/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

After breaching the once believed to be mythical threshold of a $5 trillion market cap, Nvidia (NVDA) is now looking ahead to march towards the next milestone of $8.5 trillion. Although the recent bout of profit booking has pushed the chip major's market cap to below $5 trillion again, there is some gap for Apple (AAPL) to cover to become the most valuable company in the world, as Nvidia's share price performance has once more outperformed the S&P 500 ($SPX) with a 49% uptick on a year-to-date (YTD) basis.

To that end, investment management firm Loop Capital's bullish assertions have again reinforced the optimism around the Jensen Huang-led company. Assigning a new Street-high price target of $350 for the NVDA stock and an implied market cap of $8.5 trillion for the company, firm analyst Ananda Baruah sees strong demand for the company's GB200 NVL72 racks over the next 12 to 15 months.

Baruah had sounded upbeat about Nvidia earlier this year as well when he stated, “Our work suggests we are entering the next ‘Golden Wave’ of Gen AI adoption and NVDA is at the front-end of another material leg of stronger-than-anticipated demand.”

However, as skeptics like Michael Burry initiate short positions on the company and the clamor of valuation bears gets louder, is it a good time to invest in Nvidia now? The answer remains a resounding “yes,” especially for folks who are in it for the long haul. Why? Let's find out.

Financial Powerhouse

Over the past decade, the company's track record paints a picture of relentless growth, clocking in compound annual rates of 42.52% for revenue and a whopping 66.59% for earnings. The outlook stays upbeat, with forecasters betting on revenue climbing another 67.65% and EPS pushing 74.71. These numbers tower over the sector medians of 7.73% and 11.15% for revenue and earnings, respectively.

The latest quarterly figures back up the story, as the outfit sailed past estimates on both fronts. Revenue hit $46.7 billion, up a hefty 56% from last year, while EPS settled at $1.05, edging out the $1.01 Street target and showing 54% growth year-over-year (YoY). The data center segment stole the show, raking in $41.1 billion, 5% ahead of the prior quarter and matching that 56% yearly leap of the overall revenues.

Cash generation held steady and strong, with operating inflows reaching $15.4 billion, a step up from $14.5 billion the year before. Zero short-term debt on the books, plus a $56.8 billion cash balance, leaves the balance sheet in a robust shape.

Guidance for the next period calls for about $54 billion in sales, topping the analysts' $53.14 billion call.

Valuations do carry a premium. Forward P/E at 45.59 versus the sector's 25.65, P/S at 24.25 against 3.67, and P/CF at 47.71 compared to 20.50 are all higher than the sector medians. Yet, the forward PEG of 1.27 still looks reasonable next to the industry's 1.80, tying the price to that growth promise.

No Stopping the Juggernaut

Nvidia appears well-positioned to sustain its momentum from the intensifying competition in AI infrastructure, anchored by its commanding position in the GPU sector, which continues to expand at an accelerated rate. This foundation, combined with concerted efforts to extend AI applications into domains such as networking, edge computing, and robotics, underscores the firm's commitment to preserving its competitive advantage in the evolving AI landscape.

At the core of this expansion, seen both in emerging sectors and the persistent demand from major cloud providers, lies Nvidia's comprehensive product portfolio, headlined by the Blackwell architecture. Adding to this cadence is the introduction of the Blackwell Ultra GPU, which represents a significant advancement in performance capabilities. On the other hand, the Hopper generation retains considerable market relevance, generating ongoing revenue streams, with the H200 Tensor Core GPU serving as a key example. Drawing on the Hopper design, this variant incorporates targeted improvements for large language model inference and high-performance computing applications. Notably, Nvidia's innovation pipeline extends further, as evidenced by the forthcoming Rubin platform, slated for increased deployment in 2026.

In its recent disclosures, the company reported a backlog exceeding $500 billion for Blackwell and Rubin deliveries extending through the balance of 2025 and into 2026. This substantial order book aligns with projections of annual AI infrastructure investments reaching $3 trillion to $4 trillion by 2030, implying a compound annual growth rate of 40% from 2025 levels. Although capital expenditure commitments are already substantial, Nvidia has observed that investment activity is accelerating.

Strategic alliances further bolster this trajectory. Recent collaborations with Caterpillar (CAT), a leader in infrastructure equipment, and Nokia (NOK), a prominent telecommunications provider, highlight Nvidia's intent to establish a stronger foothold in these historically underrepresented markets. Complementing these efforts is a partnership with Uber (UBER) aimed at supporting a fleet of 100,000 robotaxis, providing the underlying technology for the ride-hailing giant's extended-term deployment strategy. This initiative positions Nvidia to challenge narratives from competitors like Tesla (TSLA), with initial operations anticipated in 2027.

Thus, Nvidia's accelerators excel through their exceptional computational throughput and optimized design, achieving unparalleled efficiency in AI processing via the NVLink interconnect system. The firm enhances this with advanced networking solutions, including InfiniBand and Spectrum-X, which facilitate the linkage of expansive clusters, particularly pertinent for data center initiatives operating at gigawatt scales. Finally, the CUDA software ecosystem, now entrenched as the de facto industry benchmark, further enables the reconfiguration of GPUs for diverse computational demands. Collectively, these components cultivate a robust, client-retaining environment where viable substitutes remain scarce.

Analyst Opinion on NVDA Stock

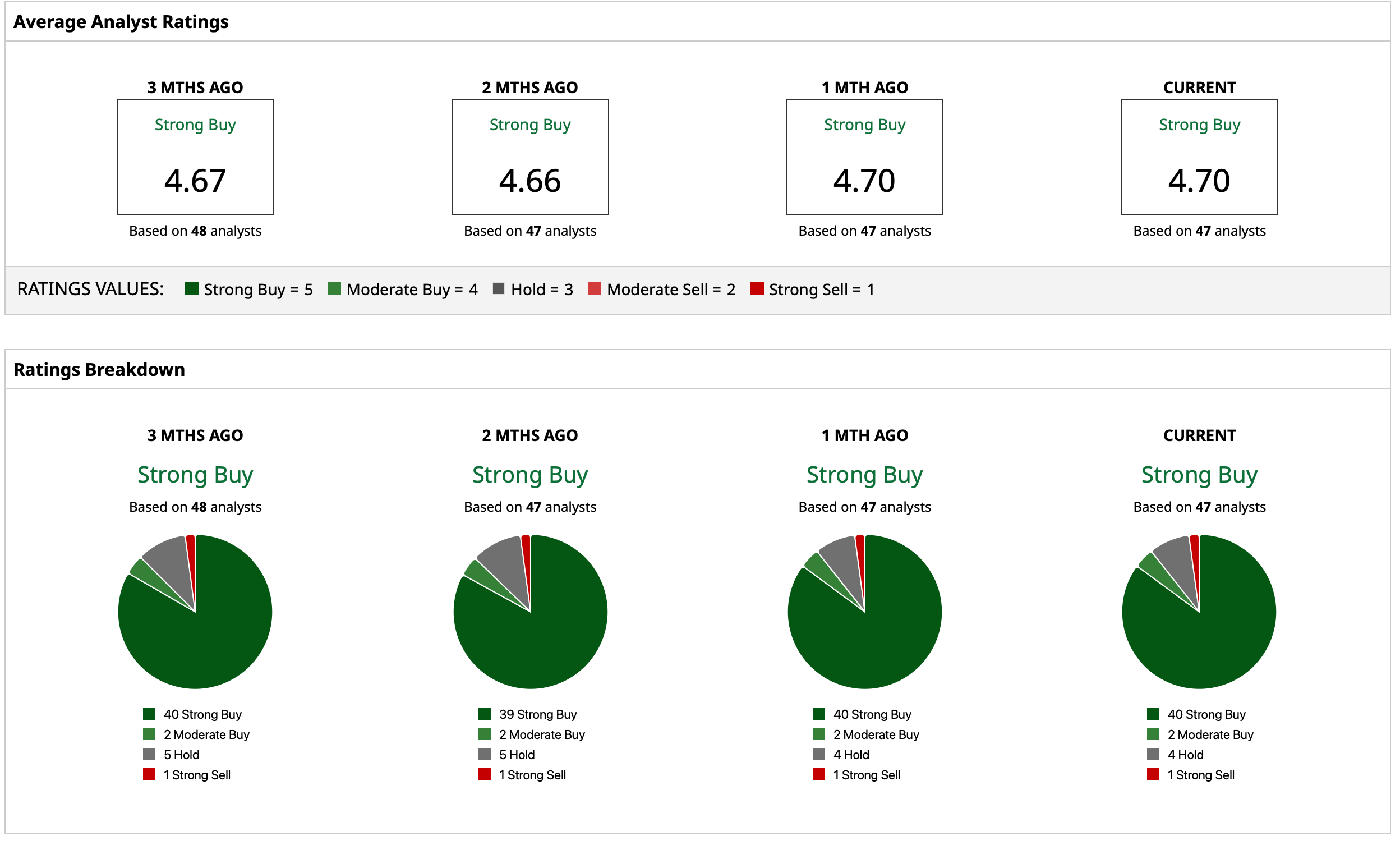

Taking all of this into account, analysts have assigned an overall rating of “Strong Buy” for the NVDA stock, with a mean target price of $233.05. This indicates upside potential of about 15% from current levels. Out of 47 analysts covering the stock, 40 have a “Strong Buy” rating, two have a “Moderate Buy” rating, four have a “Hold” rating, and one has a “Strong Sell” rating.