Netflix (NFLX) reported its Q2 earnings yesterday, July 17, after the close of markets. While the earnings were better than expected, NFLX is trading lower today. In this article, we’ll look at the key takeaways from Netflix’s Q2 report and analyze how to play the stock after its YTD outperformance.

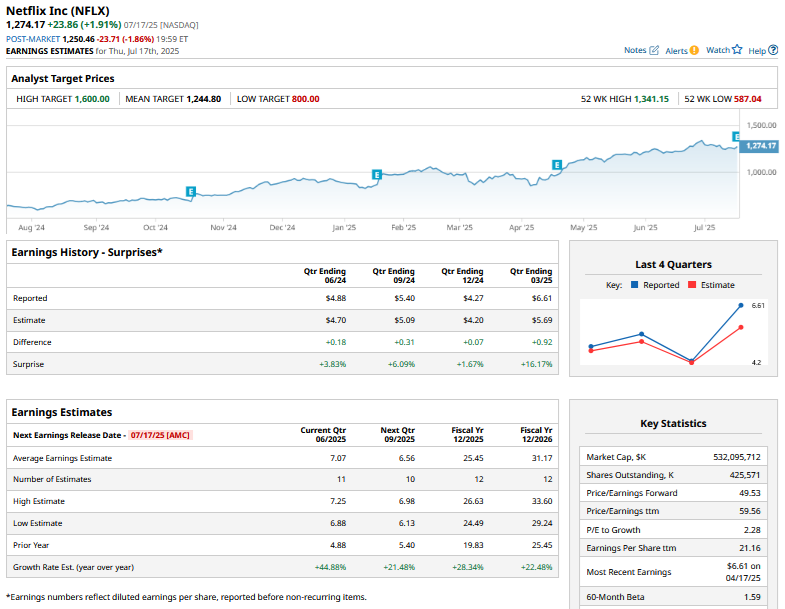

Netflix reported revenues of $11.08 billion in the second quarter, up 15.9% year-over-year and slightly ahead of Street estimates. As a reminder, Netflix has stopped reporting quarterly subscriber numbers even as it attributed the rise in revenues to “more members,” along with higher subscription prices and ad sales. The company’s earnings per share (EPS) came in at $7.19, which easily beat its guidance of $7.03 and the consensus estimate of $7.07.

Netflix Raised Its Annual Guidance

Netflix has raised its annual guidance, now expecting full-year revenues to be between $44.8 billion and $45.2 billion, up from the previous guidance of $43.5 billion to $44.5 billion. The company attributed the raised guidance primarily to favourable currency movements. Notably, the U.S. dollar ($DXY) has weakened against most major currencies this year, which is a tailwind for U.S. tech giants that get substantial revenues from global markets.

Netflix also raised the guidance for its currency-neutral operating margin by 50 basis points to 29.5%. Moreover, it now expects free cash flows to come in between $8 billion and $8.5 billion, up from the previous forecast of around $8 billion.

Key Takeaways from Netflix’s Q2 Earnings Report

Here are some of the other key takeaways from the report.

- Operating Margins to Fall in the Back Half of the Year: Netflix expects its operating margins in the second half to be lower than the first half, which it attributed to the "higher content amortization and sales and marketing costs associated with our larger second half slate.”

- Ad Revenues on Track to Double in 2025: While Netflix does not provide a dollar number for its ad business, it reiterated that its ad revenues are on track to double in 2025. In the next couple of years, ad revenues will become a significant driver of Netflix’s top line as the company adds more subscribers to the ad-supported tier and its ad sales start taking off.

- Deal with TF1 in France: Netflix has partnered with TF1 in France, which will let it show TF1's content, including free-to-air channels and on-demand content, directly on the Netflix platform in the country. This is the first of its kind partnership for Netflix, and the company did not rule out more such deals.

- Streaming Tiers: In response to an analyst’s question on whether Netflix can have more tiers in the future as it broadens its slate to include live sports and other offerings like TF1 in France, co-CEO Gregory Peters responded diplomatically by saying, “I've learned to never say never. So I would say we remain open to evolving our consumer-facing model.” Notably, the comments should be seen in the context of Netflix previously battling against ads on streaming but later pivoting to ads in a departure from its original strategy. Meanwhile, we can be reasonably sure of Netflix making some content exclusive for premium tiers in the future, which will be another revenue opportunity for the streaming giant.

Overall, I would say that Netflix’s Q2 earnings were pretty solid and justify the kind of rally we have seen this year.

However, my concern with Netflix remains the same as it was prior to the confessional. At nearly 50x its forward earnings, Netflix is priced for perfection, and the risk-reward does not look attractive, at least for the short term. I will continue to stay on the sidelines and wait for a better entry point to buy NFLX stock, even as I have no intention of selling my existing shares after an encouraging Q2 performance.

On the date of publication, Mohit Oberoi had a position in: NFLX . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.