News Corp's boss has issued a stern warning about the threat of artificial intelligence to creativity, as the company rolls out the technology across its newsrooms.

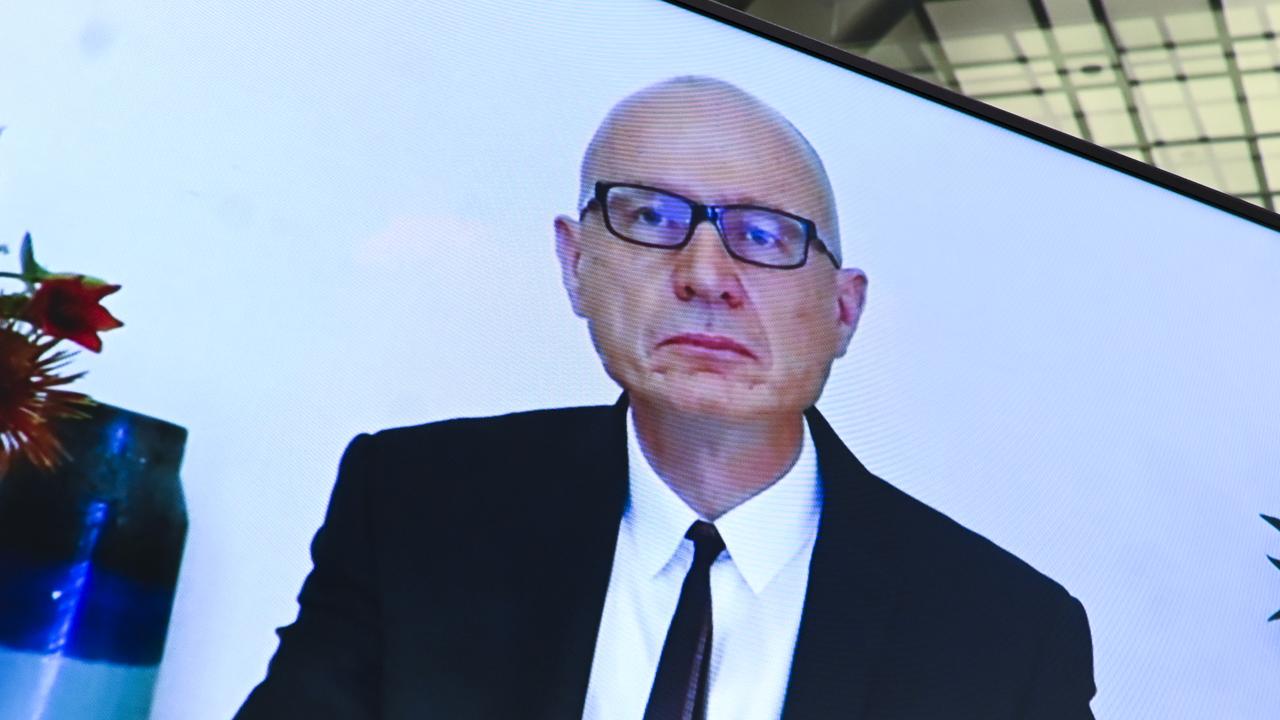

At the company's full-year results briefing in New York, chief executive Robert Thomson said the world found itself at a historic inflection point in the age of AI, in which it was essential to protect what he called America's comparative advantage in creativity.

"To undermine that comparative advantage by stripping away (intellectual property) rights is to vandalise our virtuosity," Mr Thomson said.

"We need to be more enlightened to eulogise eunoia socially and commercially."

Mr Thomson's eunoia - beautiful thinking or a harmonious goodwill towards others - avoided plumbing News Corp's rollout of AI tools NewsGPT and Story Cutter to its newsrooms.

But he was concerned about threats to intellectual property like Donald Trump's The Art of the Deal, a publication of News Corp's book division.

"Is it right that his books should be consumed by an AI engine which then profits from his thoughts by cannibalising content, thus undermining future sales?" Mr Thomson asked.

"The art of the deal has become the art of the steal."

The results briefing noted softening trends for News Corp's book publishing arm, due to the strong relative performance in the first half following strong sales of Hillbilly Elegy, the work of fellow author-turned-politician JD Vance.

Segment growth was also supported by an audiobook deal with streaming platform Spotify.

Lachlan and Rupert Murdoch were praised for their guidance in News Corp's overall performance, which boasted a two per cent lift in revenue to $US8.5 billion ($A13.1 billion), despite fading news media revenue.

Net income from continuing operations grew 71 per cent to $US648 million, up from $US379 million the previous year with Dow Jones and REA posting record revenues of $US2.3 billion and $US1.3 billion respectively.

"Fiscal 2025 marked a big step in the transformation of News Corp, as we continue to expand into high-margin content licensing and increase recurrent and digital revenues," chief financial officer Lavanya Chandrashekar said.

Weakness in news media subscriptions and declining advertising revenues was more than offset by the group's Dow Jones segment, which includes the Wall Street Journal and Barrons, along with REA Group, which owns realestate.com.au.

News Corp holds a controlling stake in REA, which posted double-digit increases to revenues and net profits on Wednesday thanks to higher listing prices.

Digital subscribers to News' Australian mastheads fell by roughly 50,000 over the financial year, while the New York Post's online subscriber pool slumped to 90 million from 117 million the year before, and from 112 million to 87 million for UK tabloid The Sun.

The Times and Sunday Times bucked the trend, growing their digital subscriber base from 594,000 to 640,000 over the year.

Despite the trend, news media profitability improved 15 per cent, which Mr Thomson attributed to the group's "editorial creativity" and cost consciousness, which included significant layoffs across brands in Australia, the US and UK.