/Apple%20Inc%20phone%20and%20data-by%20Anderson%20Reis%20via%20Shutterstock.jpg)

Apple (AAPL) stock is inching up this morning following a report that the titan’s latest iPhone Air sold out “within minutes of its launch in China – marking a strong debut in one of its most critical markets.

Preorders for Apple’s thinnest smartphone started last week after the country’s telecom operators secured regulatory approvals for eSIM services, which coincided with CEO Tim Cook’s visit to China.

At the time of writing, Apple shares are up nearly 55% versus their year-to-date low in early April.

iPhone Air’s China Performance Is Bullish for AAPL Shares

iPhone Air’s rapid sellout across major Chinese cities indicates encouraging demand despite macroeconomic headwinds and fierce local competition.

With China Mobile, China Unicom, and China Telecom now supporting eSIM, Apple gains a strategic edge in pushing slimmer, more advanced smartphones.

Plus, Tim Cook’s high-profile meetings with Beijing’s officials and pledges to deepen investment further reinforce Apple’s commitment to the region.

In a market where Huawei and Vivo are gaining ground, the giant’s ability to generate excitement around new devices bodes well for its brand resilience, revenue momentum, and the AAPL stock price.

Doug Clinton Shares View on Apple Stock

According to Doug Clinton of Intelligent Alpha, the iPhone 17 is outperforming initial forecasts, and Clinton believes the real upside lies in Apple’s artificial intelligence (AI) roadmap.

Clinton expects the Nasdaq-listed firm to announce major AI initiatives at its WWDC in June 2026, possibly including a Siri overhaul.

Until then, AAPL is choosing to “keep the bar super low for earnings,” which he described as a hidden strength in a recent interview with CNBC.

Apple shares could, therefore, pop through the end of 2025 if the iPhone maker comes in ahead of the expected $1.74 a share of earnings in its fiscal fourth quarter on Oct. 30.

Wall Street Remains Bullish on Apple

Wall Street firms also agree with Clinton’s constructive view on AAPL shares.

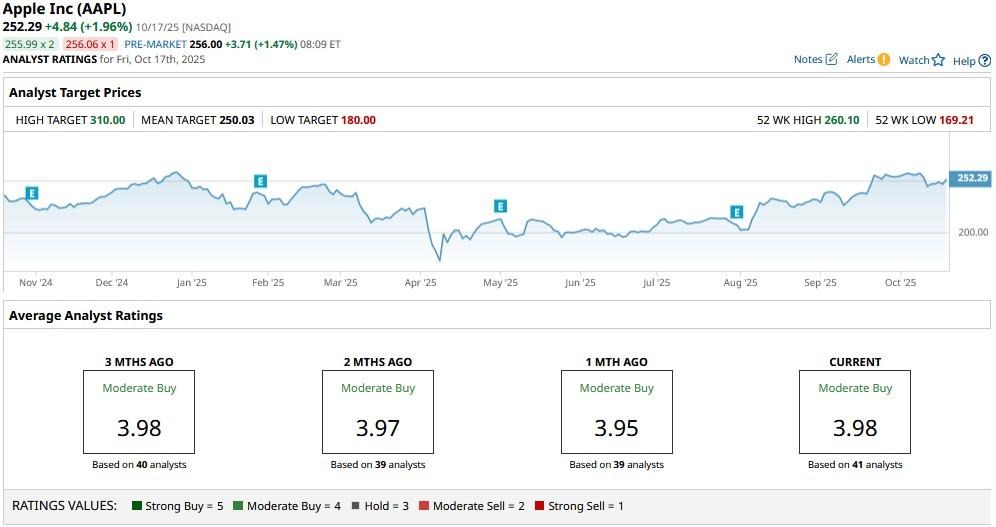

According to Barchart, the consensus rating on Apple stock remains at “Moderate Buy” with price targets going as high as $310, indicating potential upside of roughly 24% from here.