Depression remains one of the world’s most debilitating conditions, impacting millions worldwide with symptoms that can disrupt every facet of life — from work and relationships to basic daily functioning. For many, traditional antidepressants offer little relief, especially those facing treatment-resistant depression (TRD), where symptoms persist despite multiple therapies.

This growing unmet need is fueling a new frontier in mental health: Psychedelic medicine. Biotech firms are now exploring psychedelic compounds and therapeutics to rewire the brain and restore balance where conventional drugs have failed.

Amid this shift, North Carolina is emerging as an unexpected leader. After a key meeting organized by Veterans Exploring Treatment Solutions (VETS), the North Carolina Psychedelic Policy Coalition, and Students for Sensible Drug Policy, North Carolina Senator Bob Brinson said the state could “lead the nation” in expanding access to psychedelic therapies.

The news sparked a rally in the market, with Atai Life Sciences (ATAI) — a biotech focused on psychedelic-based therapies — seeing double-digit gains. With a strong pipeline, rising bipartisan support, and Wall Street’s bullish outlook, ATAI stock looks like a smart portfolio pick for those eyeing the next wave of mental health innovation.

About Atai Life Sciences Stock

Based in both Berlin, Germany and the Netherlands, Atai Life Sciences is pushing the boundaries of mental health treatment. This clinical-stage biotech focuses on next-gen therapies using psychedelic compounds and digital therapeutics to tackle depression, anxiety, and other psychiatric disorders. With a market capitalization of $1.3 billion, Atai is now expanding its footprint, aiming to acquire Beckley Psytech to create a powerhouse blending expertise in psychedelics, CNS drug development, and rapid-acting therapies.

Atai’s pipeline is designed to transform mental health care. Key assets include VLS-01 (DMT-based for treatment-resistant depression), EMP-01 (MDMA-based for social anxiety), and novel non-hallucinogenic 5-HT2A receptor agonists. With convenient administration methods and short in-clinic times, Atai is positioning itself as a market leader in next-gen psychedelic medicine.

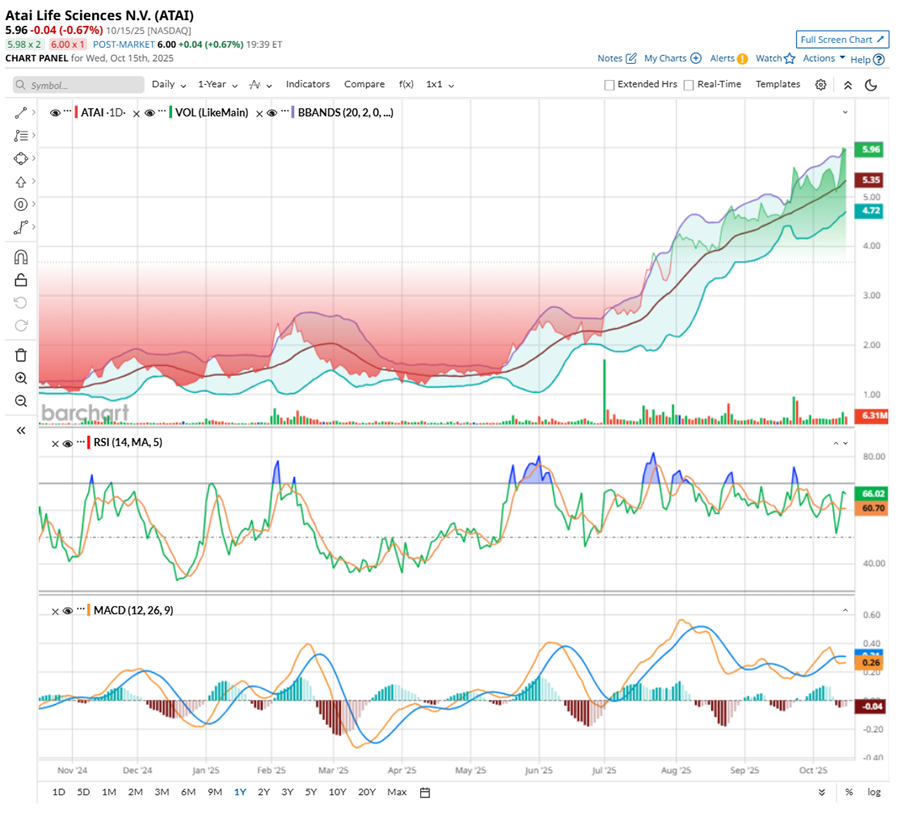

Atai Life Sciences’ performance reflects strong investor confidence and significant market enthusiasm that’s hard to ignore. Fueled by an ambitious pipeline of psychedelic-based therapies, ATAI shares have skyrocketed 411% over the past 52 weeks. Even in 2025, the stock has surged 338%, with a remarkable 281% climb over the past six months alone.

ATAI stock has hit key milestones along the way. Recently, shares touched an all-time high of $6.75 on Oct. 20, before a minor pullback, signaling healthy profit-taking amid a buying frenzy. Trading volumes highlight the intensity of the rally. Some 31 million shares exchanged hands on Oct. 17 and over 10 million shares traded on Oct. 20, showing that the stock remains a hot ticket among investors, although its technicals do hint at caution.

Atai Life Sciences’ Q2 Earnings Snapshot

Atai Life Sciences entered the second quarter of 2025 with a mix of progress and pressure — a story familiar to anyone who’s followed the long, unpredictable path of biotech innovation. On Aug. 14, the company posted its Q2 earnings report, and while the results weren’t perfect, they painted a picture of a company tightening its belt and sharpening its strategy.

Revenue came in at $719,000, a 163% year-over-year (YOY) jump, landing roughly in line with expectations. Net loss per share narrowed to $0.14, a big improvement from last year’s figure, though still a bit wider than Wall Street had hoped. It’s a sign that the company is learning to move leaner, cutting excess weight but still sprinting toward profitability.

R&D spend fell to $11.1 million from $12.6 million in last year’s quarter, reflecting lower personnel and consulting costs, even as contract research spending rose. Meanwhile, general and administrative expenses ticked up to $14.9 million, mainly tied to its planned strategic combination with Beckley Psytech — a deal that could redefine Atai’s footprint in psychedelic-based mental health.

Cash reserves told a steadier story. Cash, cash equivalents, and short-term securities came in at $95.9 million as of June 30, 2025, up from $72.3 million at the end of 2024, thanks to equity issuances and asset sales. And with another $50 million in committed funding announced in July, Atai expects to stay well-capitalized into the second half of 2027. That's a luxury few early-stage biotechs can claim.

The company also delivered a major milestone: Positive topline Phase 2b results for BPL-003, its fast-acting treatment for TRD. A U.S. Food and Drug Administration (FDA) meeting request is already on deck for later this year — a critical step toward commercialization.

So yes, the losses are still there, but the direction matters. Analysts see fiscal 2025 losses narrowing 44% YOY to $0.52 per share, remaining steady in the next fiscal year. Profitability remains a longer climb. Atai’s roadmap — from the Beckley merger to its deep R&D bench — signals a company preparing not just to survive, but to lead the mental health renaissance that’s finally catching global momentum.

Atai’s Moment to Lead

North Carolina is quietly turning into the next frontier for psychedelic medicine, and the push is being led by those who have seen the worst of war. With a large veteran population battling depression, PTSD, and anxiety, the state is now opening its doors to alternative therapies.

At a recent bipartisan event, Senator Bob Brinson and Representative Eric Ager spoke passionately about veterans who found healing through plant-based treatments, setting the tone for a serious policy shift. Their efforts are already reflected in a bipartisan bill proposing a Psychedelic Medicine Task Force, alongside a $5 million research grant program to study psilocybin and MDMA’s therapeutic potential.

For Atai Life Sciences, this is where science meets opportunity. As regulations loosen, Atai could step in with its deep R&D capabilities, partnering with universities and state agencies to accelerate trials, validate data, and bring next-gen mental health solutions to market. In a state hungry for hope and armed with funding, Atai might just find its perfect proving ground.

What Do Analysts Expect for Atai Life Sciences Stock?

This week, Needham initiated coverage on ATAI stock with a “Buy” rating and a $12 price target, seeing major upside in its psychedelic pipeline. The firm believes Atai’s lead candidate, BPL-003, could outshine Johnson & Johnson’s (JNJ) Spravato with better efficacy and easier administration.

By leveraging Spravato’s existing infrastructure, Needham projects that BPL-003 could capture 20% of the market and exceed $2.5 billion in sales by 2035. The brokerage firm believes Atai is well-positioned to unlock real value in this fast-evolving mental health frontier.

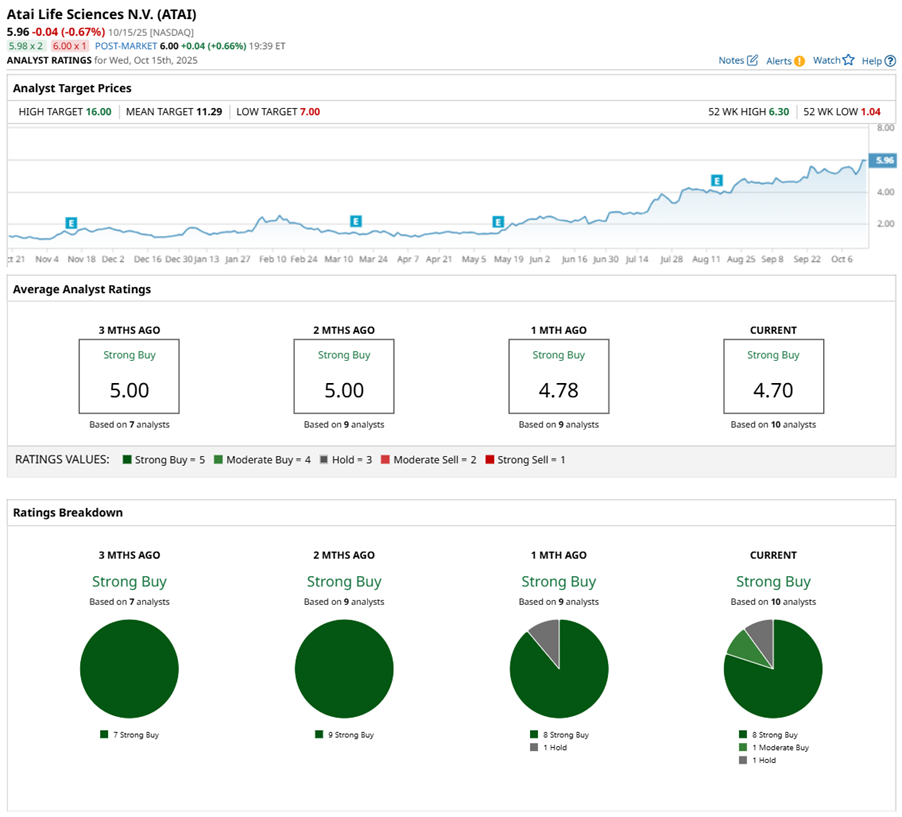

ATAI stock has a “Strong Buy” rating overall, reflecting solid confidence from the analyst community. Among the 10 analysts tracking the stock, eight issue a “Strong Buy,” one backs a “Moderate Buy,” and one advises a “Hold.”

While the average analyst price target of $12.14 suggests the biopharma stock has upside potential of 111%, the Street-high target of $16 hints that ATAI could rally as much as 178% from current levels.