Like many other high-growth companies, markets have been harsh to Netflix over the last three months: The streaming giant’s shares are down 20% since it posted better-than-expected subscriber numbers in its Oct. 19 Q3 shareholder letter.

Bulls are hoping Netflix will top expectations again when it posts its Q4 letter on Thursday afternoon. Among analysts polled by FactSet, the consensus is for Netflix to report 8.2 million paid subscriber net adds for the seasonally big fourth quarter (a little below its guidance of 8.5 million), and to guide for 5.8 million first-quarter net adds.

Netflix’s fourth-quarter revenue consensus stands at $7.71 billion (16% annual growth), while its GAAP EPS consensus stands at $0.83. However, the company’s subscriber figures typically have a much bigger impact on how its stock moves post-earnings.

Eric Jhonsa, Real Money’s tech columnist, will be live-blogging Netflix’s Q4 letter, which is expected after the bell on Thursday, along with a “video interview” with management that’s set to become available at 6 P.M. Eastern Time. Please refresh your browser for updates.

7:13 PM ET: That's a wrap for Netflix's earnings interview. Shares are down 19.7% after-hours to $408.15 after Netflix reported 8.28M Q4 paid net subscriber adds (compares with an 8.23M consensus and guidance of 8.5M) and guided for 2.5M Q1 paid net adds (below a 5.81M consensus), while stating subscriber acquisition growth "has not yet re-accelerated to pre-Covid levels."

Netflix reported higher-than-expected Q4 paid adds in North America ahead of its planned Q1 price hikes, but lower-than-expected paid adds in its 3 other regional segments. The company reiterated it expects to be free cash flow-positive in 2022, while forecasting forex swings will have a $1B full-year revenue impact. It also disclosed that it's "removing supermajority voting provisions" from its charter and bylaws, and will give shareholders the right to call special meetings.

Thanks for joining us.

7:07 PM ET: Sarandos with some closing remarks. Recaps Netflix's broader content strategy and the long-term viewing trends it benefits from. Says the pace of the migration can be tough to predict, but that it continues to happen.

7:04 PM ET: A question about balancing M&A and buybacks as FCF grows.

Neumann: Our top priority with cash is to responsibly and strategically invest in the business, whether organically or via M&A. M&A is a tactic for us rather than our strategy. We plan to return any excess cash to shareholders. Can't predict when FCF will converge with earnings. It'll converge over time and is heading in the right direction.

IR chief Spencer Wang adds that Netflix aims to keep gross debt in a range of $10B-$15B. Also notes that quarterly EPS can be skewed by one-time items such as the revaluing of Netflix's eurobonds.

6:59 PM ET: A question about Netflix's 2022 op. margin guidance of 19%-20% (below 2021's 21%). Is it just due to forex, or are there other factors?

Neumann: It's mainly due to forex. We'd be right around our pace of adding about 3 points of margin per year otherwise. We don't want forex swings to affect how we pursue our growth opportunities. We'll catch back up eventually, and are still committed to growing margins by about 3 points per year over a few-year period.

He adds Netflix's Q1 revenue growth (guided to be 10%) is affected by tough comps and price hike timings.

6:55 PM ET: A question about how many types of content Netflix wants to provide long-term.

Hastings (laughing): We have to be differentially great at the things we provide. We now have shows, films, unscripted content, documentaries, games, etc. We need to please our members by having the absolute best gaming offering. When we're winning in games, we can revisit this question.

6:52 PM ET: A follow-up question about whether Netflix (in the wake of the Take-Two/Zynga and Microsoft/Activision deals) could be willing make gaming acquisitions of its own.

Peters: We're open to acquiring game IP, and I think you'll see some of that happen over the year to come. But we're also excited about our internal efforts to create interactive experiences. Long-term, our eyes are more on creating and developing our own franchises.

6:50 PM ET: A question about Netflix's gaming efforts to date.

Peters: It's still very early days. We're seeing good user growth. We're building out our own game studio. This will allow us to deliver interactive experiences around our content. We see that as the next level of value-unlock we can provide for consumers.

6:48 PM ET: A question about building out consumer franchises that encompass content, games, consumer products, etc.

Hastings: We're building those muscles steadily. In a few years, those should be strong muscles. People think of franchises as either 0 or 1, but there's a continuum in terms of what can be done. It's already working, but it's about 20% of what it'll be in a couple of years in terms of the auxiliary boost beyond the title.

6:44 PM ET: A question about what having a strong film slate in Q4 did for Netflix.

Sarandos: There's a theory that people differently value movies because they traditionally have to pay to watch a big movie that was just released. We provide a different value proposition. We've got new movies every week on Netflix, and they're big movies that people care about.

Neumann: Our subscribers love having a great variety of high-quality content. Films are now a big part of that, but not the only part.

Sarandos again: It's easier for people to watch movies together than it is to watch a TV series together. And we're creating films for a wide variety of tastes now.

6:38 PM ET: A question about how many of the 800M-900M homes outside of China that Netflix sees as its addressable market it thinks it can reach over time.

Hastings: In the U.S., our subscriber base is now equal to about 2/3 of the pay-TV high-water mark. Getting to the remaining 1/3 will be tougher. But streaming provides a better experience than pay-TV in many ways, along with lower pricing. The current slower growth is frustrating for us. It could be just COVID effects or a smaller-than-expected market, we're not sure why. It's possible we reach our goals, but slower than we thought. We're still focused on our original goals.

Sarandos: It's still early days. It's a dynamic market and not as steady as people might like, but there's question that it continues growing.

6:33 PM ET: A question about Latin American growth. The market seems to be maturing. Is there anything you can do differently to drive penetration higher?

Neumann: We don't think it's maturing faster than other markets. There have been macro headwinds. Also, price hikes have had an impact. The business is still growing there. Pay-TV is healthy there, there's still a lot of room to grow. We're getting better everywhere every year. But there's no fundamental change in strategy.

6:30 PM ET: A question about the factors that drove Netflix's success in South Korea.

Sarandos: We built a great team in South Korea. Korean content has traveled well around the world. Previously had success with content such as Parasite and Okja.

Gupta asks if we'll get a second season of Squid Game. "Absolutely," Sarandos replies.

6:28 PM ET: A follow-up question about which other actions Netflix could take to succeed in India.

Hastings: It would be a long time before we materially change our strategy. Our experience in Brazil was brutal the first couple of years.

Peters notes Japan was also a very difficult market early on before paying off. Says Netflix is confident it can get things right in India over time.

Hastings: In every other major market, we've got the flywheel spinning. It frustrates us that we haven't been as successful in India yet. But we're definitely leaning in there.

Neumann: Entertainment is both global and local around the world. Our business scales well globally, but it's not easy.

Sarandos: We have original content coming out from all corners of the world, and that's driven international growth. We expect it to in India as well.

Peters again: We're still learning how to improve localization when it comes things like subtitles, dubbing and presenting content in a locally-appealing way.

6:21 PM ET: A question about recent Indian price cuts.

Peters: We're exploring ways to appeal to a broader number of people in India. Our actions cover prices, partnerships, payment options, etc. It's still early, but the early data for our performance in India following the price cuts.

Hastings: The average price for cable in India is $3/month. It's a very different pricing environment.

6:17 PM ET: A follow-up question about pricing. Should we compare Netflix's pricing to cable as we look at its long-term pricing runway?

Peters: We don't have a pricing target in mind. We keep an eye on metrics for engagement, churn, acquisition, etc., and try to figure out what the right time is to ask for more. We're investing a lot in a number of areas.

6:15 PM ET: A question about the U.S./Canada price hikes and their expected impact.

COO Greg Peters: We expect the price hikes to flow through over the course of Q1. What we've seen is that if we keep improving the quality of our offering, we can go back to customers and ask them for more, and most have been willing to. Consumers around the world are willing to pay for great entertainment.

6:12 PM ET: A follow-up question about subscriber growth. Is the hurdle now higher for landing a given number of net adds?

Sarandos: We didn't see a hit to engagement or retention. The pandemic has created a lot of bumpiness. But the business' fundamentals remain solid.

6:10 PM ET: A question about Q1 net add guidance (2.5M, below expectations) and what's reflected in it.

Neumann: There are no structural changes that we're seeing. Q4 trends are continuing into Q1. Viewing/engagement are strong and churn is down, but acquisitions still aren't at pre-COVID levels. We're trying to understand why. We think some of it is post-COVID overhang, along with some macro headwinds. On the margins, there could be some impact from competition. Also, our big Q1 titles are landing late in the quarter and we'll be hiking prices in North America.

Reed Hastings: The pull-forward created by COVID makes subscriber trends hard to read. We had huge subscriber growth before. There could be a number of factors at play. The trend of streaming taking share from linear TV continues, we're as confident as ever in that.

Co-CEO Ted Sarandos: Our bet on original films continues paying off. Our bets on international programming really paid off in 2021, Squid Game was a huge hit. Our bet on big-budget feature films also paid off.

6:03 PM ET: First question is about Q4 paid net adds (8.3M).

CFO Spence Neumann: We're pleased with how Q4 went. We had a bunch of new content launches. Retention was up, churn was down, viewing was up. But we didn't grow customer acquisitions quite as much as we were hoping.

6:02 PM ET: The video interview is up. Fidelity's Nidhi Gupta is once more the interviewer.

5:57 PM ET: There hasn't been any letup in selling pressure thus far: Netflix is now down 19.9% AH. Its market cap now stands at $185B.

5:55 PM ET: Hi, I'm back to cover Netflix's video interview, which should be made available in a few minutes.

5:10 PM ET: I'm taking a short break, but will be back to cover Netflix's video interview, which is set to go up at 6PM ET. Shares are currently down 19.4% AH to $410.00 after Netflix slightly topped its Q4 paid subscriber add consensus but guided Q1 paid net adds 3.3M below consensus.

5:03 PM ET: After seeing strong marketing spend growth in Q3, Netflix's GAAP marketing spend only rose 4% Y/Y in Q4 to $792.7M.

On the flip side, tech and development (R&D) spend rose 33% to $647.5M, while G&A spend rose 44% to $397.8M.

5:01 PM ET: Notably, when discussing competition, Netflix says the launch of new streaming services "may be affecting our marginal growth some."

At the same time, it reiterates its view that it's competing against entertainment options in general and that (with its share of U.S. TV screen time still below 10%) it has a lot more room to take share from linear TV.

4:57 PM ET: Netflix ended 2021 with $6B in cash and $15.4B in debt. Its deferred revenue balance (revenue it has received but not yet recognized on its income statement) stood at $1.2B.

4:55 PM ET: On a cash basis, Netflix's content spend totaled a whopping $17.5B in 2021. That's up sharply from 2020's $12.5B, which was depressed some by pandemic-related production halts. Look for content spend to rise again in 2022.

4:52 PM ET: Hours watched for new Netflix originals during their first 28 days:

The Witcher (Season 2): 484M

You (Season 3): 468M

Emily in Paris (Season 2): 287M

Maid: 469M

Squid Game: 1.65B

Netflix also says Season 4 of Cobra Kai (released on 12/31) had recorded 274M hours watched as of 1/18.

4:46 PM ET: Following a 1.3% Thursday drop for the Nasdaq-100, the Invesco QQQ Trust is down 1.1% AH following Netflix's report. Friday morning could be interesting.

4:42 PM ET: Netflix notes it didn't buy back any stock in Q4, citing its $686M purchase of the Roald Dahl Story Company. The company adds it'll pay down $700M worth of debt in Q1 to bring gross debt down to a target range of $10B-$15B, while reiterating it plans to return "excess cash above our minimum cash levels" to shareholders going forward.

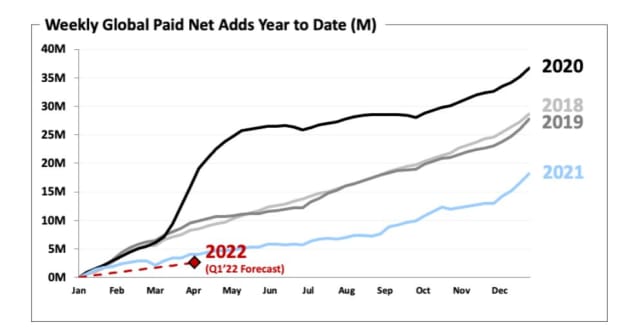

4:38 PM ET: Netflix's weekly paid net adds over the last 4 years. The 2021 line suggests Netflix had a choppy November, followed by a strong December.

4:33 PM ET: Netflix posted a 2021 operating margin of 21%, up from 2020's 18%. For 2022, it's guiding for 19%-20% op. margin, while estimating the dollar's strength will have a 2-point margin impact.

4:29 PM ET: Netflix is now down 18.6% AH to $413.96 -- a much larger decline than what it's seen in response to similar guidance misses in the past. The plunge arguably says a lot about how much fear/risk-aversion there now is among many growth-stock investors.

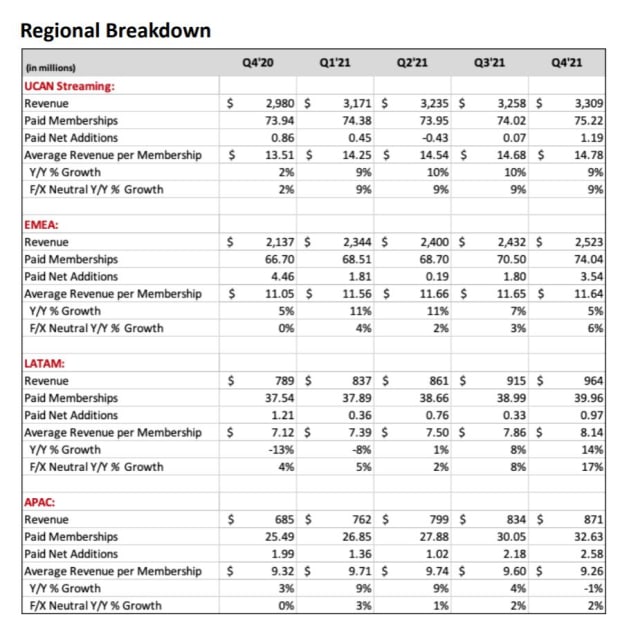

4:27 PM ET: Solid ARM growth was recorded in North America, as well as in EMEA and Latin America. By contrast, ARM was down 1% in dollars and up 2% in CC in Asia-Pac, where Netflix has been rolling out cheap mobile-only plans in some emerging markets.

4:23 PM ET: Netflix's Q4 regional performance. Ahead of the price hikes, Netflix's North American paid net adds rose by 330K Y/Y to 1.19M and topped a 553K consensus. However, EMEA and Latin American net adds were down Y/Y and missed consensus. Asia-Pac net adds were up Y/Y, but also missed consensus.

4:17 PM ET: Roku is down 4.4% AH in response to Netflix's report. Disney is down 3.9%.

4:16 PM ET: Amid rising content spend, Q4 free cash flow was negative $569M, which in turn spelled full-year FCF of negative $159M. Netflix reiterates (without giving any numbers) that it expects to be FCF-positive "for the full year 2022 and beyond."

4:12 PM ET: Shares are now down 12.1% AH to $447.02, taking out a 52-week low of $478.54 in the process. The market is very much in a take-no-prisoners mood right now towards growth companies that miss expectations.

4:11 PM ET: Ahead of its North American price hikes, Netflix's average revenue per membership (ARM) rose 7% Y/Y in dollars and constant currency in Q4. That compares with 7% dollar-based growth and 5% CC growth in Q3.

4:08 PM ET: Here's the shareholder letter, for those interested.

4:07 PM ET: Netflix also notes (echoing many other U.S. multinationals) that the dollar's strength has become a revenue headwind. The company estimates the dollar's rise will have a ~$1B 2022 revenue impact.

4:05 PM ET: Netflix on its guidance: "Our guidance reflects a more back-end weighted content slate in Q1’22 (for example, Bridgerton S2 and our new original film The Adam Project will both be launching in March). In addition, while retention and engagement remain healthy, acquisition growth has not yet re-accelerated to pre-Covid levels. We think this may be due to several factors including the ongoing Covid overhang and macro-economic hardship in several parts of the world like LATAM."

4:04 PM ET: Q4 revenue totaled $7.71B, +16% Y/Y and in-line with consensus. GAAP EPS of $1.33 beat an $0.83 consensus.

4:03 PM ET: Shares are down 9% after hours to $462.41.

4:02 PM ET: Results are out. Netflix's Q4 paid net adds totaled 8.28M, slightly above an 8.23M consensus and slightly below guidance of 8.5M.

For Q1, Netflix expects 2.5M paid net adds, below a 5.81M consensus.

3:57 PM ET: After starting the day green, Netflix has followed the market lower this afternoon, and is down 1.6% to $507.58 ahead of its report. Shares are now 28% below a their all-time high of $700.99.

3:56 PM ET: Along with its subscriber figures, any commentary that Netflix shares about its North American growth expectations will be closely watched, given its recently-announced price hikes for the U.S. and Canada. Its full-year free cash flow and (if provided) content-spending guidance will also get attention.

3:53 PM ET: The FactSet consensus is for Netflix to report 8.23M Q4 paid net subscriber adds (compares with guidance of 8.5M) and to guide for 5.81M Q1 net adds.

3:52 PM ET: Hi, this is Eric Jhonsa. I'll be live-blogging Netflix's Q4 report and video interview.