Palantir Technologies Inc. (NYSE:PLTR) stock fell more than 11% this week, even as the software company reported better-than-expected quarterly results, prompting CEO Alex Karp to criticize those betting against the stock, calling it “market manipulation.”

Check out the current price of PLTR stock here.

Burry Position Draws CEO Fire

Karp specifically called out "Big Short" investor Michael Burry, who recently revealed bearish positions against Palantir and NVIDIA Corp. (NASDAQ:NVDA).

In an interview with CNBC's Sara Eisen on Friday, Karp said, “To get out of his position, he had to screw the whole economy by besmirching the best financials ever.”

Speaking on CNBC’s “Squawk Box” on Tuesday, Karp had said it was strange that the companies generating most of the profits were being targeted, adding that betting against firms driving the AI sector was irrational.

“The two companies he’s shorting are the ones making all the money, which is super weird,” Karp said. “The idea that chips and ontology is what you want to short is bats— crazy.”

Valuation Concerns Mount

Palantir's stock trades at about 220 times forward earnings, comparable to Tesla Inc. (NASDAQ:TSLA). In contrast, Nvidia Corp. (NASDAQ:NVDA) and Meta Platforms Inc. (NASDAQ:META) have forward price-to-earnings ratios of 33 and 22, respectively.

Short seller Andrew Left of Citron Research described Palantir as "detached from fundamentals and analysis" in August and set a $40 price target.

Shares of the AI platform closed on Friday at $177.93, according to Benzinga Pro data.

Rally Continues Despite Volatility

Despite this week’s decline from Monday’s $207.52 record high, Palantir's stock has surged 136.64% in 2025, lifting its market capitalization to more than $421.93 billion.

The Colorado-based company reported third-quarter revenue of $1.18 billion, a 63% increase from a year ago, with earnings per share of $0.21. Both exceeded analysts’ expectations.

But the stock fell about 8% after the report and then slid almost 7% on Thursday.

Karp told Eisen that the recent boom in Palantir's share price isn't just for Wall Street, but for retail investors.

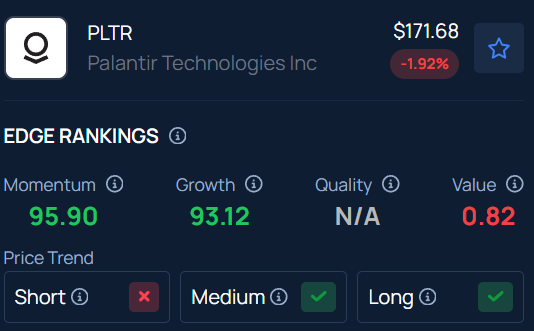

Benzinga’s Edge Stock Rankings highlight that PLTR has a Growth score of 93.12. Track the performance of other players in this segment.

Read Next:

Photo: Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.