Former hedge fund manager Martin Shkreli announced on Thursday that he has shorted Newegg Commerce Inc. (NASDAQ:NEGG) following the e-commerce retailer’s massive 1,338% surge this year, dismissing the company as fundamentally overvalued.

Shkreli Takes Short Position

Shkreli, nicknamed “Pharma Bro” for his controversial pharmaceutical pricing practices, wrote on X that he “shorted NEGG” and called the online retailer “close to worthless with 12% gross margins (in a good year).”

“Even if the company had no costs, it would be overvalued,” Shkreli stated. “Unfortunately, it does cost money to run the business, but even with significant cost cutting, shares would at best be worth $50.”

Meme Stock Resurgence Drives Rally

The Diamond Bar, California-based computer hardware retailer, has gained over 1,500% in three months. The surge appears linked to renewed meme stock interest, with 12.25% of Newegg’s float currently sold short, according to Benzinga Pro.

On July 15, Newegg announced plans to sell up to $65 million in common stock, further fueling investor interest with shares gaining 260% since the announcement.

Current Price Action

Newegg closed Thursday at $128.09, up 39.39% with after-hours trading showing $128.86. The stock trades within a 52-week range of $3.32 to $133.00, with a market capitalization of $2.50 billion and average daily volume of 1.18 million shares.

Technical Analysis Shows Overbought Conditions

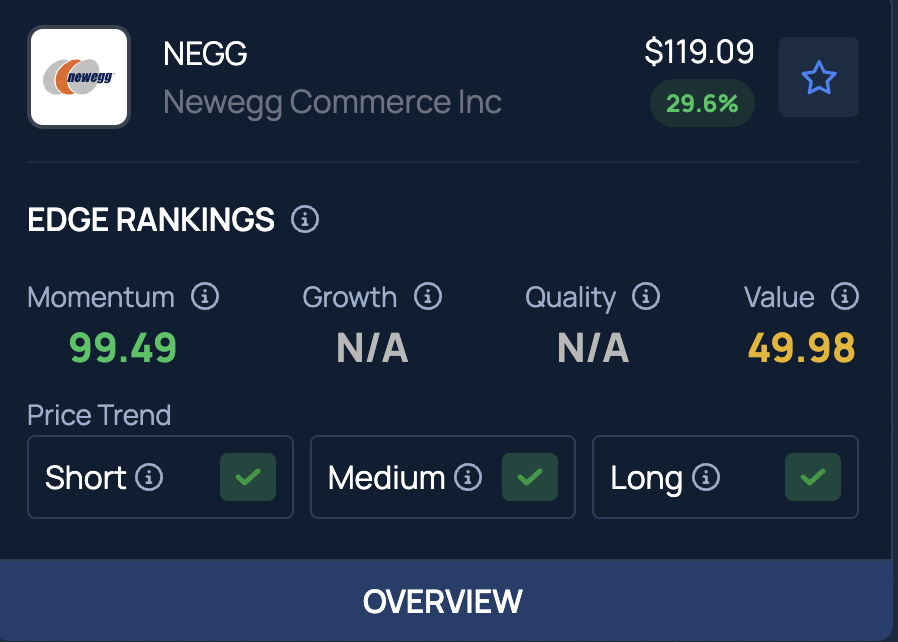

Newegg shares hit 52-week highs Thursday with robust volume of 1.36 million shares, well above the 100-day average. The stock shows strong momentum with a Benzinga Edge Stock Ranking momentum score of 99.49. However, the RSI at 80.7 indicates overbought territory, suggesting potential pullback risks.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Casimiro PT / Shutterstock.com