Posting overall strong financial results doesn't guarantee upside for the underlying public equity, especially if the report comes amid macro-level concerns. That's the tough lesson fast-food restaurant company Yum China Holdings Inc (NYSE:YUMC) learned the hard way recently. On Tuesday, before the open, Yum China disclosed its second-quarter earnings, which revealed many encouraging elements. However, it appeared that investors were hung up on the top-line miss.

Heading into the disclosure, Wall Street analysts had anticipated sales to land at $2.79 billion. However, Yum China fell slightly short of the target, generating $2.787 billion, a 0.10% miss. On the bottom line, the company posted adjusted earnings per share of 58 cents, edging past the consensus view of 57 cents. However, investors greeted the news with a sharp exit from YUMC stock, which saw the security dip 5% in early afternoon trading.

Franky, it's difficult to understand the market's rationale. Yes, technically speaking, Yum China suffered a revenue miss. As well, some lingering concerns exist about the state of its consumer economy, especially amid a contentious relationship between the U.S. and China (despite the diplomatic words being used).

It's also possible that investors are finding gremlins in the granularity. For example, on slide 19 of Yum China's investor presentation, the company notes that same-store transactions growth for KFC — one of its flagship brands — was "even." That's corporate doublespeak for flat or 0%, as the company's press release more clearly illustrated. So, it means that the 1% same-store sales growth posted at KFC came entirely from price/mix, not customer volume.

Plus, there may be worries about the sustainability of Yum China's promotional activities, such as its value-for-money offerings. This points to profit quality questions.

Even with combing over the details, investors shouldn't miss the forest for the trees. In my opinion, the bigger spotlight was that Yum China delivered a holistically strong report. For example, not only did the company top second-quarter estimates but it also drove record margins through digital and delivery growth.

In fact, digital sales reached $2.4 billion, with underlying ordering for the unit accounting for roughly 94% of total company sales. These are the kind of details you want to see in a challenged macroeconomic environment.

Respecting the Sentiment Voting Record Behind YUMC Stock

Having swallowed a financial red pill over the last few months, I no longer see the market the way most people do. For example, I'm acutely aware that, even with poring over the fundamentals, I would be making a presuppositional fallacy if I said that YUMC stock is subsequently a buying opportunity. This would smuggle the conclusion (that YUMC is discounted) into the premise (that the market has failed to price YUMC appropriately).

Indeed, the epistemological vulnerability with traditional methodologies, such as fundamental or technical analysis, is that the practitioner must define the terms being used. Nobody actually has the right to say that a stock is discounted unless that person defines what the discount means. Because if a stock is labeled as a discount, there has to be a boundary by which that stock is no longer a discount.

But who makes the rules that YUMC stock priced at $44 is a discount, but at $50, it's not? This is why the only objective truth (as far as I can tell) in the equities sector is that, at the end of the day, the market is either a net buyer or a net seller. I don't care what the market "thinks" about. I only care about its voting record on sentiment.

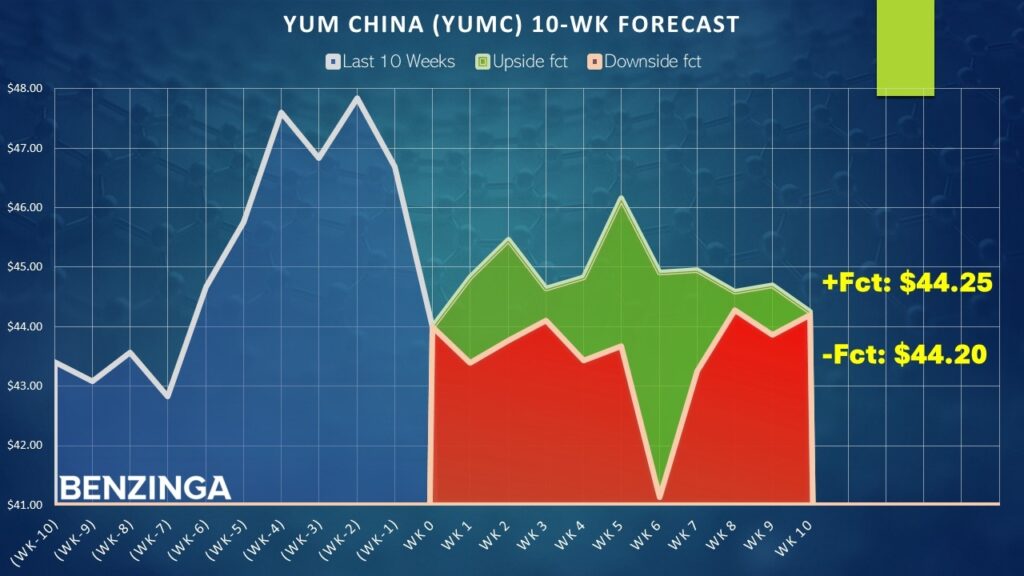

In the trailing 10 weeks (including the current one), the market voted to buy YUMC stock four times and sell six times. During this period, the security enjoyed an upward trajectory. For brevity, we can label the sequence as 4-6-U. It's an unusual pattern since the distributive sessions outweigh accumulative, yet the trajectory is positive.

Sure, compressing the price magnitude of YUMC stock into a simple binary code may seem odd, even stupid. But we now have a falsifiable pattern by which we can compare against past analogs to determine forward probabilities. Also, we can stack the 4-6-U against other demand profiles across rolling 10-week intervals:

| L10 Category | Sample Size | Up Probability | Baseline Probability | Median Return if Up |

| 2-8-D | 12 | 66.67% | 49.71% | 2.59% |

| 3-7-D | 29 | 44.83% | 49.71% | 2.43% |

| 4-6-D | 45 | 44.44% | 49.71% | 2.29% |

| 4-6-U | 15 | 80.00% | 49.71% | 1.89% |

| 5-5-D | 33 | 60.61% | 49.71% | 4.28% |

| 5-5-U | 51 | 50.98% | 49.71% | 2.62% |

| 6-4-D | 20 | 45.00% | 49.71% | 3.69% |

| 6-4-U | 73 | 45.21% | 49.71% | 2.63% |

| 7-3-U | 19 | 31.58% | 49.71% | 3.37% |

From the table above, the chance that a long position in YUMC stock (baseline probability) will rise on any given week is 49.71%, a slightly negative bias. This is effectively our null hypothesis, the assumption of no mispricing. However, our alternative hypothesis is that, because the 4-6-U sequence is flashing, the upside probability in the following week stands at 80%, with a median return of 1.89%.

But why is there such a huge delta against the baseline? If a baseball player hits a career average .200, does that mean that's the probability in all circumstances? No, against certain pitchers, in certain conditions (such as RISP), the hitting average may be much higher than normal. It's the same principle here.

The best part? I'm not making unfounded claims of mispricing (flawed fundamental analysis) nor am I making assertions of investor motivations (presuppositional technical analysis). That would be a prescriptive approach — telling the audience what should happen.

My approach is descriptive. I'm merely reporting what has happened and building a probabilistic model from that information.

Playing the Cards That Have Been Dealt

With today's heavy volatility, the smartest multi-leg options strategy arguably may be the 45.00/47.50 bull call spread expiring Sep. 19. This transaction involves buying the $45 call and simultaneously selling the $47.50 call, for a net debit paid of $85 (the most that can be lost in the trade). Should YUMC stock rise through the short strike price ($47.50) at expiration, the maximum profit is $165, a payout of over 194%.

It’s here that I must warn you that projecting out several weeks into the future is a tricky business. Mathematically, every unit of time projected forward compounds the error. Further, you must consider that YUMC stock has a tendency of bouncing higher from steep selloffs. I can see a path toward $46.50, which would be enough to exceed the above trade's breakeven price of $45.85. However, getting to $47.50 will require some luck.

Of course, much rides on the statistical viability of the 4-6-U sequence. Running a one-tailed binomial test reveals a p-value of 0.0162, which means that there's a 1.62% chance that the implications of the sequence could materialize randomly as opposed to intentionally. This meets the threshold of 5%, indicating statistical significance (though this should be taken with a grain of salt since my samples are taken through rolling intervals by necessity).

Admittedly, it's always a risky proposition to buy into red ink. However, there's real math behind this daring idea.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read Next:

Photo: Shutterstock