Billionaire investor Peter Thiel once acknowledged that selling his Meta Platforms, Inc. (NASDAQ:META), which was earlier known as Facebook, shares too early cost him billions.

What Happened: In an appearance on Piers Morgan Uncensored in 2024, Thiel, the PayPal Holdings (NASDAQ:PYPL) co-founder and Facebook's first outside investor, reflected on his 2012 decision to sell most of his Facebook stake during the company's initial public offering.

He pocketed around $400 million at the time, but had he held on longer, his shares could have been worth much more.

"I think one of the things that was very hard to gauge… was just how [big tech companies] were going to scale and scale and scale," Thiel told Morgan. "The incorrect view I had back in 2012 was that it was fractal up to $100 billion… but going from $100 billion to a trillion was actually the easiest."

Thiel used the term "fractal" to describe how he viewed the difficulty of scaling businesses in successive magnitudes — from $10 million to $100 million, and up to $100 billion.

See Also: Meta's Metaverse Dreams Tested By New ByteDance Swan Goggles

He believed each step would be just as hard, but misjudged the massive acceleration that can occur once a company hits a certain scale.

The billionaire investor added that as an investor, you want to find opportunities that are both "true and contrarian," and Facebook's eventual rise to over $1.5 trillion in market cap turned out to be just that — widely doubted, but easier to achieve than he imagined.

When asked if selling Facebook stock early was his biggest investing mistake, Thiel admitted, "There are all sorts of mistakes… but the biggest mistake people make is never making mistakes."

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It's Important: Facebook began as a social networking site for college students, launched by Mark Zuckerberg and his friends in a Harvard dorm in February 2004. Two months later, the company was officially registered, and in June 2004, Thiel made the first major investment—$500,001 for a 10.2% stake—also joining the board.

Thiel remained on Facebook's board until 2022. Today, his estimated net worth is $23 billion, according to the Bloomberg Billionaire Index, largely driven by early tech bets including Palantir Technologies Inc. (NASDAQ:PLTR) and PayPal.

Meta currently has a market capitalization of $1.767 trillion, making it the sixth most valuable company in the world.

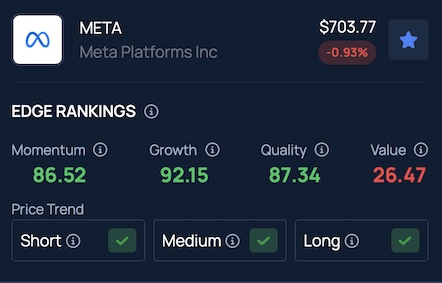

The tech giant currently holds a consensus price target of $741.41, according to ratings from 42 analysts. The latest analyst updates came from Cantor Fitzgerald, Canaccord Genuity and B of A Securities have set an average price target of $817.67, suggesting a potential upside of 16.11%, according to Benzinga Pro.

According to Benzinga's Edge Stock Rankings, META continues to demonstrate a consistent upward trajectory across short, medium and long-term periods. While its growth score remains strong, its value rating is relatively weaker. Additional performance details are available here.

Check out more of Benzinga's Consumer Tech coverage by following this link.

Read Next:

Photo Courtesy: Mark Reinstein on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.