With the technology ecosystem — including the previously red-hot cryptocurrency sector — suffering a worrying correction, investors have found comfort in traditional safe havens. On paper, that would mean gold but precious metals have also been fading recently. Instead, it's defensive enterprises like Procter & Gamble (NYSE:PG) that have witnessed an influx of investor sentiment. Even more enticing for PG stock, it may still have fuel left in the tank.

Yes, one could make the argument from the pages of fundamental analysis that the consumer goods giant is undervalued. Currently, shares trade for a bit over 23-times trailing-year earnings. At the end of the first calendar quarter, PG stock traded for over 27-times earnings. However, this claim is entirely contingent on the forward value assumption.

If the assumption is wrong, the core analysis collapses, making it a fragile assertion. In other words, the validity can't be tested ex ante or before the event materializes.

On the other hand, a technical argument could be made that, because PG stock is down more than 9% on a year-to-date basis, it's due for a comeback. Other analysts may draw lines symbolizing support and resistance, but unfortunately, these are only meaningful under an assumed framework.

In other words, the fundamental and technical arguments for PG stock could be valid — but that will not be demonstrated until after the fact. In essence, both approaches, when logically deduced, are tautological: so-and-so stock is undervalued because the model says it's undervalued and the model must be right because the market will prove it so later.

The search for actual, anchored meaning is why many retail investors are gravitating toward the quantitative approach.

PG Stock Flashes A Quant Signal Amid Tech Sector Chaos

To be fair, because investors would prefer putting their money to work rather than sticking it under the mattress, PG stock would make logical sense as a safe haven amid the tech sector chaos. However, it's not common sense that inspired me to talk about the consumer goods stock but rather its quantitative signal.

Basically, the quantitative approach measures how markets behave under defined conditions. While this sounds rather simple, keep in mind that the cornerstone attribute of quantitative models is falsifiability. More to the point, the underlying claims are not contingent on the person making the claim.

It's helpful to consider how marine ecologists tag sharks to analyze their behaviors and migration patterns. Since the ocean is a vast space — and there are many, many shark species — the tagging process becomes a critical mechanism to isolate specific datasets from the noise. It's the same principle with the equities market.

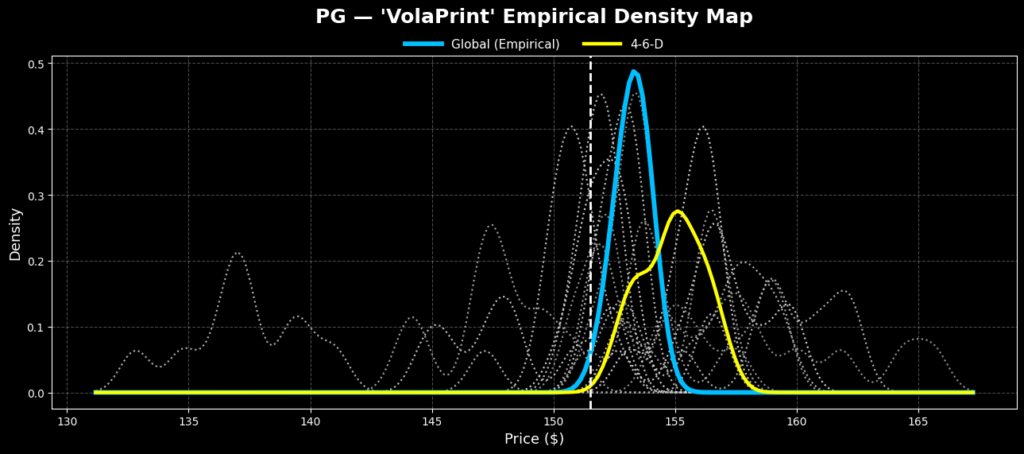

As a baseline, PG stock has an upward bias. If you enter a long position, the projected exceedance ratio is 61.8%. Stated differently, your ending price will likely be above your starting price. Out of the total pool of end prices, the median (kernel density) will range between approximately $151 and $155, with the bulk of prices landing at $153.50.

However, we're not interested — to extend the marine ecological analogy — in the behavioral patterns of all sharks. Instead, we might be interested in just tiger sharks. When it comes to the market, we can separate and distinguish individual signals.

For example, in the last 10 weeks, PG stock has printed a 4-6-D sequence: four up weeks, six down weeks, with an overall downward trajectory. So, if we just tag this sequence exclusively, we find a different probabilistic distributional curve than the baseline distribution.

Over the next 10 weeks, under 4-6-D conditions, the exceedance ratio improves to 62.2%. Moreover, the median price density lands at around $156. Therefore, an empirical incentive exists to consider going long on PG stock.

Two Daring Ideas To Consider

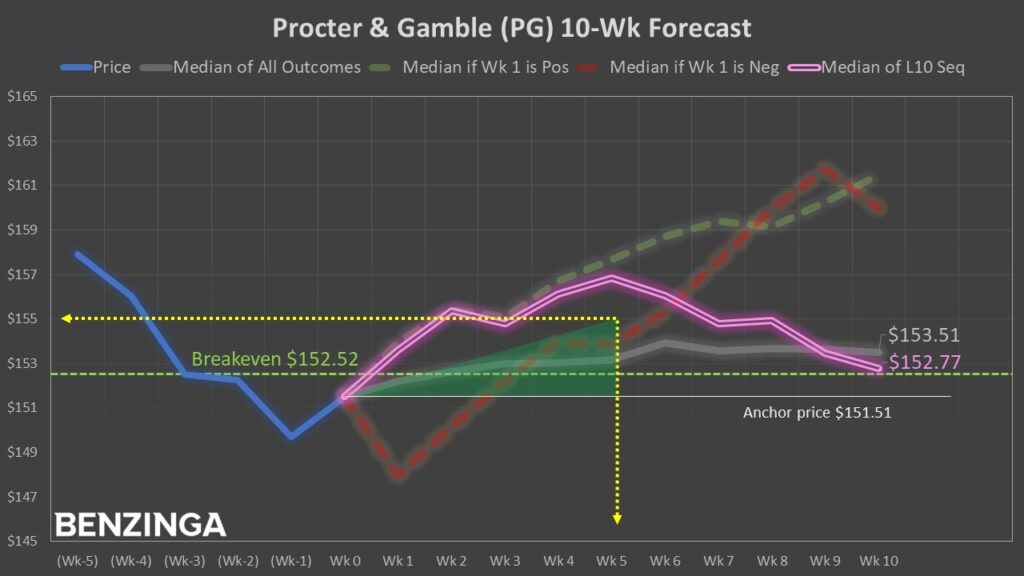

From the market intelligence above, there are two ideas that stand out. The more conservative approach is the 150/155 bull call spread expiring Nov. 21. This trade would require PG stock to rise through the $155 second-leg strike price at expiration to trigger the maximum payout of over 98%. Breakeven for this trade sits at $152.52.

For more aggressive traders, the 150/160 bull spread, also expiring Nov. 21, is enticing. Here, the payout stands at over 157% if PG stock manages to rise above $160. That's quite ambitious, to say the least. However, the breakeven for this trade is $153.89, which is realistic.

On a terminal basis (which is a different calculation from the kernel density mentioned above), the median price — under 4-6-D conditions — would be expected to land above $156 by Nov. 21. As such, the above spreads are tempting for those who have a quantitative mindset.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Photo: Shutterstock