/Molina%20Healthcare%20Inc%20location-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Molina Healthcare, Inc. (MOH) is a managed care company that provides health insurance and related services to individuals and families primarily through government-sponsored programs such as Medicaid, Medicare, and state health insurance exchanges. Headquartered in Long Beach, California, the firm operates across multiple states, focusing on underserved populations and leveraging government partnerships. Molina Healthcare’s market capitalization is around $10.4 billion. It is scheduled to announce its fiscal Q3 earnings for 2025, after the market closes on Wednesday, Oct. 22.

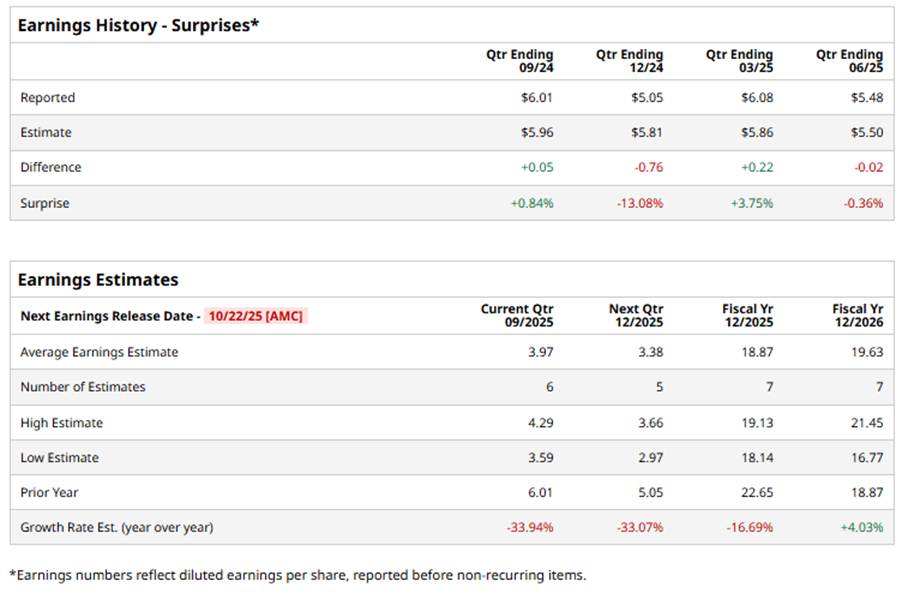

Ahead of this event, analysts expect the company to report a profit of $3.97 per share, down 33.9% from $6.01 per share in the year-ago quarter. The company has surpassed the Street’s bottom-line projections in two of the past four quarters, while missing on the other two occasions.

For fiscal 2025, analysts expect Molina Healthcare to report a profit of $18.87 per share, down 16.7% from $22.65 in fiscal 2024. However, its EPS is expected to grow 4% year-over-year (YoY) to $19.63 in fiscal 2026.

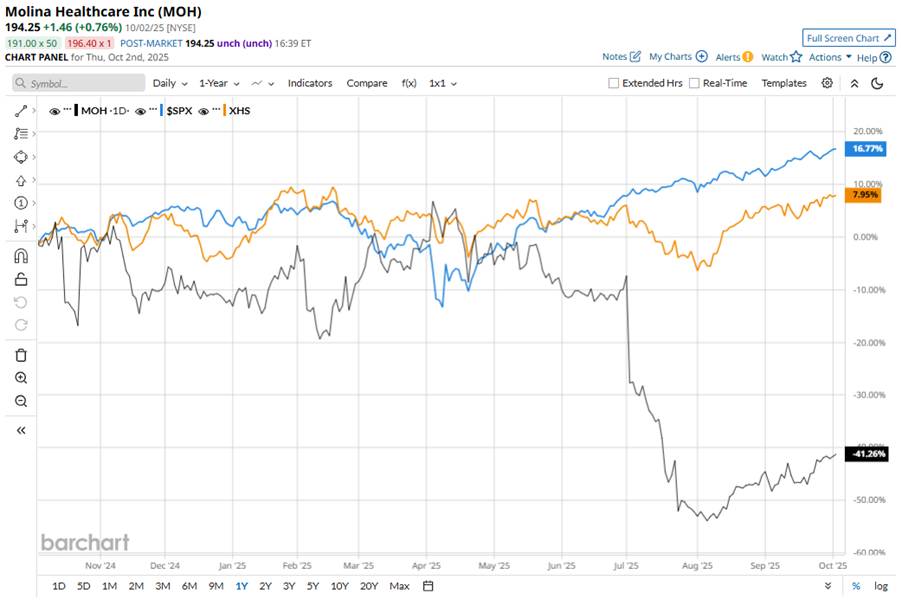

MOH stock has declined 41.5% over the past 52 weeks, underperforming the SPDR S&P Health Care Services ETF’s (XHS) 7% gains and the S&P 500 Index’s ($SPX) 17.6% uptick during the same time frame.

Molina’s shares have been under pressure largely because rising medical costs across its Medicaid, Medicare, and Affordable Care Act (ACA) businesses are squeezing margins. The company has responded by cutting its full-year earnings guidance, signaling to investors that profit headwinds are more persistent than anticipated.

Furthermore, regulatory and policy uncertainty, especially around Medicaid funding, ACA subsidies, and health-insurance program changes, adds another layer of risk that investors are pricing into the stock.

Wall Street analysts are cautious about MOH stock, with the stock having a “Hold” rating overall – a downgrade from the “Moderate Buy” rating three months back. Among 17 analysts covering the stock now, four recommend a “Strong Buy,” 11 advise a “Hold,” one suggests a “Moderate Sell,” and one gives a “Strong Sell” rating.

While the stock is trading above its mean price target of $189.43, its Street-high price target of $228 suggests a 17.4% premium to its current price levels.