/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Palantir (PLTR) recently crossed the milestone of $1 billion in quarterly revenue, as celebrated by CEO Alex Karp in his most recent letter to shareholders.

“This is still only the beginning of something much larger and, we believe, even more significant,” Karp wrote. The company generated more than $1 billion in revenue for the second quarter, marking a 48% increase over the same period the year before, and reached an annual run rate of over $4 billion.

“The skeptics are admittedly fewer now, having been defanged and bent into a kind of submission,” Karp continued. “Yet we see no reason to pause, to relent, here.”

Why This Milestone Matters

Karp put the achievement in perspective: “Our U.S. commercial business—the emerging core of Palantir and the seed of what an entire industry will become, perhaps the world’s most dominant, in the years to come—nearly doubled in twelve months, generating $306 million in revenue last quarter, representing a 93% increase from $159 million the year before.”

“For a startup, even one only a thousandth of our size, this growth rate would be striking, the talk of the town,” Karp wrote. “For a business of our scale, however, it is, we continue to believe, nearly without precedent or comparison.”

He’s right. Small startups that scale revenue at this speed are seen as the future. However, a company as large and complex as Palantir, which is still experiencing dramatic shifts in revenue growth, is worth noting as an investor.

Karp also points to the Rule of 40, an industry benchmark where a software company’s revenue growth rate plus profit margin should exceed 40%. “The software industry for years was judged by what many called the Rule of 40,” he explains. “Ours is now 94%.”

This growth comes in defiance of critics and short sellers, toward whom Alex Karp is known for not mincing words. Back in March 2024, he told CNBC: “Almost nothing makes a human happier than taking the lines of cocaine away from these short sellers.”

Parallels to Tesla’s Growth

This moment is reminiscent of Tesla’s (TSLA) rapid growth after releasing the Model 3, proving naysayers wrong that the average person couldn’t afford or didn’t want an electric car.

As Tesla helped reinvent the charging station infrastructure of the United States, Palantir is helping redesign how disparate data sets work with its clients, both in the private sector and government.

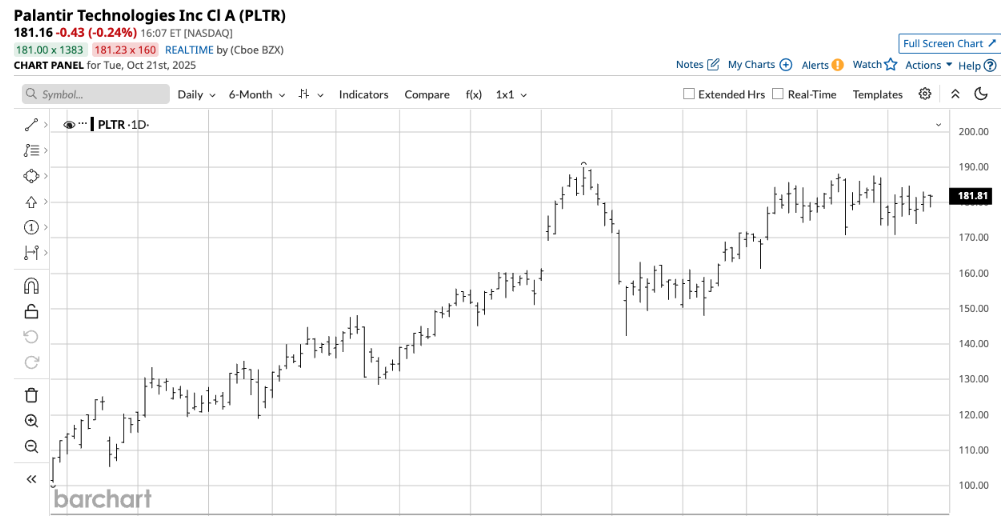

Palantir has been a widely memed stock, but it’s come a very long way from its origins as a favorite on Reddit’s r/WallStreetBets. The stock is up 135% year-to-date, and the company is consistently beating expectations. Now it is front and center as a multi-billion dollar company that has proven it can execute.

What Does Palantir Actually Do?

Many people ask what Palantir actually does. It is not just a dystopian surveillance company. It actually builds data pipelines and helps companies integrate disjointed data from different sources so that leadership can make stronger decisions.

Palantir doesn’t collect or sell data. Instead, its software sits on top of customers’ existing systems and helps them work with information they already have. Its two most powerful platforms are:

- Foundry: For commercial clients. It helps businesses manage inventory, monitor operations, and track orders by connecting data across organizations

- Gotham: For government and law enforcement, it is an investigative tool that connects people, places, and events to help analysts build intelligence reports

Palantir serves companies in the food and beverage industry, government operations, and regular businesses across various sectors. This dual focus on government and commercial clients creates a defensible moat.

This week, Palantir also just announced a partnership with Snowflake (SNOW), which is helping the company double down on its investments in the AI ecosystem.

Is Palantir Stock a Buy?

PLTR is a powerful growth stock right now, which comes as a double-edged sword. Trading at about 400 times earnings is aggressive, to say the least, and represents a major red flag for value investors. At this valuation, there’s minimal room for error.

But for those looking to invest in technology, AI, and consistently growing companies, there could be a strong argument for Palantir. The revenue growth, especially in today’s market, shows that the company is overall moving in a healthy direction.

Analysts currently recommend PLTR as a “Hold” on average, reflecting the tension between its impressive growth and stretched valuation. Whether the current price makes sense depends on your risk tolerance and belief in Palantir’s long-term trajectory as it continues building out the AI infrastructure ecosystem.

What’s clear is that Palantir has moved well past its meme stock days into legitimate growth company territory.