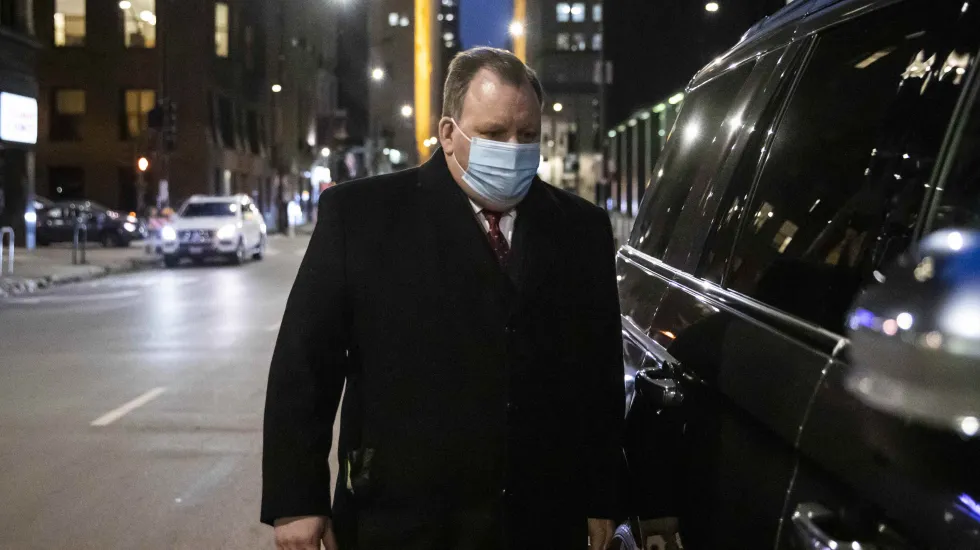

The Illinois Supreme Court suspended the law license of former Ald. Patrick Daley Thompson on Friday, about a month after he was convicted of cheating on his income taxes and lying to federal regulators about money he owed to a failed Bridgeport bank.

The three Supreme Court justices from Chicago — Anne M. Burke, P. Scott Neville Jr., and Mary Jane Theis — abstained from disciplining Thompson, the grandson of former Mayor Richard J. Daley and the nephew of former Mayor Richard M. Daley.

Thompson, 52, had been licensed to practice law on Nov. 4, 1999. He had been employed as a lawyer with the firm of Burke, Warren, MacKay & Serritella.

The court’s disciplinary action comes three days after Thompson’s criminal attorney Christopher Gair filed a motion in U.S. District Court, asking Judge Franklin Valderrama to either overturn the jury’s verdict — they unanimously convicted Thompson of five counts of tax fraud and two counts of lying to federal regulators — or to order a new trial, claiming prosecutors made inflammatory remarks during their closing arguments on Feb. 14. Prosecutors have to respond by April 20.

The jury convicted Thompson is less than four hours, prompting him to resign as alderperson of the 11th Ward, which encompasses the Bridgeport neighborhood where his family has lived for four generations.

Thompson’s criminal convictions stem from the collapse of Washington Federal Bank for Savings, a century-old institution that federal regulators shut down in December 2017. That action came less than two weeks after the bank president John F. Gembara was found sitting in a chair with a rope around his neck in the main bedroom of Park Ridge contractor Marek Matczuk, who owed the bank more than $6 million.

Federal regulators say Gembara had been running a major embezzlement scheme that forced the Federal Deposit Insurance Corp. to provide $90 milion to cover depositors’ accounts. The collapse has led to criminal charges against 15 people, including Thompson. Four bank officials have pleaded guilty.

Once the bank closed, federal regulators discovered the bank had given Thompson $219,000 between November 2011 and January 2014, but he had made only one payment of less than $400, and never paid any interest on the loans, which he used to buy an equity share in his law firm, pay off a debt to the Internal Revenue Service and cover a delinquent loan to avoid foreclosure.

While Thompson never paid any interest on the money he borrowed, federal investigators discovered he had claimed on his tax returns between 2913 and 2017 that he had paid the interest. After the bank closed, Thompson amended those tax returns, and sought to repay about $16,000 in illegal deductions, but a federal grand jury indicted him for tax fraud and lying to federal regulators about the amount of money he owed the bank.

Contributing: Mark Brown