may support higher prices soon.

Source: MRCI

The 15-year seasonal average for copper prices shows that copper prices have historically peaked near March and bottomed in September or October, creating extensive moves from these periods. The timing of the basing pattern from August until now, after the significant price drop, agrees with the seasonal pattern. Now that prices attempt to break out to the upside, will the seasonal pattern be a tailwind for higher prices?

Source: MRCI

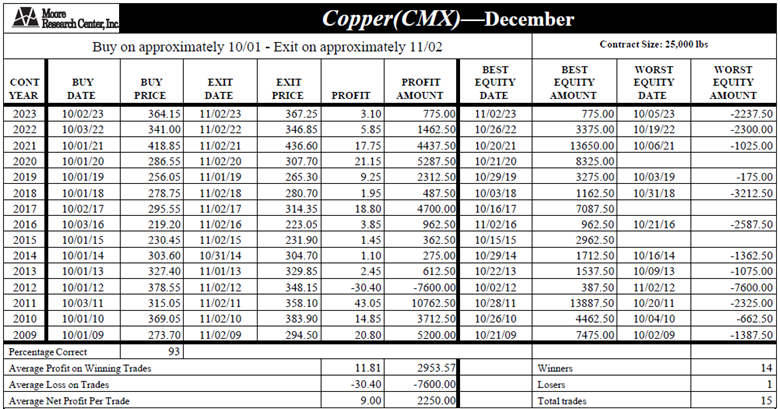

MRCI released this research in their Historical Metals Report to refine the seasonal window for buying copper. Through research, they could test and show that copper prices have closed higher on November 02 than October 01 for 14 of the recent 15 years, 93% occurrence. Also, I'd like to point out that three of those years never had a daily closing drawdown.

As a crucial reminder, while seasonal patterns can provide valuable insights, they should not be the basis for trading decisions. Traders must consider various technical and fundamental indicators, risk management strategies, and market conditions to make informed and balanced trading decisions.

In Closing…

As we enter fall 2025, copper presents a compelling opportunity for traders, underpinned by robust seasonal and fundamental drivers. The anticipated rally, fueled by home builders stockpiling for spring construction and a projected 4% rise in U.S. housing starts for 2026, aligns with a global supply deficit of 300,000 metric tons, driven by production challenges in Chile and Peru. Low LME inventories and growing demand from the energy transition—spanning electric vehicles, solar, and AI-driven data centers—further tighten the market, setting the stage for price volatility and potential gains. Traders can capitalize through CME Group Exchange futures, options, or leveraged exposure via copper miner stocks like Freeport-McMoRan or the COPX ETF. The historical 93% success rate of copper prices closing higher from October to November, as noted by MRCI, reinforces this seasonal window, with recent technical breakouts and bullish managed money positions in the COT report signaling momentum.

To maximize profits, traders should monitor key fundamentals: a weaker U.S. dollar, which enhances copper’s global affordability; China’s stimulus policies, given its 50% share of copper demand; and geopolitical risks like additional tariffs or supply disruptions that could spike volatility. LME inventory reports and housing data will provide real-time insights. While copper’s 4% return over the past year lags behind platinum (54%), silver (44%), and gold (39%), this underperformance screams value for savvy traders. By blending seasonal patterns with disciplined technical and fundamental analysis, traders can position themselves to exploit copper’s fall 2025 rally, leveraging a market poised with significant opportunity.