Kimberly-Clark Corporation (NASDAQ:KMB) rattled its shareholders when it earlier announced its acquisition of consumer goods giant Kenvue Inc (NYSE:KVUE). Ordinarily, such an acquisition might make sense due to the implied expansion of the acquiring entity's product portfolio. However, Kenvue has been ground zero for a controversy involving the flagship over-the-counter medication Tylenol.

Looking at the terms of the deal, the cash and stock transaction values Kenvue at an enterprise value of about $48.7 billion, based on the closing price of KMB stock this past Halloween. Further, the total deal value reflects an acquisition multiple of about 14.3 times Kenvue's last twelve months (LTM) adjusted EBITDA. Fundamentally, the combined enterprise aims to build on a stronger commercial platform to better meet evolving consumer needs.

Of course, the biggest concern about the buyout is Kenvue's branding and legal issues, particularly surrounding claims that acetaminophen — Tylenol's active ingredient — may increase the risk of autism and attention disorders in children. To be clear, the scientific consensus demonstrates no link between autism and Tylenol use during pregnancy.

However, this consensus did not stop the state of Texas in filing a lawsuit against Kenvue and former parent company Johnson & Johnson (NYSE:JNJ) for misleading pregnant women about the drug's safety. But after analyzing the actual lawsuit, one of the fundamental problems that Texas has is that it confuses correlation with causation (specifically by not meaningfully eliminating confounders).

Another issue with the allegations Texas is making is post-hoc narrative construction. For example, the suit claimed that "Children with acetaminophen detected in meconium also showed brain development problems." However, this statement means that researchers first found acetaminophen in meconium, then discovered some brain-development differences in the children and then lastly constructed a narrative that the drug caused the problem.

This is basically technical analysis but conducted in the scientific realm. It's also the reason why I've been so critical of the methodology as it is commonly practiced. When the technical approach is broadly disseminated without any empirical anchoring, it actually corrupts the way people think.

KMB Stock Flashes A Legitimate Reversal Signal

In the financial market — especially when trading options — you must calculate two probabilities: the baseline expectations of the target security and the conditional odds of the setup or signal that you identified. Going a bit deeper, every stock has two distributions of outcomes. One distribution covers the expected outcomes under a normal or homeostatic state while the other distribution covers the expected outcomes under the current condition.

These two probabilities are essential for consistent success in the market because if you don't know what your baseline is, how the heck would you determine whether you're making a sound decision or not? That's another reason why I'm critical of technical analysis. This approach presumes an outcome without confirming the decision's efficiency relative to the underlying risk profile.

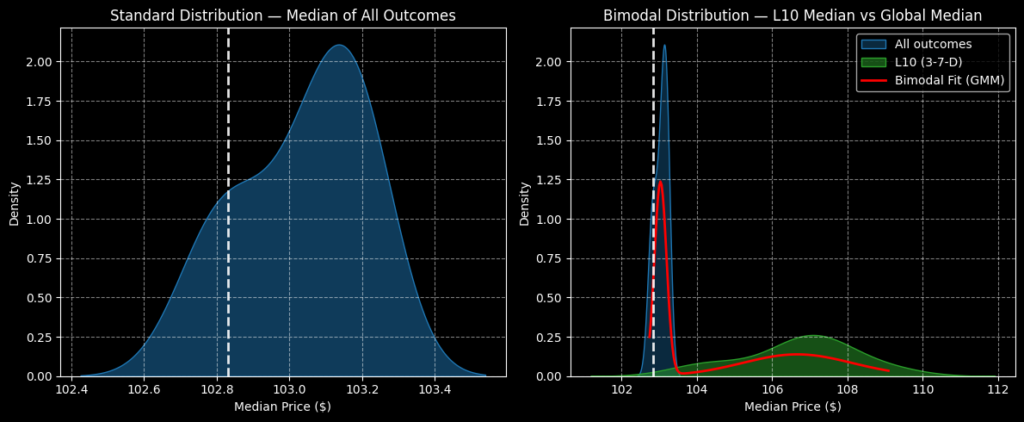

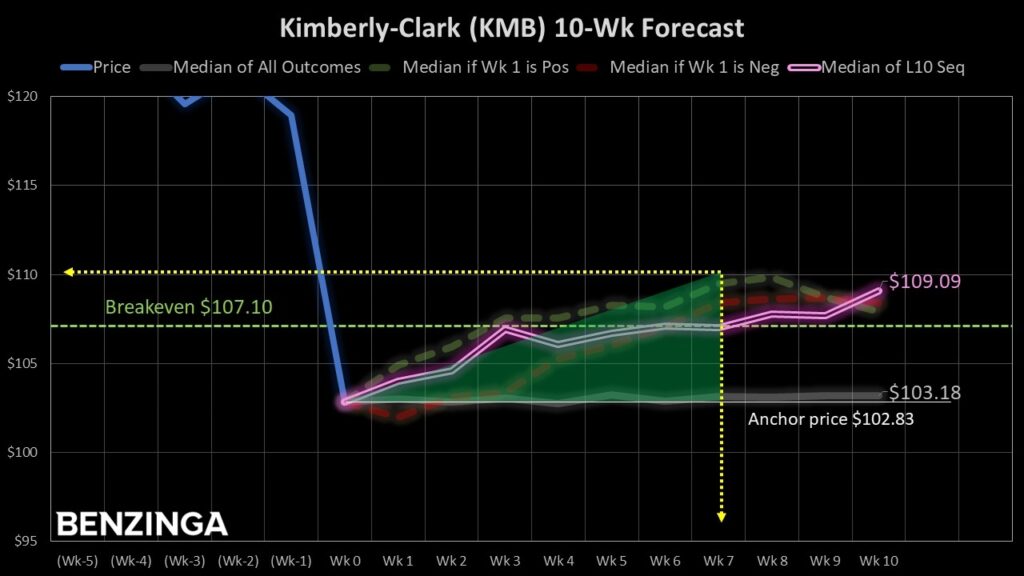

In contrast, the quantitative approach seeks the delta between the baseline and the condition at hand to better determine odds of success. Using data going back to January 2019, under a normal or homeostatic state, the forward 10-week median returns would be expected to form a distributional curve, with outcomes ranging between $102.40 to $103.50 (assuming an anchor price of $102.83). Further, price clustering would likely be predominant at around $103.10.

Interestingly, though, we know through GARCH (Generalized Autoregressive Conditional Heteroskedasticity) studies that volatility diffuses in a clustered, non-linear fashion. To make a long story short, the logical deduction is that different market stimuli yield different market behaviors. It's really the same principle undergirding Newtonian mechanics, just adapted for the financial markets.

In the trailing 10 weeks, KMB stock is structured in a distinct 3-7-D formation: three up weeks, seven down weeks, with an overall downward slope. Under this sequence, the distributional curve expands to $101 to nearly $112. While the risk tail does extend to the left, the reward tail jumps way out to the right, presenting a bullish opportunity.

Most significantly, price clustering would be expected to occur predominantly at $107. That's a 3.78% positive delta in density dynamics.

This again also explains why I'm critical of technical analysis. No "technician" is picking up on this 3.78% delta, which is an informational arbitrage that exists for no other reason than society finds comfort in the familiar.

Here's the scary part, though: every stock has this probabilistic variance. But if I'm the only one talking about this issue, you're trading blind on every other security.

Putting The Numbers To Good Use

One of the conveniences of the quantitative approach is that it makes identifying intriguing trading ideas so much easier. That's because you have empirically backed numbers to work with.

For the most aggressive traders, the idea that stands out the most (in my opinion) is the 105/110 bull call spread expiring Dec. 19. This transaction involves buying the $105 call and simultaneously selling the $110 call, for a net debit paid of $210 (the most that can be lost).

Should KMB stock rise through the second-leg strike ($110) at expiration, the maximum profit stands at $290, a payout of over 138%. Breakeven clocks in at $107.10, which is a realistic target based on the aforementioned price density dynamics.

Lastly, it should be noted that the above trade is based on calculated probabilities. There is no guarantee that the outcome will materialize as broadcasted. However, the point here is that we're using empirical data to make our decisions, which is far different from the opinion-driven assessments of traditional methodologies.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Image: Shutterstock