Galaxy Digital Inc. (NASDAQ: GLXY) CEO Mike Novogratz, said in an interview aired Tuesday that Solana (CRYPTO: SOL) would capture the “lion’s share” of financial markets in the future.

Novograts Bets On Solana’s Speed

Appearing on Anthony Pompliano's podcast, Novogratz shared his thoughts on the potential of the proof-of-stake blockchain.

“Solana is going to be one of the blockchains that gets the [lion’s] share of the financial market stuff because it’s kind of tailor built for financial markets,” he stated.

Novogratz called Solana as the “fastest” network currently and one that is poised to surpass even the likes of Ethereum (CRYPTO: ETH), owing to its speed and processing capabilities.

According to blockchain analytics firm Chainspect, Solana averaged around 950 transactions per second, in daily operations, far exceeding Ethereum’s 18 tx/s. Even its Layer-2 networks were slower than Solana.

See Also: Solana (SOL) Price Prediction: 2025, 2026, 2030

Solana’s Yield Potential

Novogratz also highlighted Solana’s yield-bearing potential, claiming that its “7-8.5%” yearly return could double investments in eight years.

According to Staking Rewards, Solana has an annualized average reward rate of 6.7%, compared to Ethereum’s 2.92%.

Galaxy Digital Investments In Solana

Novogratz’s Galaxy Digital, along with Web3 infrastructure firm Jump Crypto, and venture capitalist Multicoin Capital, led a private investment in public equity into Forward Industries, Inc. (NASDAQ: FORD) earlier this month to set up the biggest SOL-focused treasury company.

Forward Industries held a stash of 6.82 million SOL, worth nearly $1.4 billion, as of this writing, according to CoinGecko.

Galaxy Digital, meanwhile, held 22,409 SOL, totaling $4.57 million, according to data from Arkham.

Price Action: At the time of writing, SOL was trading at $203.67, down 3.42% over the last 24 hours, according to data from Benzinga Pro.

Galaxy Digital shares rose 0.58% in after-hours trading after closing 3.50% higher at $34.30 during Wednesday’s regular trading session.

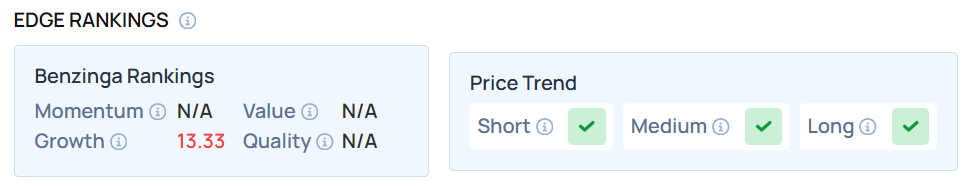

The stock demonstrated a low Growth score, but checked out on Short, Medium and Long-term price trends. Visit Benzinga Edge Stock Rankings to find out more.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.