As a networking giant, Cisco Systems Inc (NASDAQ:CSCO) essentially provides the default plumbing of the internet and enterprise IT. By connecting data centers, branch offices and telecom networks, it plays a critical role in the broader dissemination of information. At the same time, competitive pressures are rising, thus raising questions about the company's valuation. With CSCO stock also flashing a rare bearish signal, traders may be better served — at least for the near term — exercising skepticism.

To be clear, the business itself hasn't broadcasted any overt signs of trouble. In the company's fourth-quarter earnings report — released on Aug. 13 — Cisco posted adjusted earnings per share of 99 cents, beating out analysts' consensus target of 91 cents. In the year-ago quarter, the networking specialist posted earnings of 91 cents per share.

On the top line, Cisco generated $14.67 billion, again beating out the consensus view, which stood at $14.61 billion. Last year, the company rang up $13.64 billion in sales.

Still, the issue may now come down to how much investors are willing to push the needle in terms of valuation. At the moment, shareholders must pay roughly five times trailing-year sales. Around this time last year, the metric was around four times. Further, the average multiple for the communication equipment sector is 2.37.

Adding to concerns may be Oracle (NYSE:ORCL) and its dramatic pop higher on Wednesday. While the enterprise software company's headline numbers missed analysts' expectations, ORCL stock nevertheless skyrocketed. A combination of an exceptionally bullish forward outlook and a backlog of remaining performance obligations totaling $455 billion represented the main catalysts.

Down the line, enterprises may migrate to Oracle's namesake infrastructure unit, thus potentially reducing demand for on-premise networking hardware. If so, that would likely represent a headwind for CSCO stock.

Granted, the argument isn't that Cisco is going to collapse. However, investors might not want to continue paying the high premium for CSCO, thus creating near-term risk.

An Unusual Pricing Behavior Warrants Caution For CSCO Stock

Although the fundamental argument presents a legitimate need for further investigation, what really captured my attention was Cisco's unusual pricing behavior. We can talk all day about the possible direction of the business. However, what cannot be empirically dismissed is the data on the chart, which effectively broadcasts CSCO's voting record.

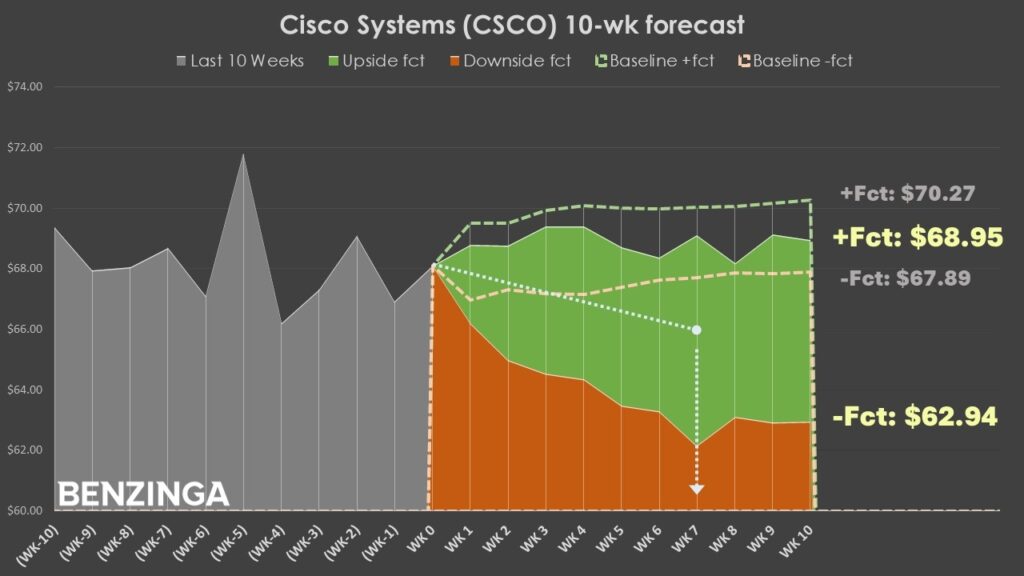

Quantitatively, in the trailing 10 weeks (inclusive of Wednesday's session), the market voted to buy CSCO stock six times and sell four times. Intuitively, with the balance of accumulative sessions outweighing distributive, you would anticipate that the overall trajectory points northward. However, it pointed downward, thus creating a counterintuitive 6-4-D sequence.

A few months ago, I noted that CSCO stock was printing an almost identical 6-4-U sequence. The only difference is that the latter sequence yielded (and forecasted) a positive trajectory. Still, this one shift changes everything statistically. Between January 2019 to July 2025, the 6-4-D sequence has flashed only 13 times on a rolling basis. Of this figure, CSCO has only been up at the end of the next 10-week period five times.

This translates to a 38.46% disadvantage to the bulls. It's also not the only reason why I'm concerned about CSCO stock.

One of the key problems of almost any analysis found in the financial publication industry is in-sample bias. When the claim and the evidence to support the claim come from the same pool of data, the underlying argument is self-referential and thus circular. To establish some level of empirical confidence, the assertion must be tested out-of-sample to better control for exogenous factors.

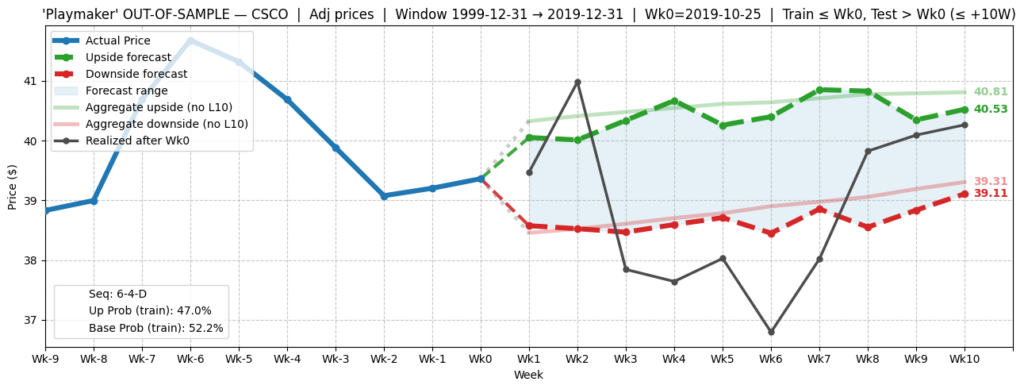

After running multiple tests on different sentiment regimes, the conclusion is that, outside of rare circumstances, the 6-4-D sequence leads to a negative drift over the following 10-week period. As evidence, I ran an out-of-sample test between 2000 and 2019, which reveals that the aforementioned sequence creates a slightly negative drift relative to aggregate or baseline expectations.

With the in-sample dataset showcasing heightened downside risk, the context of a rich premium to sales justifies a cautious outlook for CSCO stock in the near term.

Taking A Shot To The Downside

Using the market intelligence above, those who are interested in taking an aggressive wager may consider the 67/66 bear put spread expiring Oct. 24. This transaction involves buying the $67 put and simultaneously selling the $66 put, for a net debit paid of $45 (the most that can be lost in the trade).

Should CSCO stock fall through the second-leg strike price ($66) at expiration, the maximum profit would be $55, a payout of over 122%. Breakeven stands at $66.55.

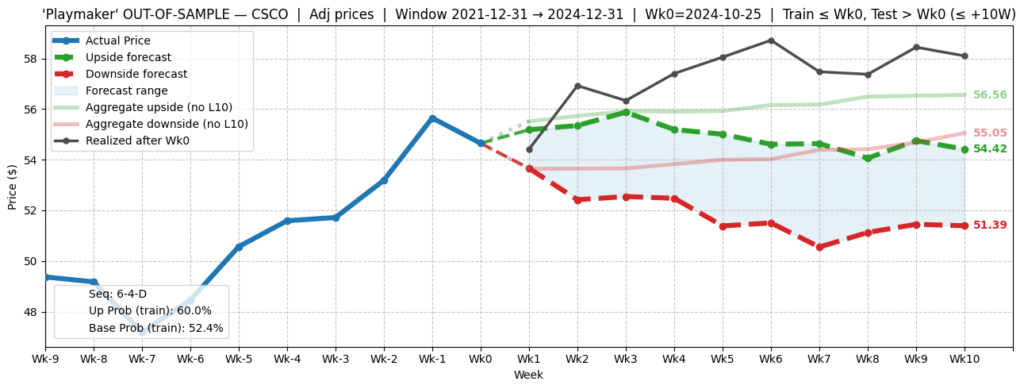

Mainly, this trade makes sense because the 6-4-D sequence has been unusually bearish in the post-pandemic environment. For example, an out-of-sample test isolated for the period between 2022 and 2024 shows a clear negative drift relative to baseline expectations.

Of course, the market is an open, entropic system, meaning that anything can happen. If the sentiment regime suddenly reverts to the positive, the analysis above would be dead wrong. The harsh reality is that we're dealing with probabilities, not certainties.

That said, the empirical data consistently shows that the 6-4-D consistently represents a harbinger of downside rather than upside. As such, for the next several weeks, I would say the odds favor the bears.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Image created using artificial intelligence via Midjourney.