Under the current market regime, rising short interest always attracts eyeballs. In theory, an accumulation of bearish pressure represents an awful harbinger for the targeted security. However, these short traders risk the underlying asset moving in the wrong-to-them direction, which is northward. Interestingly, though, relatively very few speculators want a piece of the short action against Strategy Inc (NASDAQ:MSTR). For contrarian investors, this dynamic could be a compelling opportunity.

Usually, the prospect of short squeezes offers an intuitive argument for bullish speculators. Under a typical transaction, investors initiate a position in a security by buying to open. However, short traders initiate their speculative activity by selling to open. These shares were first loaned out by a broker, which means that at some point, bearish speculators must return the borrowed securities.

For a short trade to be profitable, then, the underlying stock must fall in value. Later, the bears buy back the securities on discount and return them to the broker, pocketing the difference. But either way, the return of borrowed assets must happen. Therefore, if the targeted security shoots higher, short traders have a difficult decision to make.

Obviously, the prudent ones cut their losses early. However, to close a short position, the transaction involves buying to close. That's what creates the short squeeze.

With MSTR stock, the security — which effectively operates as a proxy for the cryptocurrency market — previously witnessed sky-high short interest, particularly during 2022 and 2023. However, a strong run last year, followed up by an impressive performance this year, has apparently led to an unwillingness to short Strategy.

Between January 2021 to September 2025, the correlation coefficient between the short interest of MSTR stock and its price action sits at -0.796. That's a strong inverse relationship, indicating that the bears simply don't want any of this smoke.

MSTR Stock Also Attracts Bargain Hunters

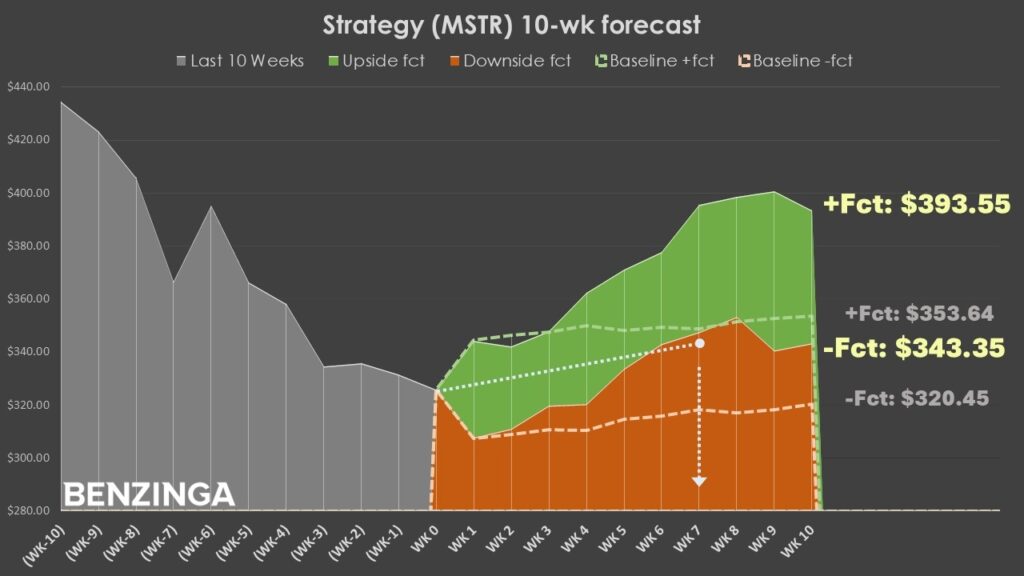

If the declining short interest rate wasn't enough to convince you about MSTR stock, its buy-the-dip tendencies may be the ultimate temptation. Quantitatively, MSTR in the past 10 weeks has printed four up weeks (defined as the return from Monday's open to Friday's close) and six down weeks, with an overall downward trajectory. For classification, we can call this a 4-6-D sequence.

Under an intuitive framework, the balance of distributive sessions being greater than accumulative would warrant caution. However, for MSTR stock, the red ink tends to attract bargain hunters. Using in-sample data that runs from January 2019 to July 2025, the drift stemming from the flashing of the 4-6-D sequence may carry the stock between approximately $341 to $391.

Assuming no special mispricing, the aggregate or baseline drift would be expected to carry MSTR between approximately $318 to $351. In other words, investors generally view MSTR's volatility as a chance to load up the boat at a cheaper rate. Further, without bearish traders actively betting against Strategy, it's possible that MSTR may have a less-contested swing upward.

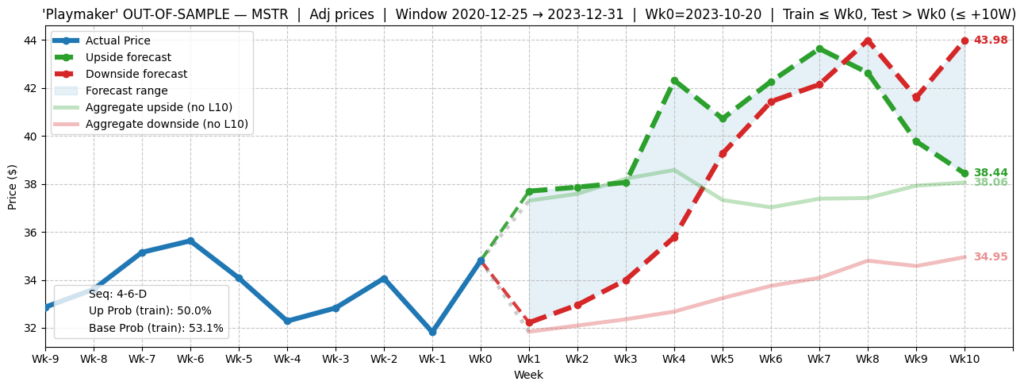

However, it's important to account for exogenous factors and even outright coincidences. To better determine if the 4-6-D sequence has predictive power, I ran an out-of-sample test, specifically targeting the dataset between 2021 through 2023. In this manner, I capture trading behaviors largely outside of the extreme boom periods of late 2020 and the years 2024 and 2025 to date.

What I discovered is that the 4-6-D sequence tends to signal an upward swing in the latter weeks. Since this phenomenon is observed in both boom periods and non-boom periods, my conclusion is that the sequence offers predictive power. Therefore, a bullish posture toward MSTR stock — despite the current weakness where it has lost 12% in the trailing month — makes sense.

A Tempting Offer On The Table

Because market makers are evaluating their probabilistic expectations based on stochastic (continuous, assumption-driven) models rather than empiric (discrete, evidence-driven) models — such as the methodology I use — the asking price for various strategies is all over the map. I would argue that there's considerable mispricing here.

In my opinion, the options strategy that makes the most sense is the 350/360 bull call spread expiring Oct. 31. This transaction involves buying the $350 call and simultaneously selling the $360 call, for a net debit paid of $395 (the most that can be lost in the trade).

Should MSTR stock rise through the second-leg strike price ($360) at expiration, the maximum profit is $605, a payout of over 153%. Breakeven comes in at $353.95.

On paper and without any other context, anticipating a nearly 11% move over the next seven weeks may seem aggressive. However, because of Strategy's crypto-proxy play, I don't find the threshold to profitability unreasonable. It would also seem that the bears feel the same way.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Image: Shutterstock