Golden, Colorado-based Molson Coors Beverage Company (TAP) is a leading global brewer that produces, markets, and sells beer, flavored malt beverages, and other beverages. Valued at a market cap of $9.2 billion, the company’s portfolio includes well-known brands, including Coors Light, Miller Lite, Molson Canadian, Carling, and Blue Moon, along with an expanding range of non-alcoholic and innovative drink options. It is expected to announce its fiscal Q3 earnings for 2025 before the market opens on Tuesday, Nov. 4.

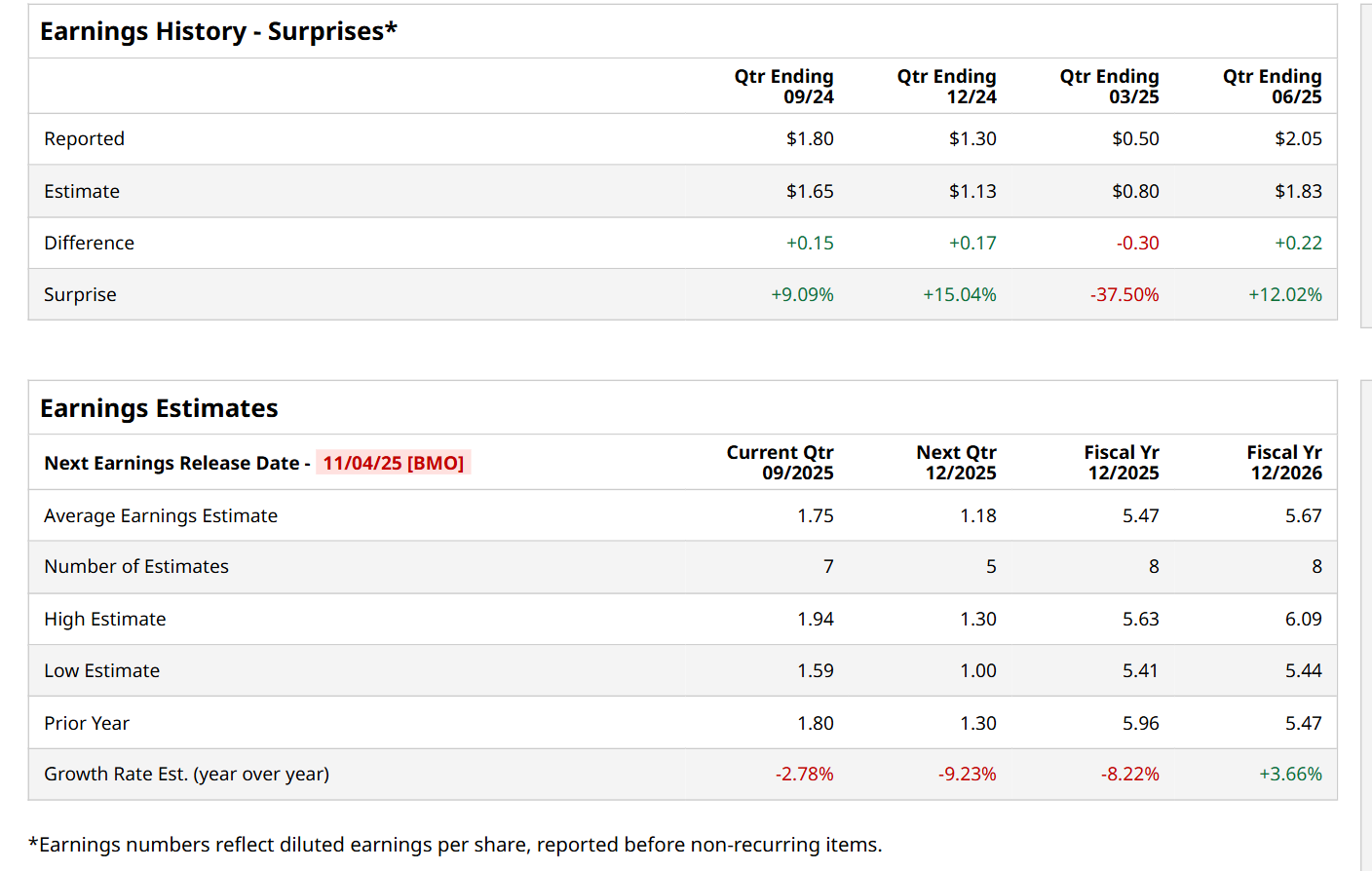

Before this event, analysts expect this leading brewer to report a profit of $1.75 per share, down 2.8% from $1.80 per share in the year-ago quarter. The company has exceeded Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. Its earnings of $2.05 per share in the previous quarter topped the consensus estimates by a notable margin of 12%.

For fiscal 2025, analysts expect TAP to report a profit of $5.47 per share, representing an 8.2% decrease from $5.96 per share in fiscal 2024. Nonetheless, its EPS is expected to rebound and grow by 3.7% year-over-year to $5.67 in fiscal 2026.

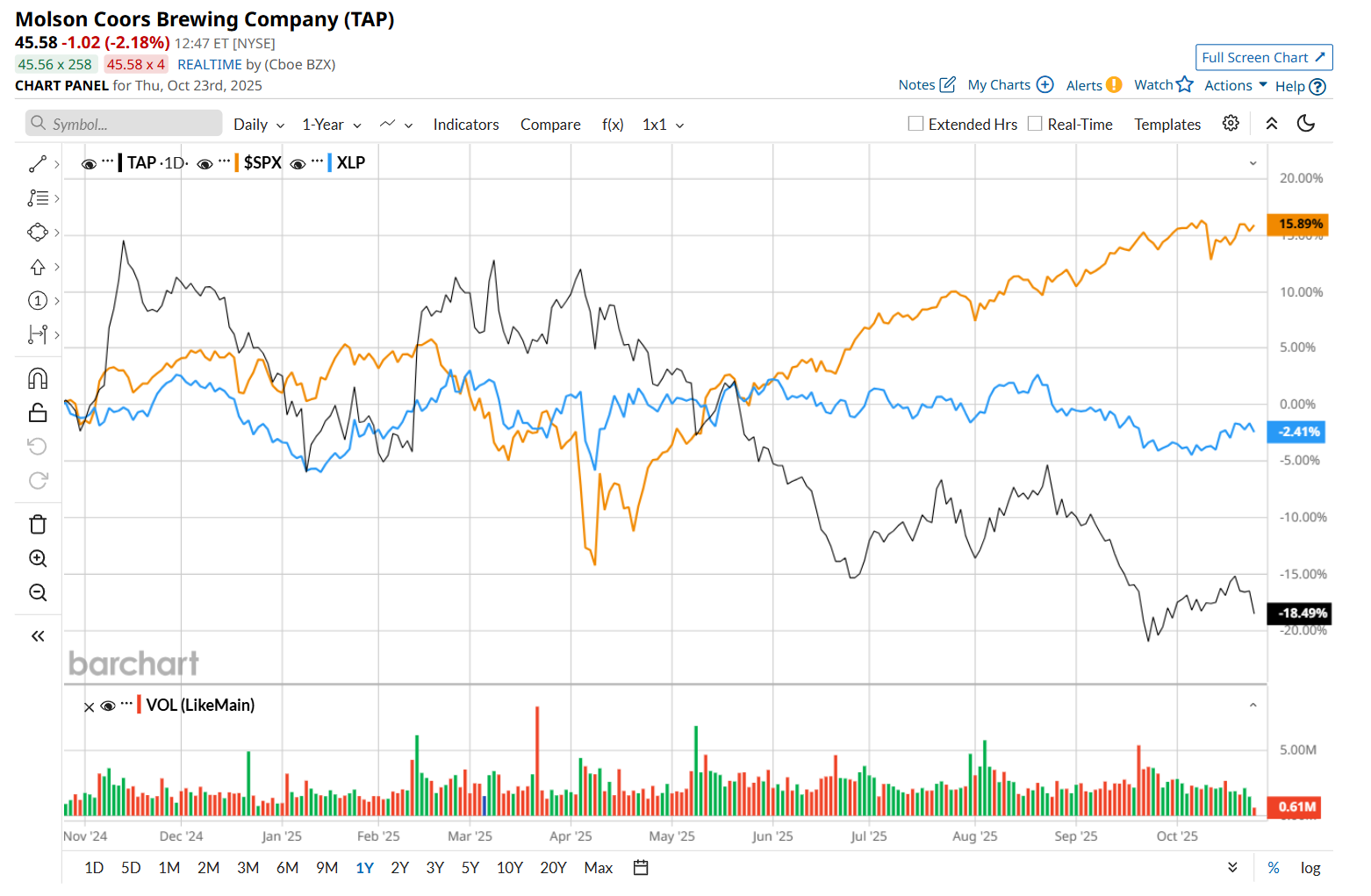

Shares of TAP have declined 18.9% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 16.1% return and the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.4% drop over the same time frame.

Shares of TAP surged 1.3% on Aug. 5 after the company reported better-than-expected Q2 results. While the company’s net sales declined 1.6% year-over-year to $3.2 billion, it topped the consensus estimates by 2.6%. Meanwhile, its adjusted EPS of $2.05 improved 6.8% from the year-ago quarter, beating analyst expectations by a notable margin of 12%.

However, despite the upbeat results, the company lowered its fiscal 2025 guidance, citing higher aluminum tariffs, weaker U.S. market share, and ongoing macroeconomic headwinds.

Wall Street analysts are cautious about TAP’s stock, with an overall "Hold" rating. Among 22 analysts covering the stock, five recommend "Strong Buy," one indicates a "Moderate Buy,” 14 suggest "Hold,” and two advise “Strong Sell.” The mean price target for TAP is $53.14, indicating a 16.9% potential upside from the current levels.