/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

Nvidia (NVDA) will release its fiscal second-quarter earnings on Wednesday, Aug. 27. After a sluggish start to 2025, the chipmaker’s stock has staged a remarkable rebound, recently climbing to a new all-time high of $184.48 on Aug. 12. Over just the past three months, shares have surged 38%, easily outpacing the broader S&P 500 Index’s ($SPX) 10% gain during the same stretch.

This impressive rally reflects the growing investor enthusiasm surrounding NVDA, particularly as the company continues to dominate the artificial intelligence (AI) space with its chips. Further, the resumption of H20 chip sales to China is a positive step. That development could even pave the way for Nvidia to raise its full-year outlook when it reports results this week.

Despite the stock’s big move higher, Nvidia’s technical picture suggests there may still be room to run. The 14-day Relative Strength Index sits at 58.44, well below the threshold that typically signals overbought conditions. That indicates the rally is not yet overstretched and could have more fuel, particularly with AI tailwinds and supportive market sentiment in play.

What the Options Market Is Pricing in for NVDA Stock

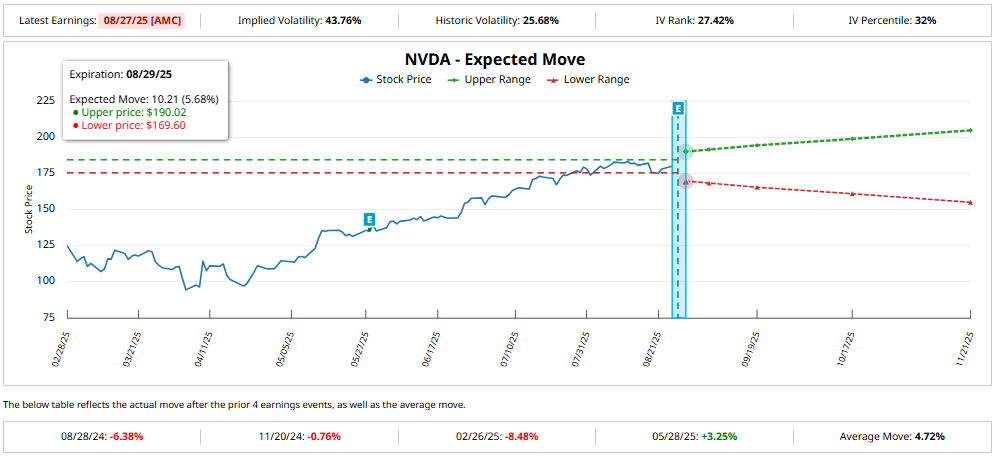

While Nvidia is likely to deliver another strong quarter, the options market is not expecting much volatility in NVDA stock post earnings. Traders are pricing in a post-earnings move of about 5.7% in either direction. That’s slightly higher than NVDA’s average post-earnings move of 4.7% over the past year.

However, history shows that Nvidia’s shares have dropped after three of the last four earnings reports, a reminder that even strong results don’t always translate to immediate stock gains.

Is Nvidia Stock a Buy Now?

Nvidia’s upcoming second-quarter financials are likely to remain strong as demand for its data center compute products continues to surge. Notably, its Blackwell GPU architecture is witnessing solid growth and could remain the key growth catalyst in Q2.

Notably, in the first quarter, Nvidia delivered $44 billion in revenue, up 69% year-over-year. Data Center sales, which account for the bulk of business, surged 73% to $39 billion as AI workloads transitioned from training to inference. The ramp-up of Blackwell, the fastest in Nvidia’s history, played a key role, contributing nearly 70% of Data Center compute revenue as customers shifted away from Hopper. The launch of the GB200 NVL system marked a major architectural breakthrough, allowing data centers to scale workloads efficiently and deliver lower inference costs. Manufacturing yields have improved, and rack shipments to customers are accelerating.

Nvidia’s Networking business has become a powerful growth engine. In Q1, its revenue reached $5 billion, rising 64% from the prior quarter, supported by technologies like NVLink and Spectrum-X. These solutions are critical to building the high-bandwidth, low-latency infrastructure needed for emerging agentic AI.

Growth is not confined to the Data Center segment. Nvidia’s Gaming unit achieved record revenue of $3.8 billion, up 48% sequentially, while Automotive revenue climbed 72% year-over-year on strong demand for self-driving platforms and AI-driven cockpit technologies. The company is also expanding into AI-powered PCs and robotics, broadening its total addressable market.

Management expects Q2 revenue of about $45 billion, with continued contributions from Blackwell and modest growth across all platforms.

While its top line is expected to register solid growth, Blackwell’s profitability is expected to lift gross margins slightly. Further, analysts forecast Q2 earnings of $0.94 per share, reflecting a 44.6% year-over-year increase. Notably, Nvidia has topped Wall Street expectations as tracked by Barchart in three of the last four quarters.

Analysts’ sentiment remains overwhelmingly bullish ahead of earnings. Of the 46 analysts covering Nvidia, 83% rate the stock a “Strong Buy,” reflecting confidence in the company’s leadership in AI infrastructure and its ability to sustain growth.

In short, Nvidia heads into its Q2 earnings with strong momentum, driven by surging demand for its Blackwell GPUs and strength across multiple business segments. While the stock has already rallied sharply in recent months, its technicals and fundamentals suggest more upside potential remains. However, note that NVDA’s recent history shows that even strong results don’t always guarantee an immediate stock rally.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.