Martin Shkreli, also popularly known as ‘Pharma Bro,’ announced late Tuesday that he has taken a short position against iBuying real estate company Opendoor Technologies Inc. (NASDAQ:OPEN).

Check out OPEN’s stock price here.

Pharma Bro To Launch Public Due Diligence Against OPEN

In a post on the social media platform X, Shkreli revealed he shorted the stock at $9.36, marking his first trade in the company. He also declared his intention to launch a public due diligence campaign into the firm.

“This is the first trade I've made in the stock,” Shkreli wrote, before detailing his unconventional next steps. “I will be doing diligence calls with former employees, customers, competitors, and hopefully, management too! I will send invites to the calls or anonymous transcripts as appropriate.”

The move signals Shkreli’s intent to not only bet against the company but also to publicly build a bearish case against it.

Opendoor Is ‘An Obvious Short'

The trade materializes Shkreli’s increasingly vocal bearish stance on Opendoor. In recent weeks, he has repeatedly targeted the company on X, calling it “an obvious short” and warning that anyone long on the stock “should never ever invest again.”

He previously drew parallels to his successful short call against Newegg Commerce Inc. (NASDAQ:NEGG), another retail-favorite stock, posting on Sept. 8th, “first NEGG now OPEN – game over losers,” suggesting he expects a similar decline for Opendoor.

Citron Research Also Bets Against OPEN

Shkreli is not the only prominent short-seller targeting the company. Famed short-seller Andrew Left of Citron Research recently called the company “a science project in how to burn money.”

This bearish pressure comes after Opendoor’s stock experienced a meteoric rise from its 52-week lows, gaining over 1,000% at one point and attracting the “meme stock” label from market observers.

Shkreli’s public short position and investigation promise to add another chapter to the volatile battle between retail bulls and institutional bears.

Price Action

OPEN fell 6.06% on Tuesday to $8.92 per share and rose 0.78% in after-hours. The stock has advanced 461.01% year-to-date and 277.97% over the year.

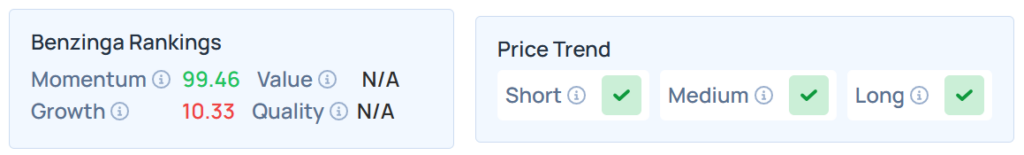

Benzinga’s Edge Stock Rankings indicate that OPEN maintains a stronger price trend in the short, medium, and long terms. However, the stock’s growth ranking is relatively weak. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended lower on Tuesday. The SPY was down 0.14% at $660.00, while the QQQ declined 0.085% to $591.18, according to Benzinga Pro data.

On Wednesday, the futures of the Dow Jones, S&P 500, and Nasdaq 100 indices were lower.

Read Next:

- Eric Jackson Rejects ‘Roaring Kitty’ Label: OPEN ‘Isn’t A Meme Stock. It’s A Cult Stock,’ Unlike GME

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Tada Images / Shutterstock.com