Shares of COVID-19 vaccine makers Pfizer Inc (NYSE:PFE), BioNTech SE ADR (NASDAQ:BNTX) and Moderna Inc (NASDAQ:MRNA) are trading lower Friday following a Washington Post report that Trump administration health officials intend to link the vaccines to 25 child deaths. This assertion is reportedly based on unverified submissions to the Vaccine Adverse Event Reporting System.

What To Know: The plan has alarmed career scientists, who note the vaccines have been extensively studied. According to the report, Trump officials will present the claim to an influential CDC advisory panel next week.

Per the Washington Post, this panel, the Advisory Committee on Immunization Practices, is considering new, more restrictive vaccine recommendations. Its decisions are critical as they determine insurance coverage and pharmacy access to the shots.

Future revenue for COVID-19 vaccine makers could be significantly impacted. The committee is weighing options such as recommending the vaccine only for those 75 and older or instructing younger individuals to consult a physician before vaccination.

This potential narrowing of the market, driven by an administration critical of past vaccine policies, signals a major headwind for future sales.

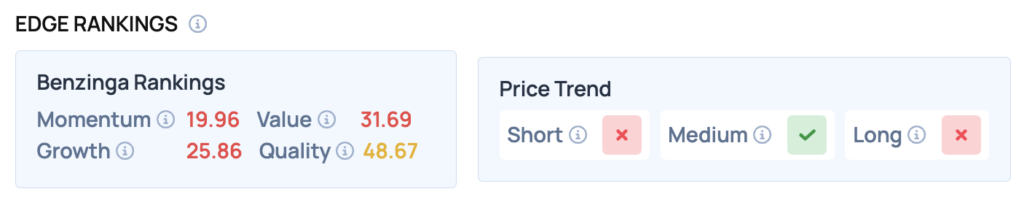

Benzinga Edge Rankings: Reflecting Friday’s negative pressure, Benzinga Edge rankings show Pfizer’s stock has a particularly weak Momentum score of just 19.96.

Price Action: According to data from Benzinga Pro, shares of BioNTech are trading lower by 8.20% at $95.87, Moderna lower by 8.05% at $23.34 and Pfizer down 3.98% at $23.88.

Friday afternoon’s price action left Moderna trading just above its 52-week low of $23.15, while Pfizer and BioNTech hovered near their session lows of $23.93 and $90.12, respectively.

Read Also: Eli Lilly Loses Appeal Over Medicaid Drug Pricing Fraud Case

How To Buy PFE Stock

By now you're likely curious about how to participate in the market for Pfizer – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Read Next:

Image: Shutterstock