/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Palantir’s (PLTR) solid run has hit a speed bump. After soaring to new highs earlier this year, PLTR stock has slipped nearly 22% from its peak of $207.52. The pullback comes as investors grow uneasy about the company’s stretched valuations and concerns over the artificial intelligence (AI) bubble.

Even with this decline, the stock is still up roughly 112% in 2025, and its valuation is still absurdly high. Palantir stock trades at a price-sales ratio of 128.8x, far beyond the multiples typically associated with even the most profitable technology giants.

To put this into perspective, companies like Alphabet (GOOGL) and Microsoft (MSFT), both with massive cash flows and dominant positioning in the AI space, trade at far more modest P/S multiples of 10.3x and 12.46x, respectively. Even Nvidia, which is considered the backbone of the AI revolution, has a P/S of 33.3x, far below Palantir’s current valuation.

This drastic valuation gap reflects the enormous expectations the market has placed on Palantir. Investors are pricing in years of explosive growth, assuming the company will continue to outperform and rapidly expand its AI-driven revenues. But when expectations run this high, even strong earnings may not be enough. That’s precisely what happened in the most recent quarter. Palantir delivered another solid beat-and-raise performance, yet the stock still retreated as valuation anxiety took center stage.

Against this backdrop, does the recent pullback in PLTR stock represent a healthy reset? Let’s take a look.

Palantir to Deliver Explosive Growth

Palantir is in a solid growth phase, and the momentum in its business will sustain, reflecting surging demand for its AI Platform (AIP). Notably, its commercial business is growing rapidly, and its growing scale is widening the gap between Palantir and its competitors in the enterprise AI software space.

The company’s revenue surged 63% year-over-year to $1.18 billion, with commercial sales doing the heavy lifting. That segment jumped 73% year-over-year and 22% sequentially to $548 million, extending its lead over the U.S. government division for a fourth straight quarter. This shift matters as commercial contracts tend to be more scalable, faster to deploy, and more lucrative over time, particularly as companies race to integrate AI into core operations.

AIP is the engine behind this expansion. Adoption is growing, especially in the U.S., where commercial revenue more than doubled from last year. The company’s ability to win and expand customer relationships also showed up in its contract metrics. Total contract value reached a record $2.8 billion, up 151% year-over-year. At the same time, customer count climbed 45% to 911.

Notably, existing clients are spending significantly more, with the top 20 customers generating an average of $83 million each over the past year. Meanwhile, a net dollar retention rate of 134% reflects not just stickiness but accelerating usage.

Palantir’s strong revenue is flowing directly into profits. Palantir posted its highest-ever adjusted operating margin at 51%, up sharply from 38% a year earlier. As a result, management raised its 2025 outlook, projecting more than $2.15 billion in adjusted operating income and up to $2.1 billion in free cash flow. Guidance for U.S. commercial revenue was also lifted to at least $1.43 billion in 2025, implying growth of more than 100%.

Palantir’s trajectory suggests the company is evolving from a specialized government-focused contractor into a broad-based AI platform provider with expanding market share and rising profitability. With AIP adoption accelerating, commercial demand strengthening, and margins widening, Palantir appears positioned for sustained, high-quality growth.

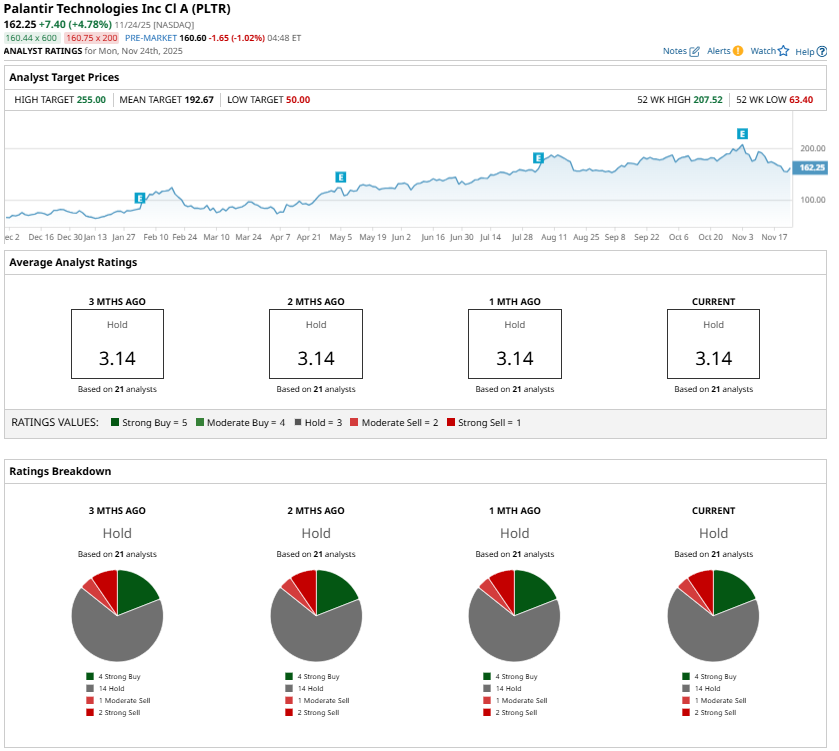

Is PLTR Stock a Buy, Sell, or Hold?

Palantir is firing on all cylinders, with commercial adoption accelerating, margins expanding, and AIP driving its customer base and contract value. By most fundamental measures, Palantir is executing exceptionally well. However, PLTR’s high valuation already reflects these positives.

Wall Street maintains a consensus “Hold” rating on PLTR stock. This implies that waiting for a more compelling valuation could offer a better risk-reward setup.