THE federal government is expected to ask state governments to cap domestic coal prices at its National Cabinet meeting on Friday as a way of countering high power prices.

The focus has been on the main coal-producing states of NSW and Queensland but the policy may also apply in Western Australia, which has coal-fired power stations fuelled mainly from the Collie region in the south-west of the state.

Late on Wednesday, reports emerged that the Albanese government had settled on a price cap of $125 a tonne for domestic coal used in Australian power stations.

But as the Newcastle Herald reported yesterday, a major supplier to domestic power stations, Centennial Coal, is already selling much of its product on long-term "legacy" contracts with prices that are just a quarter or less of the current record export prices.

They are also under the $125 a tonne mooted from Canberra.

Minerals Council of NSW CEO Stephen Galilee said yesterday that "domestic coal sales in NSW are generally already at much lower prices than export prices".

"Imposing price caps on these already low prices will have little or no impact on NSW electricity prices," Mr Galilee said.

"Price caps on domestic coal sales are a political response driven by those who feel they need to be seen to be doing something about high energy prices.

"Coal price caps will not address the fundamental problems driving up energy costs. Those issues result from a lack of electricity supply at times of high demand, not the price of coal."

Mr Galilee said some power stations did have to buy expensive coal on the spot market earlier this year to cover shortages of supply.

Domestic coal contract prices and volumes are considered confidential to avoid the potential for anti-competitive behaviour but corporate filings indicate Centennial supplies about 6 million tonnes of the 20 million tonnes a year burned in NSW power stations.

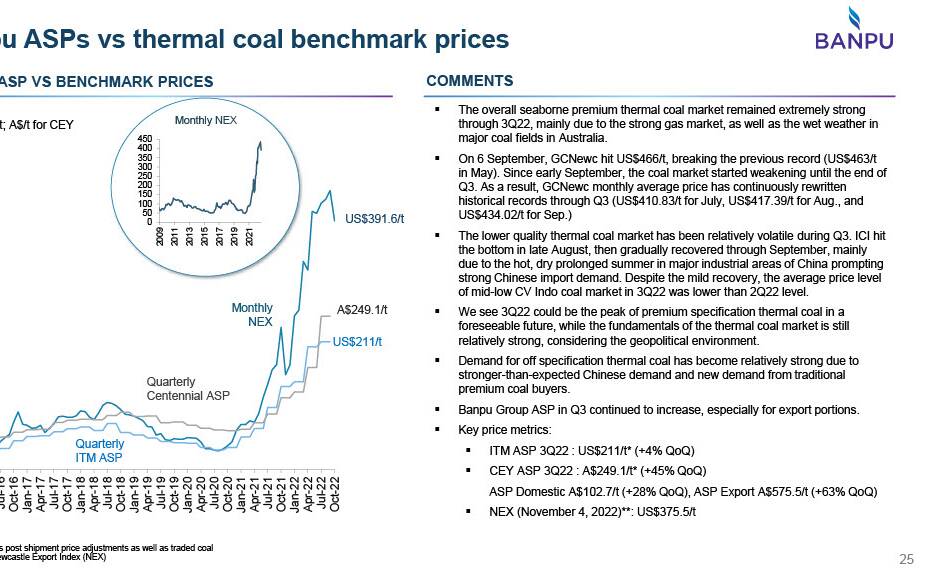

Centennial's parent company Banpu reported its sales to NSW power stations returned an average of $102.70 a tonne in the September quarter, up from $A75 a tonne at September 30 last year.

By contrast, yesterday's edition of the weekly Australian Coal Report said the index price of high-quality Newcastle thermal export coal hit an all-time high of $US457.12 ($687.12) on September 9.

Prices have eased since but this week's price of $US395 ($589.50) a tonne is still more than five times that earned by Centennial for its domestic sales.

Other companies supplying coal domestically include Peabody and Glencore.

BHP stopped supplying AGL's Bayswater and Liddell power stations in mid-2020 and yesterday confirmed it had dismantled the conveyor that supplied the stations from its Mount Arthur mine.

Origin Energy, which runs Eraring, is understood to get about 4 million tonnes, on average, a year from Centennial, but well-publicised problems at Centennial's Mandalong mine earlier this year led Origin to tell the stockmarket in June that "material under-delivery of coal to Eraring" had resulted in "lower output from the plant" and "additional replacement coal purchases at significantly higher prices".

"Contracted coal reflects both legacy priced contracts and contracts priced at market forward prices at the time of contracting," Origin told the market in October.

Delta Electricity, which owns Vales Point power station and the adjacent Chain Valley also buys coal from Centennial.

Another major Hunter miner, Yancoal, said yesterday that it did not sell any coal into the domestic market, but it remained concerned at the possibility of additional taxes or royalty payments on export coal.

Chief executive David Moult said coal was a cyclic industry experiencing a period of strong prices.

" At some point this will end," Mr Moult said.

"The government needs to understand that in periods of low coal prices, such as between 2013 and 2016, companies such as Yancoal were generating losses rather than profits.

"These losses were incurred because we kept mines operational despite the downturn, which, in turn, ensured our employees maintained their jobs, investment in our operations continued, local communities survived and Australia earned valuable export revenues.

"The cyclic nature of the coal market means the damage of a new tax would impose on the Australian coal industry and future investment would linger for decades."

Federal government says final 'cap' decision not made

By Maeve Bannister and Alex Mitchell

TREASURER Jim Chalmers says the federal government has not yet reached a decision to cap coal and gas prices ahead of a key energy meeting, but "temporary" interventions are on the table.

Energy Minister Chris Bowen will meet with his state and territory counterparts in Brisbane on Thursday to discuss long-term strategies to drive down power prices and the next steps in Australia's transition to renewables.

The ministers will also settle on a model for a capacity mechanism, something Mr Bowen said had been in the "too hard basket" for too long.

"It's really a keep-the-lights-on mechanism to ensure that our transition to renewables happens more quickly and in a more orderly fashion," he told ABC News.

The proposed capacity mechanism is expected to guarantee energy supply while not undermining emissions targets or being used as an excuse to keep coal and gas generators operating.

On Friday, Prime Minister Anthony Albanese will meet virtually with premiers and chief ministers for national cabinet, after he tested positive to COVID-19.

Asked if the government had resolved to cap the wholesale coal price at $125 and the gas price at $13 a gigajoule, Dr Chalmers said no.

He said one level of government could not work alone to address the issue and it needed collaboration from all.

"We are very concerned that the prospects of higher energy prices ... There is a case here for temporary, responsible, sensible but meaningful interventions in the markets, to see if we can take some of the sting out of these high energy prices," he told ABC Radio.

"This is a challenge of such complexity and such consequence for industry and for Australians around the country, that it needs to be a genuine partnership between governments."

Opposition spokeswoman Karen Andrews said the government was yet to explain what is was planning and how this would affect consumers and had not confirmed if negotiations with energy generators had taken place.

"The federal government hasn't gone in with a longer term plan, a longer term vision ... and now they're in a position of scrambling around," she told Sky News.

Ms Andrews said if the government compensates the states for lost royalties from a cap on coal, that would mean a cost to the taxpayer.

Mr Bowen said he had read "various things" in the newspaper about what the Commonwealth was proposing, but most had not been accurate.

"I've seen lots of stories written about what we've been discussing ... some of them have had some truth to it and some of them haven't," he said.

The energy minister said the federal government had considered all the options carefully, and had discussed "in good faith" with the states.

"We need to weigh up existing contracts and (have) sensible, grown-up management of existing contractual arrangements," Mr Bowen said.

He said the government wanted state and Commonwealth powers in the energy market to be used as effectively as possible to help bring down prices.

October's federal budget made a shocking forecast of a 56 per cent increase in electricity prices, and 44 per cent in gas prices, for households over the next two years without government intervention.

WHAT DO YOU THINK? We've made it a whole lot easier for you to have your say. Our new comment platform requires only one log-in to access articles and to join the discussion on the Newcastle Herald website. Find out how to register so you can enjoy civil, friendly and engaging discussions. Sign up for a subscription here.