Although I'm no longer a big fan of the term because of its misuse, I genuinely believe that the market can overreact to less-than-desirable news. Case in point is Braze Inc (NASDAQ:BRZE). In early June, the cloud-based customer engagement platform released its first-quarter fiscal 2026 earnings report. Though the company delivered the goods, investors didn't care for the details. As such, BRZE stock succumbed to significant volatility — leading to a potential discount for options traders.

First, let's go over the numbers and the fundamental (though I believe flawed) reason for bullishness. On the bottom line, Braze posted earnings per share of 7 cents, beating Wall Street analysts' consensus view of 5 cents. This was also a big improvement over the year-ago quarter's loss of 5 cents per share.

On the top line, the engagement platform generated $162.06 million, again beating the consensus estimate, which happened to be $158.66 million. The latest tally represented a 19.64% jump from the period one year ago. This then raises the question: why did BRZE stock plunge from $36.10 to $29.73 (a nearly 18% drop) immediately following the disclosure?

When it comes to market responses to earnings, the financial analysis industry often speaks with language suggesting authoritative causality. In reality, I don't think anyone really knows — I think it just comes down to plausible storytelling. That said, based on Braze's financial presentation, it appears that investors became concerned about the company's 33% quarterly sales growth rate, which has since dropped to a current sub-20% rate.

Also, the market may have viewed Braze's fiscal 2026 revenue guidance as tepid. At the high end of the range ($706 million), this figure would represent just under 20% growth against fiscal 2025 sales. In the year-ago comparison, the growth rate stood at nearly 26%.

That said, there are some positives to consider. For example, free cash flow in the first quarter was $22.9 million, compared to $11.4 million in the year-ago period. There's also an argument to be made that BRZE stock is more attractively priced. Using the company's weighted average shares outstanding figure, BRZE is currently trading at 4.13 times forward sales, much lower than the 8.65x multiple one year ago.

Getting Down to the Quantitative Argument for BRZE Stock

So, the burning question you may have is, why did I label the fundamental argument — specifically that BRZE stock is priced at a lower sales multiple — as flawed? The answer is that the argument (while seemingly very reasonable) is a presuppositional fallacy because it starts with the conclusion and works backwards.

Of course, the conclusion is that BRZE stock is cheap right now and therefore will likely rise higher. However, this desired outcome — the investment thesis or let's be honest, the marketing hook — is justified by the forward sales multiple being 4x, down from 8x. But this is not an inherently meaningful statistic unless you presuppose that 8x was a fair or reasonable valuation.

I hope the light bulb is going off here. The problem with the financial analysis industry is that, from the top tier to the bottom, these so-called experts hide the core premise inside a presupposition. The only objective truth here is that, at the end of the day, the market is either a net buyer or a net seller. That's it.

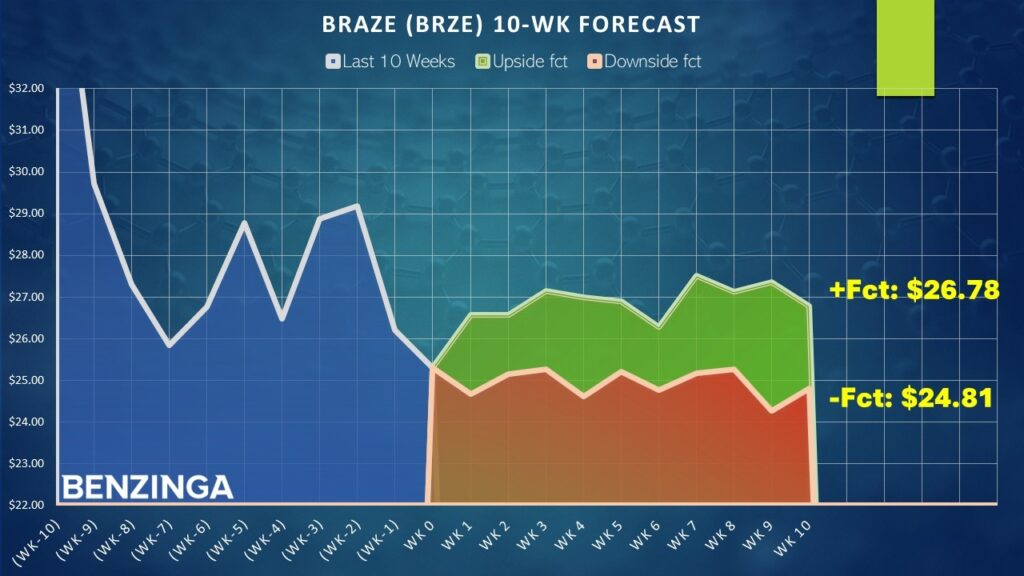

So, let's look back at the last 10 weeks (with 10 weeks being a nice round number that I picked arbitrarily). The market voted to buy BRZE four times and sell six times. During this period, the security incurred a downward trajectory. For brevity, we can label this sequence as 4-6-D.

Next, I want to create a decision-tree logic using these sequences as a statistical anchor. In other words, I want to know how the market responds to BRZE stock based on different demand profiles. Conducting this exercise across rolling 10-week intervals gives us the following framework:

| L10 Category | Sample Size | Up Probability | Baseline Probability | Median Return if Up |

| 2-8-D | 10 | 30.00% | 51.55% | 8.18% |

| 3-7-D | 12 | 66.67% | 51.55% | 1.97% |

| 4-6-D | 28 | 64.29% | 51.55% | 5.00% |

| 5-5-D | 27 | 48.15% | 51.55% | 7.12% |

| 5-5-U | 24 | 50.00% | 51.55% | 5.47% |

| 6-4-D | 10 | 60.00% | 51.55% | 6.29% |

| 6-4-U | 25 | 36.00% | 51.55% | 4.43% |

| 7-3-U | 25 | 72.00% | 51.55% | 3.94% |

| 8-2-U | 9 | 22.22% | 51.55% | 5.47% |

From the table above, we can see that the baseline probability or the chance that a long position in BRZE stock will rise on any given week is 51.55%. This is effectively our null hypothesis, the probabilistic expectation assuming no mispricing. However, our alternative hypothesis is that, because of the 4-6-D sequence, a favorable mispricing exists and that the expected win rate is actually 64.29%.

Of course, all arguments — including mine — presuppose something. In the above analysis, I am presupposing that the market has absorbed all publicly available information into its price discovery process and that we can use this data to analyze probabilistic responses in like-to-like cases. Critically, I'm not starting from the conclusion and generating post-hoc rationalizations to justify my bias.

In other words, I let the market tell me whether BRZE stock is a good deal or not.

Using Data to Find a Viable Options Strategy

Based on the market intelligence above, the 25.00/27.50 bull call spread expiring Sept. 19 is intriguing. This transaction involves buying the $25 call and simultaneously selling the $27.50 call, for a net debit paid of $115 (the most that can be lost in the trade). Should BRZE stock rise through the short strike price ($27.50) at expiration, the maximum profit is $135, a payout of over 117%.

From past analogs, the median return following the 4-6-D sequence — assuming the positive pathway — stands at 5%. Further, if the bulls maintain control of the market for the next three weeks, the expected median performance is an additional 2.2%. Earlier, BRZE stock was trending around $25.30. At this level, the anticipated positive forecast by the end of this month would be approximately $27.15.

That's not quite reaching the $27.50 target, though it would be a buck above the breakeven price of $26.15. With some luck, perhaps a boost from exogenous factors, this 1.3% gap could potentially be filled. Plus, it helps that the net debit required is relatively small.

Still, the question remains: is the 4-6-D sequence statistically significant? Running a one-tailed binomial test reveals a p-value of 0.1171, meaning that there's an 11.71% chance that the implications of the sequence can materialize randomly as opposed to intentionally. This does not mean the significance threshold. However, I would argue that the signal is empirically intriguing given the market's open and entropic system.

Plus, retail traders are likely using epistemologically flawed methodologies to place their bets. While using empirically coherent analyses doesn't guarantee success, they offer structural advantages for which traditional fundamental and technical approaches have no answer.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read Next:

Photo: Shutterstock