Around 5 million households have seen their mortgage interest rate change since the Bank of England base rate started to rise in late 2021. Over the course of the 2023 alone, the base rate increased from 3.5% to 5.25%, surpassing economists’ expectations and pushing mortgage rates to the highest levels since 2008. For some people, repayments have increased by hundreds of pounds overnight.

Many people facing increased monthly mortgage payments were already managing stretched budgets due to the rising cost of living. Inflation for households with mortgages is estimated to be the highest for any socio-economic group.

Some households have chosen to reduce the pressure by remortgaging over a longer term. Mortgages of 35 years or more have increased from around 5% to 12% of the market in the last two years. What’s more, 28% of new owner-occupier mortgages were agreed on terms longer than 30 years.

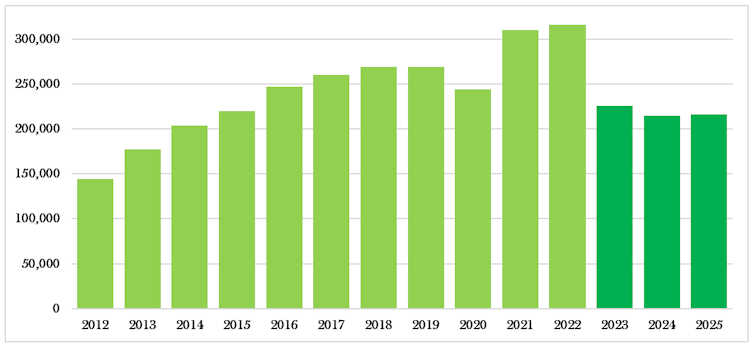

People that want to get on the property ladder – particularly millennials, the oldest of whom are now reaching their mid-30s – are instead being forced to continue to rent, even as rents soar by 10.2%. The resulting drop in demand for homeloans can be seen in the figures for new mortgage approvals for home purchases, which averaged around 47,000 per month in 2023 (as of October), well below the pre-pandemic average of 65,000 approvals.

Total mortgage lending fell by 25% in 2023 and is not expected to recover in 2024.

Mortgage lending has fallen recently

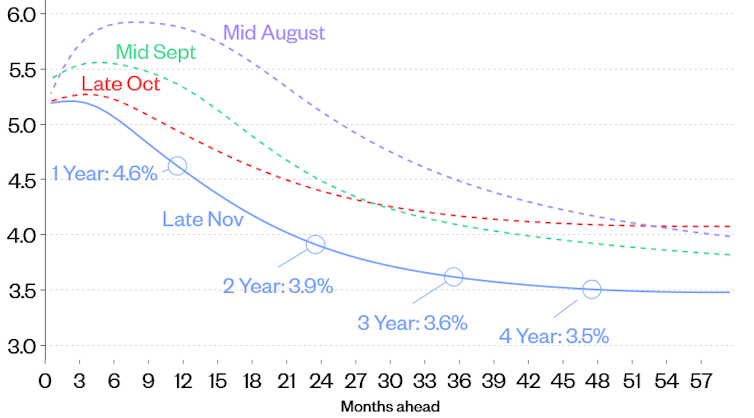

Where are rates headed in 2024?

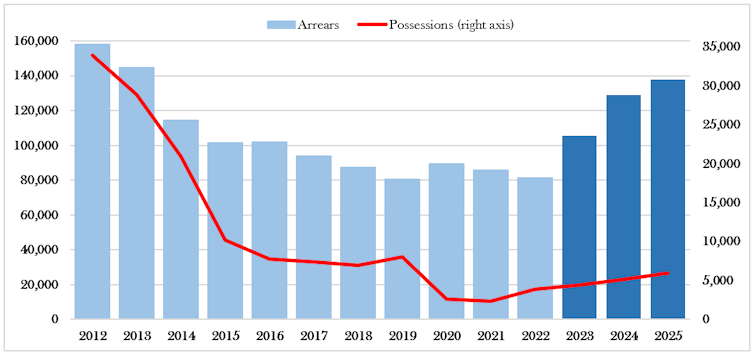

Signs that households are struggling to keep up with mortgage payments are getting stronger, with more people now falling into arrears. Although less severe than previously forecast, industry body UK Finance expects arrears and possessions to continue to rise.

Arrears and repossessions are rising

And as more homeowners come off the cheap fixed rates of pre-2022 period, around 2.3 million households are expected to face higher rates in 2024, with an average monthly repayment increase of £240. The Bank of England has forecast that around 440,000 households will struggle to afford these increases.

There is some good news: market expectations are for the Bank of England base rate to fall. It is expected to ease to around 4.25% by the end of 2026, from 5.25% right now. So, we may well have passed the peak for interest rates.

Expectations for the Bank of England base rate are changing

Mortgage rates (which are generally tied to the base rate) have already dropped since September, when the Bank of England decided to hold the base rate as inflation slowed. In early January, Halifax cut some rates by nearly 0.8% and HSBC also announced reductions for certain products. Mortgage brokers believe this could encourage more rate cuts by other lenders.

Rates still remain high compared to recent years, but this downward trend will continue to help household finances this year. For the average £200,000 mortgage, for example, a 1% drop from 5.8% to 4.8% would lead to yearly savings of around £2,000.

But it’s unrealistic to expect the mortgage rates to return to the 325-year lows observed between 2008 and 2021. Furthermore, a third of the Monetary Policy Committee – the team that decides what the Bank of England base rate should be – are still keen to increase the base rate to meet the Bank of England’s 2% inflation target. The current level of inflation is 4.2%.

So, UK homeowners may not be out of the woods yet. Further rate cuts will depend on the future course of inflation, which is difficult to predict because it’s influenced by many external factors – energy and food prices can be affected by wars and other global crises.

Read more: Five ways to reduce your mortgage repayments in 2023 – and why rates have risen so high

What to do if you need a mortgage in 2024

To start with, consider seeking advice from a qualified, independent mortgage advisor. They can discuss your personal circumstances with you. They also may have access to better deals than you can find yourself online or through your bank.

If you are a first-time buyer, since the Bank of England is expected to hold rates for now, it may be sensible to wait for rates to ease a bit more. During this time, save as much as you can towards your deposit. Both will help to reduce your borrowing costs. However, there is always the risk that rates and inflation stop falling or slowing due to unexpected changes in the economic and political environment.

If your budget is tight and you are worried about affording increased repayments in the future, extending your mortgage term would reduce monthly payments. But it will take longer to pay off your mortgage as a result. You may be able to make overpayments in the future to catch up if your financial situation changes, but this is typically limited to 10% of the balance per year.

Another alternative is to temporarily switch to interest-only repayments for a couple of years. This means you are not paying off the money you have borrowed, just the interest. Once the rates are lower you can switch back to a repayment mortgage. But again, this will lengthen the time it takes to pay off your mortgage.

If you are on a fixed-rate mortgage that is about to end in 2024, make sure to check your lender’s standard variable rate (SVR). This is the rate you will automatically move on to if you do not remortgage. But SVRs are often the highest rates around, so it may be best to look for a better deal before your current rate ends.

If your home is one of the 375,654 properties bought via the government’s help-to-buy loan scheme, check how much you will be charged if you continue with your current deal. The rates under these schemes can be more competitive than normal market rates. However, keep in mind that you will share any future capital gain with the government if your home increases in value as the scheme owns a share of it (typically a maximum of 20%).

Recently, the UK’s mortgage lenders agreed with the government on a number of measures to support people struggling with their mortgage repayments. So, if you are worried, it’s best to talk to your bank in advance about how it can help.

Alper Kara does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

This article was originally published on The Conversation. Read the original article.